Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The AI Trader's Fast Track

100 members • Free

Flippin' Empire [free]

3.8k members • Free

6 contributions to The AI Trader's Fast Track

TradingView offers professional-grade screeners

Advice for traders: Don’t limit yourself to Finviz… Here are 4 golden filters on TradingView Here are the 4 most important free filters you can use daily and weekly to improve your performance: 1) “Best Winners” Screener This is the core filter for finding the strongest stocks and the real market leaders. It excels at detecting high momentum, relative strength, and clear trends. These are the names that can become multi-week winners when market conditions allow. https://tradingview.com/screener/KZAnxsfO/ 2) “Daily Strong” Screener This filter gives you the pure “market reaction” of the day. Run it daily to see exactly where the money is flowing — it clearly shows whether strength is expanding or drying up — no personal opinions, no noise. https://tradingview.com/screener/FfS5rWq1/ 3) “Short Screener” Its importance increases especially during downtrends. It spots exhausted stocks that have lost momentum, showing weak reactions or failed highs. The professional trader doesn’t guess short setups — he prepares for them. https://tradingview.com/screener/PgvR2xvf/ 4) “Pre-Market” Screener For monitoring gap-ups, unusual volume, and fresh catalysts. The goal is not to chase — but to observe and build structured plans before emotions take over at the session open. https://tradingview.com/screener/B3i61uz8/ The truth you need to understand: The screener itself doesn’t give you the edge — knowing how to read it is what makes the difference. Screeners are just tools, and experience + practice are what turn these tools into a real weapon. These patterns repeat constantly, and mastering how to handle them is a skill any trader can develop over time.

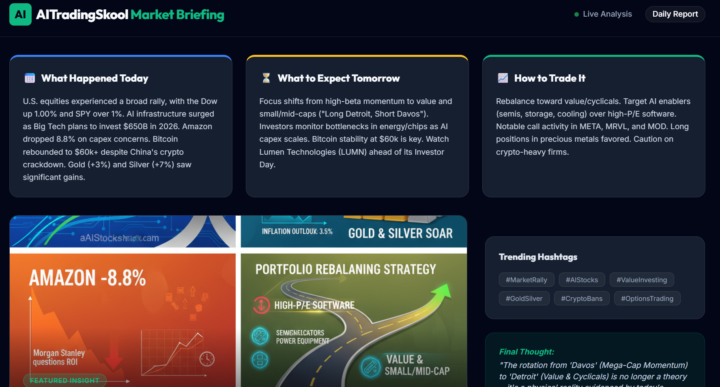

AI: Daily Briefing February 6, 2026

How to Trade It Rebalance toward value/cyclicals. Target AI enablers (semis, storage, cooling) over high-P/E software. Notable call activity in META, MRVL, and MOD. Long positions in precious metals favored. Caution on crypto-heavy firms.

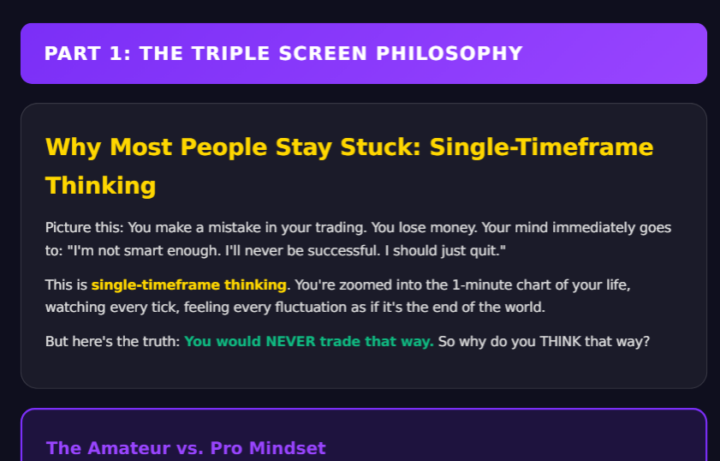

TRIPLE SCREEN PHILOSPHY - MINDSET TOPIC 2-4-2026 In DCG

The 3D Philosophy (why single-timeframe thinking keeps people stuck)

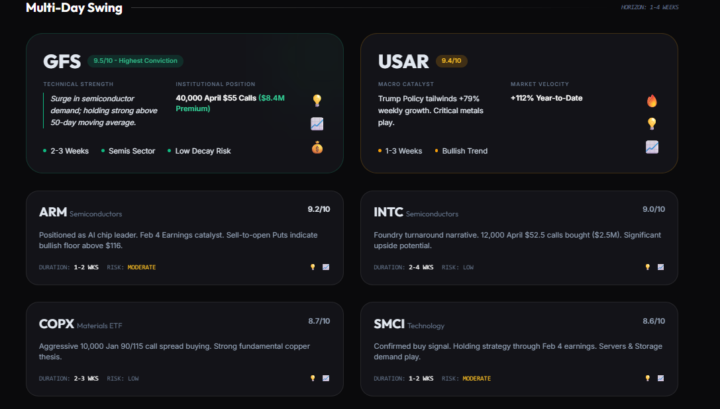

Whats Your Favorite Play On This List For January 28th 2026

Let me know who likes money, which one is your favorite play to take today?

FEB TRADE -

The U.S. is reportedly considering $HOOD as a platform for proposed “Trump Accounts” aimed at investing on behalf of children.

1-6 of 6

Active 2d ago

Joined Jan 26, 2026

Powered by