10d • Trade Alerts

A Sector Spread With Teeth: XLV-XLE Pair Trade

Hey, in the previous posts, I shared that rotation charts are finally giving us clean signals: XLV (Healthcare) keeps gaining relative strength, while XLE (Energy) is recovering after weeks of underperformance. Both sectors moved into a decision zone, and today I'm showing the exact structure I'm using to trade that divergence in the hedge fund.

Part 1: XLE Call Debit Spread (Defined-Risk Snapback Play)

- Buy 88C / Sell 91C Jan 16 (51 DTE), Debit: $1.59, Max Profit: $141

- A clean, defined-risk way to play the standard Energy bounce inside a choppy, low-volatility range. If XLE mean-reverts toward 90–92, this structure pays quickly

Part 2: XLV Call Ratio Spread (Harvesting Exhaustion)

- Buy 160C / Sell 2× 163C Jan 16 (51 DTE), Max Profit: $357, Max Risk is undefined (but extremely manageable in XLV).

- XLV is extended, overbought, and showing early fatigue. Elevated IV makes upper-strike calls expensive, perfect for a ratio spread that benefits from slowing momentum or shallow consolidation.

Why it works as a pairs trade?

These aren't two isolated ideas, they're one combined expression:

- XLE - defined-risk long delta where bounce probability is high

- XLV - premium capture where trend exhaustion is visible

- Combined - smooth Greeks, positive theta, and exposure to sector divergence rather than index direction.

This is how you express rotation and sector behavior without guessing the market's next move. A clean, elegant pairs structure built for this macro regime.

1

0 comments

powered by

skool.com/painlesstraders-8746

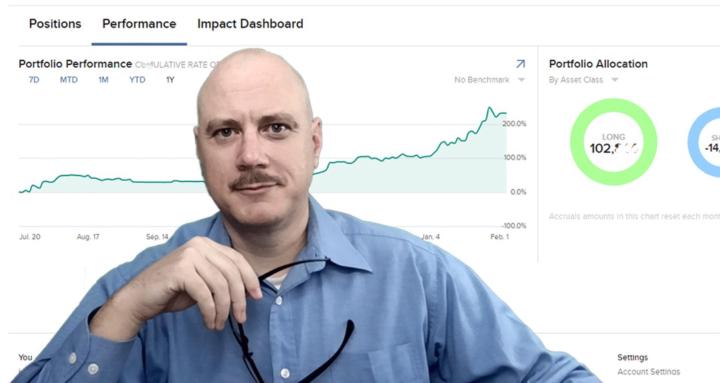

I've been trading for twenty years, I'll share my experience.

Suggested communities

Powered by