Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Don't Buy Real Estate

262 members • $19/m

12 contributions to Don't Buy Real Estate

OFF-MARKET DEAL – SAN ANTONIO, TX

Need this gone FAST – my buyer fell through last minute! Single Family Home – Great area of San Antonio ARV: Strong (happy to share comps & scope of work) Asking: $60,000 AS-IS (cash or hard money only) Assignment fee is built in – plenty of meat on the bone Perfect for a fix & flip or buy-and-hold. Light to moderate rehab. DAISY CHAIN WELCOME If you don’t want it but know an investor who does – just add your fee on top and lock it up! I’ll even send you my San Antonio cash buyer list to help you move it quick. https://www.redfin.com/TX/San-Antonio/1203-Churing-Dr-78245/home/49018782 https://drive.google.com/drive/folders/1mkLcYpmLWnWjxYFdxOn_nr3lxC7fGpdt?usp=sharing Let’s make some money today

Looking for lenders/investors

Not sure if this is the right place to post this? I'm in Bismarck, Nd and there's a gorgeous historic building 10000sqft downtown. Upstairs is abandoned and needs a full gut, downstairs is a functional long term restaurant and next door is vacant. We are close to getting a sweet deal on it but the reno costs will be a lot. Me and my partner are looking for additional lenders or investors. Hit me up if you want more details.

Cold Call Results – Josh’s Call Sheet

Hi, just wanted to share what I found. I went through Josh’s call sheet and created a pivot table with just the names and the first three phone numbers listed for each person. I called each of those numbers, and on the right side of the sheet, I noted the results. Most of the calls either didn’t get a response or the numbers were disconnected. There was one person who answered but said they weren’t looking to sell. My question is: is this kind of result typical when cold calling? I reached out to about 26 individuals, and most either didn’t answer or had disconnected numbers. Should I consider following up via email instead? Also, does the time I’m calling matter? I made the calls around 2 PM on a Friday and again around 2 PM on a Sunday on PST. What is the most optimal time? Thank you !

📍 START HERE - Don’t Just Lurk, Introduce Yourself

🏴☠️ Welcome to Don’t Buy Real Estate - the community built for people who don’t just blindly follow traditional advice. We’re here to: 🏚 Find off-market deals. 🤝 Partner up on JV opportunities. 💼 Help agents and investors grow smart, profitable businesses. 💸 And build a machine that generates monthly revenue together. First order of business👇 COMMENT BELOW with: - Your name + location - Wholesale, Agent, lender or ???? List them all. - Your #1 goal in real estate right now - One tip, strategy, or lesson you've learned that others here can benefit from. (keep it simple) - Your instagram handle This is not a group where people flex. It's a place where we share, collaborate, and win - as a crew. If you're inactive for more than 14 days or seem to be here to just get views on your social media - you'll be kicked. We actually want people who give a shit about making money and helping others. ⚡Pro Tip: If you want traction here, start by adding value on other intros too. Ask a question. Offer insight. Share a win. Help someone move forward.

2 likes • Jul 6

- Sebastian Haboczki - Bismarck ND - Otw to getting my license (85% done the coursework) and investor - My goal is to get this license done soon, already knocking on neighbours' doors and introducing myself, and actually got a couple of leads - Biggest tip that I've learned in my life that is good for ANY business, be true to your word, if you say you're going to go above and beyond or "call me at any time" then you better stick to it, integrity is more and more rare these days, you'll be surprised how much people appreciate it - my Instagram has nothing to do with real estate haha @Sebastian_Tenor

Deal Talk/Breakdown

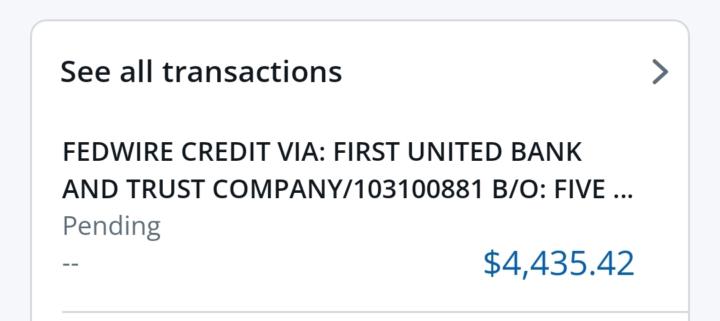

Just closed and funded on a JV Deal that I got from DBR on the spreadsheet. S/O to Josh and Gilbert and all of the Cult! We got plugged in and were working with the acquisition wholesaler who told us we were fine to put our fee on top. They were contracted to seller at 165, so we said that we would profit anything over 177 and would cover closing costs... We had buyer ready and waiting and knew where they could close and it would be all cash at 185k. Buyer actually ends up telling us they can come up higher up to 190k which offends the acquisition group...I found out after viewing the HUD that this is because we would have ended up netting more than their side which was understandable so I offered to adjust the structure to make it where everything was equal...Ultimately, we had to agree to pay an additional 4-5k off of our fee to cover remaining lien on solar panels in addition to closing costs. This deal ended up getting closed and all sides were profitable. Lessons Learned: 1. Be willing to negotiate on any and all deals. 2. Be honest and firm. I had a lengthy discussion with the acquisition representative that had previously agreed verbally to equally split closing costs and the cost of the liens with me but after viewing the HUD they refused to budge. I made it clear that I was willing to compromise but did want them to acknowledge that they had moved the goal posts and shifted the terms of the agreement that we had agreed to verbally. 3. Be flexible. See above...I swallowed my pride and allow myself to be "beat" in this negotiation because ultimately what was important was getting the deal done, showing my value, and making sure that myself, my partner, and the acquisition group all got paid. Let's do some more deals babyyyyyy. HORRRRRNNNNNNNNNNNNNNNN 📯

1-10 of 12

@sebastian-haboczki-3547

Opera singer, Church organist/music director; I lead a large team and love connecting with new ppl..passionate about investing/finance/real estate

Active 9d ago

Joined Mar 19, 2025

Powered by