Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Ruta del Electricista

84 members • Free

Electrical Academy

50 members • Free

Electricians Wired Together

64 members • Free

The Electricity Lab

146 members • Free

DIY Solar Alliance

46 members • Free

Solar Union Ascension

73 members • Free

Solar Operations Excellence

240 members • Free

CG Python Academy (Free)

1.1k members • Free

Inteligencia Artificial México

2.5k members • Free

24 contributions to Energy Data Scientist

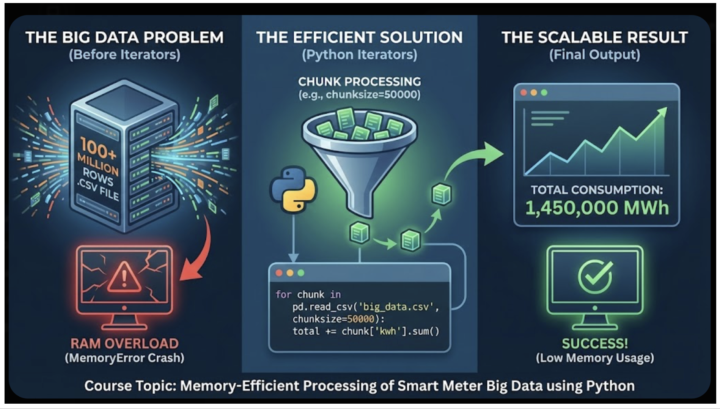

New Online Course: How Big data from Smart Meters are processed efficiently

I’ve just published a new online course about Memory-Efficient Processing of Big Data. This course teaches real-world skills as they are used in practice. Smart meters measure the electricity-consumption data every hour, and store the information in CSV files. These files eventually become very large (big data). The new online course is called "Smart Meter Big Data Efficient Processing" and it is in the Classroom in 1.36. This online course teaches a Python methodology that is used by energy companies in practice to read extremely large datasets (Big Data). Without this technique such files cannot be read because they cause a memory (RAM) error. Companies that sell electricity to consumers are known as 'Retailers' or 'Suppliers'. Such companies have CSV files with hundreds of millions of rows, where each row is the hourly kWh electricity consumption. If they try to load these CSV files, their computers will run out of RAM and crash. So these companies process these files using Python iterators, which enable a memory-efficient and fast processing method. In this course, I show you the industry-standard solution: using Python Iterators to process Big Data in "chunks". See the attached image; this is analysed in detail in the course.

Hedge Funds moving into Physical Energy Commodities

A hedge fund is an investment firm that tries to make profits using many different trading strategies. More and more hedge funds and trading firms are moving beyond “paper trading”. Paper trading is where they are buying and selling financial contracts linked to oil, gas, or power. It is about trading financial contracts (futures, options, swaps) where the trader never actually touches the physical asset. Traditionally, hedge funds are financial entities, not logistical ones. They almost exclusively trade "paper" while leaving "physical" trading to commodity trading houses (like Glencore, Vitol, or Trafigura) and industrial producers (like Exxon or Cargill). So, paper trading is when hedge funds are buying a contract on an energy commodity like oil, and buy it to bet that its price will go up. Before the contract expires, they sell the contract to someone else. The only thing that changes hands is cash. Hedge funds now are also moving into Physical Trading i.e. they are buying a number of actual barrels of oil, putting them on a ship, storing them in a tank, and delivering them to a refinery. Hedge funds historically avoided physical trading. Physical trading requires ships, warehouses, pipelines, and insurance. It involves dealing with weather delays, customs, and quality degradation (e.g., grain rotting). Hedge funds are built to move capital, not cargo. Also, hedge funds thrive on leverage. It is much easier to get 10x leverage on a financial futures contract than it is to get a bank to lend you money to buy physical coal. However, in recent years, hedge funds (like Citadel, Millennium, Balyasny, and Point72) have built out physical trading desks, particularly in energy (natural gas and electricity). The full report is inside Classroom ---> 6.2. Sources: [1]: Financial Times: https://www.ft.com/content/598c3bfc-008c-438f-837c-f7ec73a993f6 [2]: The Economist: https://www.economist.com/finance-and-economics/2025/06/26/why-commodities-are-on-a-rollercoaster-ride

Certification

Kariyer ilerlemesinde alınan sertifikaların önemli olduğunu düşünüyor musunuz? Düşünüyorsanız hangi sertifikaları tavsiye edersiniz?

Science fiction scenarios about energy

Predicting the future of energy (literature) In France, the Defense Red Team for the Ministry of the Armed Forces publishes science fiction stories that are accessible to all, offering a new way of looking at energy and geopolitical issues. Are there any current science fiction stories, scenarios, about energy in other countries? Stories written by science fiction authors who are members of a state-affiliated circle?

1 like • Dec '25

Yes. The SIGMA Forum in the US, it’s a group of science fiction authors. They advise the Department of Homeland Security on future risks. I know for energy, the National Renewable Energy Laboratory in the US hosted a 'Visioning Energy' workshop. They paired sci-fi authors with researchers to write scenarios about a clean-energy future. And in China, the government heavily promotes the 'Ecological Civilization' narrative. And in this one Liu Cixin (The Wandering Earth) has analyzed insights into Chinese energy futurism

Important applications of ML/AI in Energy Economics?

Share some ideas. I have implemented some, already

1-10 of 24

@joshua-levvy-1786

energy focus - machine learning forecast models at M. Lynch

Active 2d ago

Joined Nov 1, 2025

ISFJ

USA