Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Wholesale Real Estate

1k members • Free

Wolves of Real Estate

807 members • Free

Wholesale To Millions Skool

312 members • $49/month

Real Estate Investing

5.6k members • Free

🐐The Creditprenuer Group

2.2k members • $49/m

BB

Building Builders Academy Plus

1.2k members • Free

Wholesaling Real Estate

67.3k members • Free

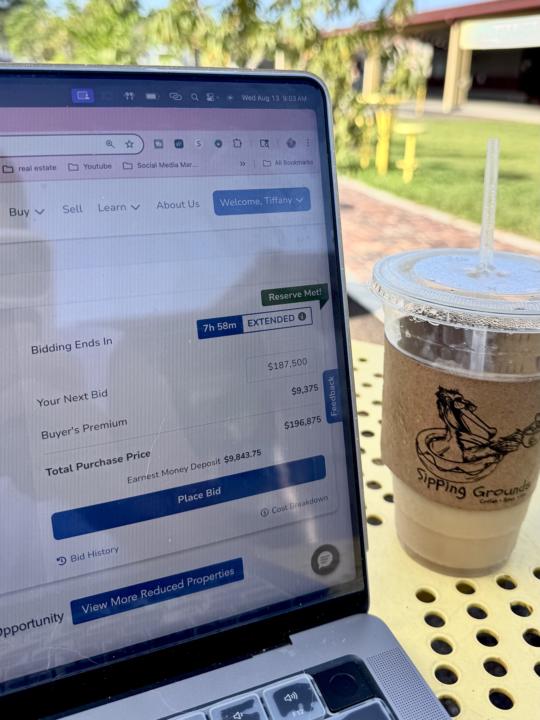

Auction Property Academy

352 members • Free

Free Good Credit Now 101

543 members • Free

6 contributions to Auction Property Academy

Analyze Any Auction Property in Under 10 Minutes

Happy Monday, everyone! Today we’re going over one of the most important skills you can develop as an investor — quick property analysis. When you’re working with auctions, speed matters. Deals move fast, bidding moves fast, and opportunities come and go in hours. So here’s a simple framework you can use to analyze ANY auction property in under 10 minutes. ⏱️ Step 1: Check the Comps (2 minutes) Go straight to: - Recently sold properties (last 1–6 months) - Same bed/bath count - Similar square footage - Within 0.25–0.5 miles You’re looking for the ARV (After Repair Value) — what the home will sell for in its best condition. If there are zero comps, that’s a MAJOR red flag. Move on. 🔧 Step 2: Evaluate Condition (2 minutes) Use the photos + description (and Google Street View) to get a quick read: - Light cosmetic? - Mid-level rehab? - Full gut? You don't need to be a contractor. Just determine which category it falls into — because your numbers will be based on it. Rule of thumb: - Cosmetic = $5K–$20K - Medium = $20K–$40K - Heavy = $40K+ 📁 Step 3: Check for Liens, Violations & HOA (2 minutes) Quick checks: - Property Appraiser - Clerk of Courts - Probate/Foreclosure records - HOA listed? → Expect rules + monthly dues If you see unpaid taxes, utility liens, or heavy code violations…Bake that into your numbers or consider passing. 💰 Step 4: Estimate Total Cost (2 minutes) Add together: - Projected bid price - Rehab - Closing + holding costs (usually 8–12% total) This gives you your all-in number. Now compare it to the ARV you found in Step 1. 📊 Step 5: Make Your Call (1–2 minutes) A deal is worth pursuing if: - The spread is strong (aiming for a 30%+ Profit) - The neighborhood supports your ARV - Rehab is reasonable - Financing works - Risk is manageable If not?✨ PASS. Remember — passing is a winning strategy in auction investing. 💬 Your Turn If you feel like you’re ready for more help and you’re serious about investing —drop a message below and I’ll reach out with details on how to work with me 1:1 to lock in your first auction deal.

This is Why You're Missing out on a Real Estate Deal...

