Pinned

Site plan issue but solved

I recently got my site plan to start building. It looked good to me so I gave it out to my contractors. My concrete guy recommended I have a surveyor mark out my corners of the lot and the corners of the house. But when I gave them the site plan he noticed an issue in the measurements from the architect. The overall distance looks like 61.26’ but it’s not. It’s only 55.86’. So we lost just over 5’ . Which put us at 6’ and 5.5 ft on each side of the house. Instead of 9 and 10 ft. We were close. Because city requires 5 ft on each side. I could have had to redo my whole house plans! I don’t think I could have caught this because I didn’t know where the lot pins were. Take a look at the pictures and see if you can tell where the architect messed up.

Pinned

📌 Duplex B2R Skool Community Guidelines

PLEASE READ! 🚨 Welcome to the Duplex Build 2 Rent Skool Community!! 🙌🏼 This is a free educational space designed to help investors and landlords learn how to Build Duplexes from the Ground Up. 😎 To protect the integrity of the community and people inside it, ALL members are required to follow the guidelines below. ⬇️ By participating in this community, you agree to these guidelines as well as our official Terms of Service and Acceptable Use Policy. 🎯 Purpose of This Community This community exists for: • Learning • Collaboration • Asking questions • Sharing insights related to new construction, building, property management, raising capital, mortgages & scaling. This is NOT a place for selling, recruiting, or promoting services. 🚫 NO Self-Promotion or Solicitation Self-promotion is STRICTLY prohibited. You may not: • Promote or solicit your own services • Ask members to DM you for work • Offer coaching, consulting, or “done-for-you” services This includes (but is not limited to): • Website design • Digital marketing • AI tools or funnels • Any offer that encourages members to reach out to you for paid services If you are here to sell, this is not the community for you. 🔗 NO External Links (Outside of Skool & Social Media) To protect members from spam, scams, and misuse: • Do NOT post external links, except for: • Direct social media links (Instagram, TikTok, YouTube, etc.) • Native Skool links Posting or requesting links to the following is STRICTLY prohibited: • Websites or landing pages • Funnels or booking calendars • Apps or tools • WhatsApp • Telegram • Discord • Any external platform not explicitly approved ⚠️ DO NOT CLICK any links that are not social media or Skool. Users who post prohibited links risk immediate removal or ban. ✅ Keep It Positive & On Topic This is a learning environment. Keep conversations: • Respectful • Constructive • Relevant to land acquisition, building, mortgages and business growth We do not allow: • Harassment or personal attacks

Step-by-Step How To Analyze Lots To BUILD ON!

This is EXACTLY my process for analyzing lots to build on y'all. Save this post. Tab it. Let me know what you learned. Re-watch it. I've done this for years so it's easy for me but I go through this process every time. Let's go! Juan-

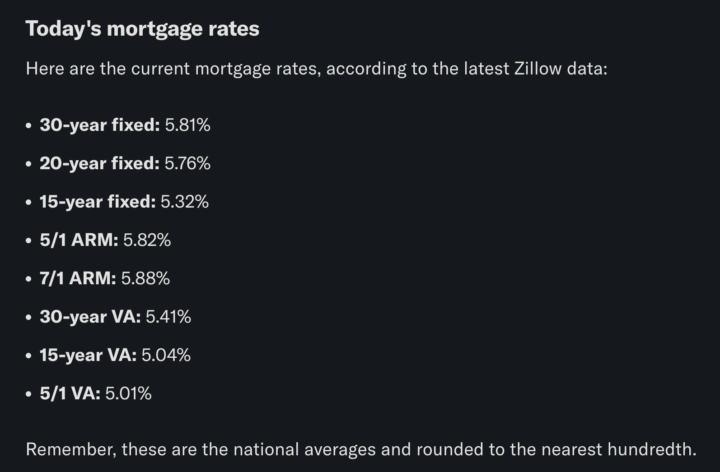

Friday 2/28/26 Mortgage Rates!

Look, if you're sitting on the sidelines wondering: - is it a good time to build? - is it possible to have multiple exit strategies? All you have to do is look at today's mortgage rates. The most popular is obviously the 30-yr rate... 🔥🔥🔥 IT'S AT 5.81!! 🔥🔥🔥 And this is up 7 basis points from 5.74! Get your build in THIS year. Build 2 Rent is easy with these low rates. Build 2 Sell, you have more buyers looking at your duplexes to buy. You can set up a time to talk so we can work together to build you one ASAP. Book a call here. Let's go! B2R, Juan-

Slab Unevenness

@Juan Cristales what criteria do you hold your foundation contractor to in regards to how level the slab needs to be once complete? A follow-on question would be: Does your flooring guy automatically level the slab before he installs the flooring planks? Is that level work built into his square foot price that he gives you or is that an additional charge?

1-30 of 554