Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Timothy

If you're focused on becoming a millionaire broker or building a CRE portfolio, this is your gateway to unlocking new opportunities and leveling up.

Memberships

Google Ads Masterclass

10.2k members • Free

Skoolers

189.3k members • Free

17 contributions to Elite CRE Agent Mastermind

What deals are you closing?

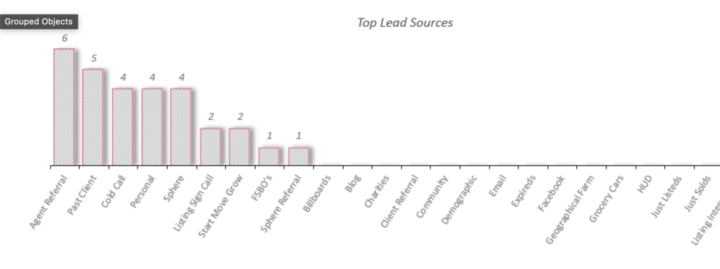

Quick temperature reading on the market in your area, what kind of deals are you closing? Is your volume up or down this year? So far in my business we have: 26 Commercial Units Closed/Pending for just under $12M for $428k in GCI (3.2% Commission) - 5 Investment/Land sales - 17 Lease Deals (50/50 LL/Tenant) - 4 Buyer Deals (1 Owner User/3 Investment Sales) Active Listing Volume: $16.7M YOY GCI increase of 150% but # of Transactions is down by 10% Our mantra for 2025 was to focus on bigger deals, but not so big they don't close. $1.5-5M in Volume lead to better deals. Focus on 1031 Exchange properties or double sided deals. In our market Small 5-15 acre Land Deals for development are selling. So 12 months ago we began increasing prospecting around those deals and now have a pipeline of 10-15 off market sellers in the same space, small industrial buildings, storage facilities and raw land in the ETJ all turn into 2 sided deals as owner users turn into investors. These deals accounted for higher GCI from single prospects. Multiple ranch deals turned into NNN lease investment purchases. Top Lead Sources: - Residential Agent Referrals (Most recently resulted in a franchise deal worth $30M in Lease Volume over the next 3-5 years) - Facebook Leads (Resulted in one tenant worth $10M+ in volume) - FSBO - Cold Calls - Past clients

Poll

2 members have voted

0

0

Prospecting Plan for the Next 90 Days

Who to prospect (names & buckets) Use these buckets to build call lists; I’ve included example org types and recent-activity names you can mirror locally in Texas and your target metros. 1. Active institutional buyers/operators (core/value-add) 2. Affordable/mission-driven capital 3. Bridge-loan vintage owners (2019–2022 acquisitions) 4. Developers with 2023–2024 deliveries in heavy-supply submarkets 5. Build-to-Rent (BTR) platforms & JV capital 6. Lenders & special servicers for pre-market opportunities 90-day prospecting plan (to set up 2026 closings) Weeks 1–2: Build lists & hooks - Pull your CRM for: (a) 2019–2022 purchases ≥50 units, (b) 2023–2024 deliveries, (c) any sponsor on bridge debt. Tag “cap-expiry ≤18 months.” - Draft two email/call tracks: “Agency-eligible recap” (mission/green, loan sizing) and “Lease-up to stabilized exit.” Support with a quick BOV teaser (NOI, capex, green scope). Use FHFA caps and rent/supply data as credibility hooks. FHFA.gov+1 Weeks 3–4: Meetings with capital & servicers - Book 8–10 intros: acquisitions heads at the institutional list above + 2–3 LIHTC/mission groups + 2 DUS lenders + 1–2 special servicers. Goal: define buy boxes, pricing guardrails, and “need-to-see” property profiles. Bisnow Weeks 5–6: Targeted owner outreach - Hit owners of 80s–00s garden and 2010s urban mid-rise in Dallas–Austin–San Antonio–Houston submarkets with highest 2024–2025 deliveries. Offer (1) assumption scenarios, (2) pref/JV recap pitches, (3) agency-forward term sheets for eligible assets. Axios+1

0

0

Whats happening in the Multifamily Market?

What’s closing (and who’s active): - Institutional & large operators are selectively buying core/“brown-to-green” value-add in top metros (esp. Chicago, Atlanta, Dallas, Phoenix) at recalibrated pricing. Recent examples include Waterton acquiring a 263-unit high-rise in Chicago’s Fulton Market and Cortland upping its stake in Buckhead; other names showing up in 2025 deal sheets: Nuveen, Jamestown, Penler. Bisnow+1 - Affordable/mission-driven capital is acquiring portfolios as sellers rebalance. National Equity Fund (NEF) and Guardian Real Estate Services bought a 2,700-unit portfolio from GSL for ~$444M—flagging real demand for LIHTC/affordable. Bisnow - Supply is finally cooling in 2025–2026 after record 2024 completions; completions are down YoY nationally, which supports a firmer pricing floor for stabilized assets later in 2025/2026. (Houston example: completions down ~38%; nationwide completions projected -21% vs. 2024.) Axios - Agencies remain the liquidity backstop. FHFA set 2025 caps at $73B each for Fannie and Freddie ($146B total), which continues to grease trades for qualifying business plans (affordable, mission-driven, and green). FHFA.gov+2FHFA.gov+2 Seller & distress signals you can target - Large 2019–2022 bridge borrowers facing rate caps expiring / refi gaps; many are motivated to sell or JV. Special servicing in CMBS is still elevated (~10% overall), and maturity/refi pressure remains a theme through 2026. Multi-Housing News+1 - Developers with 2023–2024 lease-ups in heavy-supply submarkets (Sun Belt, Texas Triangle) where negative leverage persists—prime for recap/JV or a stabilization sale. Macro reads (Yardi Matrix) point to tepid rent growth with supply digestion, creating motivation to transact. Yardi Matrix+2Yardi+2 - Non-core dispositions by institutions (trimming overweight Sun Belt exposure; rotating to Midwest or to affordable/workforce strategies). Recent deal sheets show exactly these trims and rotations. Bisnow

1

0

Metrics

Here are some calling metrics for this week for those of you making cold calls. I’m targeting smaller building landlords who’ve owned their property for more than 5 years. So far this week I’ve made 179 calls, gotten 10 leads and set 3 appointments. One of the appointments is for 1 property, one for 2 and one for 4 properties, all looking to sell for economic reasons ie rent is not covering their expenses any more.

Q4 Prospecting Qs?

What’s working for you right now? Who’s the target and what’s the tactic? For me, investors with smaller properties are getting eaten up by taxes and insurance and their return on equity isn’t what it used to be. Part of what I do is show them that while their return on their basis may still seem good the overall return on equity is very low vs maybe reallocating into a bigger and higher performing asset and have preloaded financing options for the next investment with my lender partner lined up. Just curious what’s working for you?

0

0

1-10 of 17

@timothy-warlow-jr-2069

Commercial real estate expert, investor and business coach, I’m here to build a community of like-minded real estate agents who invest!

Active 33d ago

Joined Sep 17, 2024

Powered by