Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

The MHP Pros Mastermind

111 members • $99/month

Mobile Home Park Mastermind

655 members • Free

103 contributions to The MHP Pros Mastermind

Does This Deal Have Any Potential?

During my time in Lubbock, I had the opportunity to build some great relationships and connect with a few amazing people . One of those connections is a lender who’s involved in a different mobile home park—the same park that a seller I previously worked with is now trying to offload. That seller still technically owns the park, but he plans to step back from the deal to avoid future legal complications. The lender is in a tough spot. His team is facing a $1.2 million loss on the property, so he's open to almost any deal structure to avoid taking that hit. As it stands, the park is worth about $300,000 and requires significant infill and infrastructure upgrades. It's an old 1960s-style park with outdated clay sewer lines and ¾-inch galvanized steel water lines. Some water lines are already leaking, and the sewer system will likely need to be fully replaced within the next 3–5 years. As part of the agreement with the lender, the seller must move 20 homes into the park. He’s in a position to do this, as he recently sold another park and is relocating 15 tenant-occupied homes and another 5 homes that need renovation. This move-in process is expected to be completed within the next three months. Currently, the lot rent is $300 per unit, and the expense ratio is around 30%, which is fairly reasonable. Once the 15 occupied homes are brought in, the park’s value could increase by about $450,000 overnight, assuming a 9% cap rate. So there’s definite upside potential. That said, it’s still a heavy infill project with infrastructure challenges—and for that reason, I feel it may be too risky for a first-time park acquisition. Would love to hear your thoughts or suggestions on how you would approach this.

0 likes • 3h

So this is a deal for a very experienced operator or a construction company owner. If you are either of those take it down. Good market but a complete redo of water and sewer is not a cheap project. Clay tile is a nightmare. Great when it's installed but not a great lifespan. I have passed on good deals bc of clay tile

Q3 2025 Manufactured Housing Report

REITs are posting strong numbers. Rents are up. Occupancy is tight. Investor appetite is steady, but disciplined. 📍 What’s happening: – ELS pushing 5.1% rent hikes for 2026 – Sun Communities hitting 98% occupancy and $457M in new acquisitions – UMH expanding aggressively with 321 new sites and double-digit NOI growth – Financing is available, but only for the best: 5.25–5.75% rates, ~65% LTV Even with home sales cooling, the big players are leaning into infill, operational gains, and long-term demand. The playbook is clear: buy scale, push rents, control costs. 🧠 If you’re not watching how the REITs are moving, you’re missing the

Chris Kelch intro

What’s up everyone, Chris Kelch here. I was in one of Ryan’s Legacy mentorship groups, and his mentorship was huge for me. I'm grateful that Michael and Ryan have launched this program. In 2022, I purchased three heavy value‑add mobile home park projects at roughly the same time. I'm only now getting to the other side of that push: back above water and set to close on a big refi for those deals in a couple of weeks. My original strategy was “all value‑add, all equity multiple” so I could stay bootstrapped. Looking back, I wouldn’t recommend that. The risk of total burnout and the whole thing coming apart is very real. So going into 2026, we’re pivoting: I’m taking Ryan’s advice and only taking on one major project at a time. That said, taking tired trailer parks and turning them into thriving manufactured housing communities has been extremely fulfilling. No words can describe how incredible it is to hand over keys to a resident who never thought they'd be able to afford a home. Being the first real landlord after a long line of slumlords. Actually giving a sh*t about a park and investing back into the community as opposed to sucking the life out of it. This industry is so rewarding if approached the right way. I'm looking forward to catching up with everyone here!

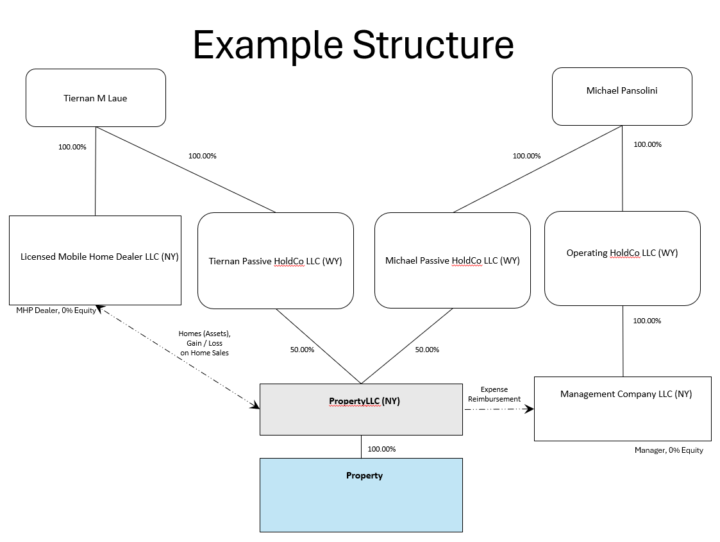

Example Structure of our Latest Investment

@Tiernan Laue and I structured our latest investment as follows, for those interested. The HoldCo for Operating companies is a separate step I took that I'm not sure is entirely necessary but I wanted an extra layer of anonymity and protection between my OpCos and my Operating Entities. Everything else is pretty standard. As you can see by the dotted lines, there is no ownership of the property LLC by the Mobile Home Dealer Entity OR the Property Management Company entity. These are fireable entities - ultimately we could hire other dealers / property managers other than ourselves to replace those roles.

Paid Mentorship IS Worth It

ATTENTION ALL MEMBERS: you see my progress and you comment about who, what, where and how. I came in to this niche with no knowledge of mh other than some of my friends grew up in trailers. EVERYTHING I learned is from the systems taught by the founders of this group. Watch the training videos, practice the exercises, join the weekly calls and when you need help join the mentorship group. PAY FOR YOUR SUCCESS. It’s much cheaper to get the concentrated knowledge than to struggle with diy. I paid for group mentorship and got my training wheels on and bought a few small parks. I utilized Ryan’s brain again and bought a bigger one. When I needed to adjust my systems to get past a blockade, I paid for the one on one. This group is not a Facebook group or just some chat forum with no bite. Invest hard dollars in yourself and it will be worth it. Make connections, partner with people if needed, be an lp if you like what you see but can’t/won’t jump in full force. There are tens of millions if not hundreds of millions worth of deals flowing through this group every year. Jump in with a solid foundation and grow. There is no left behind bc the opportunity is always there but it is the cheapest it will ever be. FYI…I have lp investors in my own deals in this group, I have mentees of my own in this group, I have gp money partners in this group! I don’t make money off you buying into the mentorship’s. I make money off the relationships I grow and the business I create from the solid gold I have mined from the founder’s brains. CONQUER 2026

1-10 of 103

@caleb-hogan-9067

Park owner, operator and gp in multiple syndications. Headed to 2000 lots quickly with a goal of 10,000

Active 3h ago

Joined Dec 11, 2024

Powered by