Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

DeFi University

241 members • Free

21 contributions to DeFi University

Hacked!

Hey everyone, I just wanted to give you a heads up to be extra careful. I just lost 4.6 ETH. I used Aperture finance to open and LP, 1 week later I withdrew my position on Revert finance and the funds hit my wallet and instantaneously were sent to an unauthorized contract address. Turns out there was a hack on Aperture Finance, that I am just now realizing I was affected by - https://phemex.com/news/article/17-million-stolen-in-attacks-on-aperture-finance-and-0xswapnet-56041 I use a Tangem hardware wallet, VPN, and am very cautious, yet this still happened to me. It's enough to make me vomit and want to run from the crypto space. 🤮 Just sharing so hopefully you can avoid something like this.

🎯 MASTERING UNISWAP V3 LIQUIDITY: From Passive LP to Active Volatility Trader 📊

Hey DeFi fam! 👋 Just dove deep into this incredible quantitative framework for managing Uniswap V3 positions, and I HAD to share this with you all. This isn't your typical "set it and forget it" LP strategy - this is next-level stuff. 🚀 💡 THE BIG IDEA: Short Volatility, Don't Just Provide Liquidity Most LPs are getting REKT because they treat liquidity provision like passive yield farming. But here's the truth bomb 💣: When you provide liquidity, you're essentially underwriting variance and profiting when markets overpay for risk. This framework shows you how to do it systematically. 📋 THE 4-PHASE FRAMEWORK: Phase 1️⃣: Entry Analysis (The Go/No-Go Decision) ✅ Before you even think about deploying capital, you need to pass THREE critical tests: 1. Calculate the Variance Risk Premium (VRP) - Only enter if VRP > 0, meaning the volatility implied by fees is HIGHER than actual realized volatility. The market needs to be overpaying you for risk! 📈 2. Filter for Market Regime - Use the Hurst exponent to identify market conditions. H > 0.55 = trending market (stay out!), H = 0.5 = random walk, H < 0.55 = mean-reverting (perfect for LPing) 🎲 3. Check Breakeven Volatility - Your forecast for realized volatility must be LESS than your position's breakeven volatility. Otherwise, you're just donating to arbitrageurs. 😬 Phase 2️⃣: Position Structuring & Active Management ⚙️ - High volatility environment? → Set WIDER ranges to survive longer - Low volatility environment? → Set NARROW ranges to maximize capital efficiency - Always aim for delta neutrality by opening a short futures position equal to your LP delta. This isolates the volatility premium! 🎯 Phase 3️⃣: Rebalancing (The Stopping Problem) 🔄 Here's where most people blow up their returns. Rebalancing is DANGEROUS and COSTLY because: - You crystallize permanent impermanent loss 💸 - Swap costs eat into your profits - You're essentially resetting your position The Rebalancing Breakeven Test: Only rebalance if: Expected Future Fees > (GAS + Swap Costs + Crystallized Loss)

BTC follwoing gold price moves?

Remember, when a few months ago one youtuber brought a chart that showed something about BTC potentially following gold's moves up? David thought it was a classic case of curve fitting and it possibly is. Here is another one of the guys I follow on yt, Aaron Bennett, and he claims the same thing at 2 mins. https://www.youtube.com/watch?v=ko1Ip3tzeto What do you guys think?

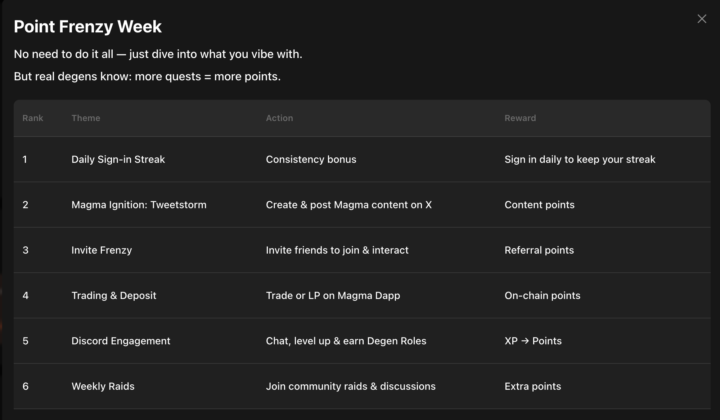

Farming points on Magma

It started providing liquidity on Magma (Sui) and they have a points program where you can earn points in many different ways.

1-10 of 21