Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

SAT Prep

16.2k members • Free

The Skool Hub

5k members • Free

Superior Students

19.1k members • Free

ConstruPRO

354 members • Free

Data Career Network

103 members • Free

69 𝓒𝓸𝓶𝓮 𝓐𝓵𝓲𝓿𝓮 💖

72 members • Free

🇪🇪 Skool IRL: Estonia

61 members • Free

SQL Answers - Data & AI

238 members • Free

Everyday Analysts Hub

137 members • Free

52 contributions to Energy Data Scientist 2026

New Online Course: Stochastic Optimization

Inside the 'Classroom' , there is a new course (116) , which shows how to develop, in Python, a 2-stage and a 3-stage stochastic optimization model. The code is available for download, and it is explained through a video of about 1 hour in total. The prerequisites are courses 115 (deterministic optimization) and 116 (Monte Carlo). Stochastic Optimization is used a lot in energy, economics and finance. Anytime we have something uncertain, we use scenarios to describe how the future may play out. For example, the electricity demand tomorrow can be 100 kW, 50kW, 20kW. So we have 3 scenarios. We can have as many scenarios as we think is reasonable. For example in the code we build a 'scenario tree' consisting of 1000 scenarios. And we then assign a probability to each of these scenarios. Then, we have an objective function, which includes probabilities. We have constraints. And this is like any other optimization model. We call it 'stochastic' because it has probabilities in the objective function and because it has scenarios. It is like any other optimization model. So , the jargon may sound a bit intimidating , but it is very simple actually. We apply stochastic optimization to a smart building, which has a solar Photovoltaics unit and also it has residents who consume electricity (electricity demand). And we want to minimize the daily cost of operating this smart building in the future. Since we want to 'minimize' something' we speak about 'optimization'. And also we have uncertainties: the electricity demand is uncertain. Also, the output of the solar PV unit is uncertain. See the two screenshots attached for some extra context.

Power Market Modelling Consultant

Hi, im new here, and recently taking the course to understand energy analytics. Ive been having a look around on linkedin at some jobs as a junior can get into. theres a role for "Power Market Modelling Consultant" - Here is a snippet of their requirements.. What You’ll Be Doing - Building and running market models to explore price evolution, dispatch patterns, capacity dynamics, and policy impacts. - Applying tools such as PLEXOS, Python, R, and advanced spreadsheet modelling to deliver evidence driven insights. - Supporting economic and regulatory assessments, including evaluating future energy scenarios and system wide implications. - Communicating complex findings clearly to internal teams and external stakeholders. - Working with multidisciplinary colleagues on projects for government, industry, and energy ecosystem organisations. About You - A good understanding of UK or European electricity markets, system operation, and market drivers. - Experience using PLEXOS or similar modelling environments, plus familiarity with scripting or statistical tools. - A background in energy modelling, forecasting, simulation, economics, or related analytical fields. - Excellent communication skills, collaborative mindset, and the ability to translate complex modelling outputs into clear messages. can someone just explain what type of knowledge i would require for a job like this? i have general python, sql, excel knowledge so trying to transfer into energy analytics. or can someone recommend some junior analyst roles i can do instead or what the job spec will look like? im just trying to understand, what type of things i should be focusing on. Would really love everyones input.

New Report on Energy Trends: CfDs in the Energy Market

A new report on energy trends has been published in the Classroom, at the very end, in the section “Energy Industry Reports.” It is written in simple, easy-to-understand language, with all terminology and jargon clearly explained. It also includes diagrams and draws on official sources such as the Financial Times, Bloomberg, Wall Street Journal, The Economist, Forbes, Investor’s Chronicle, and others. Feel free to use this report in your projects, work, or studies. As shown in the attached diagram, this report focuses on how the UK is using Contracts for Difference (CfDs) to accelerate new low-carbon electricity generation as it targets power sector decarbonisation by 2030. It explains the outcomes of the latest auction, including record solar awards (4.9GW) alongside onshore wind (1.3GW) and tidal power (about 21MW), and discusses what current strike prices suggest about market conditions. It also highlights key delivery risks, especially grid connection backlogs and planning delays, which could slow down project build-out. Reading these reports can directly help with interviews, meetings, presentations, networking, and public speaking, so it is strongly recommended.