One thing I’ve noticed (both in my own journey and from talking to many of you) is that auction deals often feel more intimidating than they actually are. And most of the time, it’s not because the deals are bad — it’s because there are a lot of unknowns. So for today’s post, I wanted to share something simple and practical for us to break through those barriers: 👉 The biggest reason most people hesitate on auction opportunities is uncertainty — not lack of money or experience. Uncertainty around things like: - whether the numbers make sense - how much rehab the property actually needs - how to confirm liens or title - how to calculate a max bid you can feel good about - what the real profit looks like after everything is paid Here’s a quick framework you can use to make the process feel a lot more manageable: 1️⃣ Start with the numbers — always. Run ARV → estimated rehab → holding → selling → profit. If the spread works, then go deeper. 2️⃣ Categorize the rehab. You don’t need a full inspection to know the difference between: - light cosmetic - moderate interior updates - full repair / structural concerns This alone keeps you from walking into surprises. 3️⃣ Do fast due diligence. Checking taxes, permits, violations, and liens takes minutes — and clears up most of the uncertainty right away. 4️⃣ Set a max bid you trust. Once you calculate it, stick to it. Auctions move fast, but your decision-making shouldn’t. If you focus on these four steps consistently, you’ll feel a lot more confident and far less overwhelmed. If you want more support with this process… I’m reopening the doors to my Group Coaching Program, where I walk you through this step-by-step and help you get fully comfortable evaluating, bidding, and closing on auction properties. If you’ve been wanting guidance or you’d like help building out your strategy… 👉 You can book a call to go over program details and see if it’s a good fit. https://calendly.com/tiiffxny/new-meeting?month=2025-08

3rd-Party Auctions vs. County Auctions (Know the Difference Before You Bid)

Happy Monday, everyone!Today we’re breaking down two very different types of auction platforms — and why understanding the difference can save you thousands of dollars (and major headaches). Not all auctions are created equal. 🖥️ 3rd-Party Auction Sites (Ex: Auction.com) These are platforms that host bank-owned or lender-controlled properties. ✅ Why Beginners Like These: - Often allow financing (DSCR, Fix & Flip, Non-QM, etc.) - Some properties allow inspections and appraisals - Liens are typically cleared at closing (but still verify) - More time between winning the bid and closing - Familiar buying process (title company, escrow, etc.) ⚠️ Things to Watch For: - Buyer’s premiums and auction fees - Reserve prices (not always disclosed) - Competition can drive prices up ➡️ These are generally lower risk and more beginner-friendly when paired with proper analysis. 🏛️ State & County Auctions (Tax Deeds / Foreclosures) These auctions are run directly by the county or state — and the rules are VERY different. 🚨 Why These Are Riskier: - Properties can come with liens, code violations, or unpaid utilities - You usually cannot inspect the interior - No financing — ALL CASH - Payment is often due within 24–48 hours of winning - Title issues are common (quiet title actions may be needed) 💡 Why Some Investors Still Love Them: - Less competition - Deep discounts - Strong margins if you know what you’re doing ➡️ These auctions reward advanced investors with strong systems and cash reserves. 🧠 Quick Rule of Thumb If you’re newer: ➡️ Start with 3rd-party auction platforms where risk is more controlled. If you’re experienced, well-capitalized, and understand title: ➡️ County auctions can be powerful — but mistakes are expensive. 💬 Which type of auction are you most interested in right now? 🚀 Ready to Go Deeper? If you’re serious about buying your first (or next) auction property and want step-by-step guidance, live deal breakdowns, and support inside a proven system…

Poll

3 members have voted

Have Questions?

Hey Investors! Im creating a tab for the community to be able to ask questions as i've been getting a ton of questions in my messages & think we can all benefit from Q&As. Just remember, no question is too small so drop them as a post on here👇🏼

Welcome to the Deal Hub

This discussion forum will be used to share deals between members, high profit opportunities I find & want to share with you, & deal breakdowns. Comment what market (City, State) you'd like to see some deals in👇🏼 Let's get investing!

1-6 of 6

@mamadee-morris-kamara-5590

I Buy houses nationwide call me, Volunteer, Humanitarian, I love to Explore and JV with Good People,

Active 1d ago

Joined Dec 13, 2025