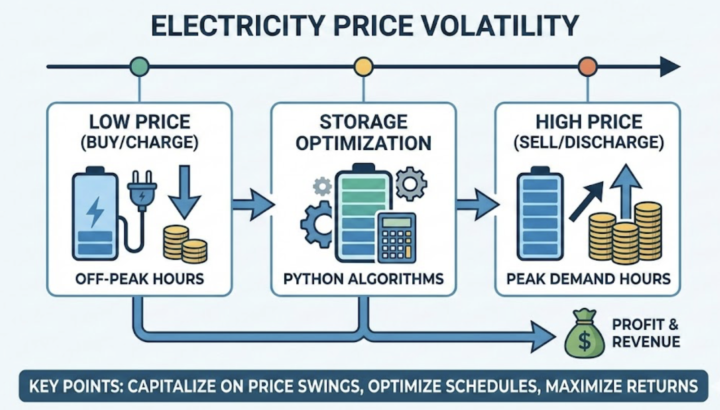

New Online Course: Energy Storage Trading & Arbitrage in Python

The course (available in Classroom) teaches how to develop a profit-maximizing arbitrage strategy for energy storage using mathematical optimization (Linear and Mixed-Integer programming) in Python. Full Python code available to download and fully explained in the video (1 hour and 15 minutes). No prerequisites (beginner-friendly). Energy storage can make money through various ways, one of which is energy storage trading (arbitrage). See the attached figure summarising the energy storage arbitrage strategy. The algorithms and strategies taught in this course are the industry standard for the following roles: - Quantitative Analysts (Quants) in energy firms - Energy Traders - Data Scientists (Energy) - Asset Managers Where is this code used? This specific type of optimization (Arbitrage & Dispatch) is used in firms across the energy and financial sectors: - Hedge Funds & Prop Trading - Investment Banks - Commodity Trading Houses - Energy Majors & Tech Energy Storage : - Utilities (e.g., Duke Energy, NextEra, Enel) own batteries (energy storage) to help stabilise the electricity grid. - Independent Power Producers (IPPs) (e.g., Vistra, AES, Neoen) are companies that build and own power plants (solar, wind, batteries) specifically to sell electricity for profit. They are very active users of arbitrage strategies. - Investment Funds (e.g., Gresham House, Gore Street Capital) are specialized funds that buy batteries as financial assets, similar to how a real estate fund buys apartment buildings to collect rent. - Hedge funds (like Citadel, D.E. Shaw, or Millennium) thrive on volatility. In energy markets, prices can jump from $20 to $2,000 in minutes.

Trick interview question for energy consultancy role!

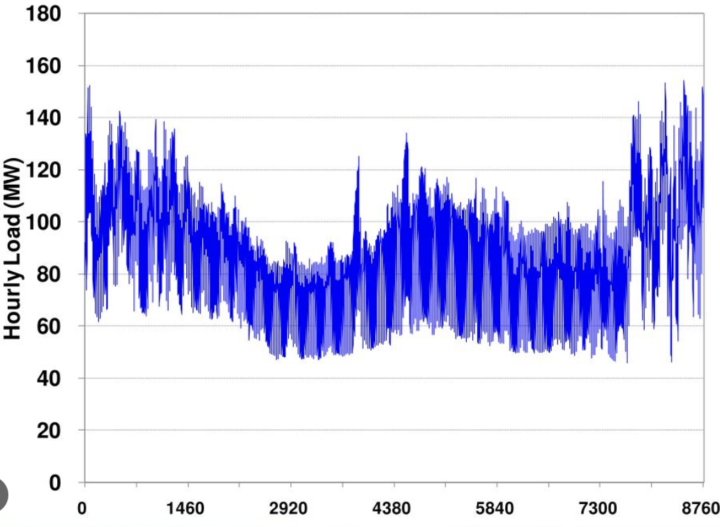

Speaking of interview rounds, I am sharing a very classic 'tricky' and frequently occurring question asked to those applying for consultancy roles in energy for entry roles . By 'entry roles' I do not mean internship. You need to have a BSc for sure, and you aim for a salary around $120k gross annual revenue - speaking of the United States , for 0-1 years of experience , i.e. fresh graduates. But this question is also asked to intermediate experience candidates e.g. 2-5 years experience (salary around. $180k / year in the USA. This is gross ie pre-tax, and annual). Below you see the plot of an electricity demand profile i.e. shows the electricity demand over a day. First, the question is to explain what we see. What do we understand in this plot. To explain the ups and downs. They may point with their finger e.g. 'why here it is low ' , 'why there it is high', speaking of this blue line. And then explain what happens to the price of electricity. Can we infer the wholesale electricity price from this plot? Because this plot doesn't show the price. It shows the demand . And this is the total demand in that region. Electricity demand. This question is asked because when you' re a consultant, your client often asks such questions. And you have to reply fast and accurately, or you may risk your reputation. If you try to evade e.g. by changing topic, then your client isn't stupid.. they will understand... and sometimes they will ask again... So such questions are asked. So this is a classic "gotcha" interview question. The interviewer is testing two things: your technical knowledge of energy markets and, more importantly, your attention to data validation.

1-10 of 52

@paul-e-adams-phd-8694

MEng. Aiming for PhD. Software Engineering

Active 11d ago

Joined Sep 13, 2025

ESFJ

Wales