Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Owned by Michael

🚀 Cut out the noise. Built for action-takers: connect with top MHP pros, access pro-level tools, and tap into real deal flow with a networking map.

Mobile Home Park Investment for new or existing investors who want to find cash-flowing, off-market deals and manage them like a pro!

Memberships

skoot crm

317 members • $97/month

Commercial Real Estate 101

4.9k members • Free

𝙂𝙊𝙊𝙎𝙄𝙁𝙔 🍓🐛🦋🌈⭐️🩷

11.5k members • Free

Airbnb Free Course

8.3k members • Free

Mobile Home Formula

7 members • Free

Mobile Home Investing 101

586 members • Free

ADHD Entrepreneurs

6.9k members • $49

Real Estate w/ Nick Chapman

403 members • Free

Ai Automation Vault

15.4k members • Free

668 contributions to The MHP Pros Mastermind

Off-Market NC Parks

Hey guys, I've got an owner looking to sell two of her NC parks. She'd love to do a package deal on them, but would be open to selling individually. These do not fit mine or my partners particular buy box, so wanted to see if anyone in here might be interested. The info I have is below. Please reach out if you'd like to discuss further – ntb712@gmail.com (609)-471-0197. Thanks! Park 1 – Wadesboro, NC - 27 lots (one empty lot) - 24 TOH @ $350/mo (market closer to $450) - 2 POH @ $775 & $800/mo - 1:1 septic, city water separately metered and direct-billed - Gravel roads - LL pays for trash (individual cans) billed ~$30/mo/lot - Owner looking for ~$1.5M Park 2 – Newport, NC - 10 lots fully occupied + 1 stick built home - 9 TOH @ $450/mo - 1 RTO @ $905/mo (unsure of current balance) - Stick built home @ $1200/mo - 1:1 septic, 2 wells, mix of asphalt/gravel roads - Owner looking for $525k

We are LIVE with Ryan's Office Hours RIGHT NOW

https://www.skool.com/mobilehomeparks/calendar?eid=feed0b3d7d9f43c7923ce2f4df461ff3

1

0

Spanish

Curious how many operators speak Spanish? As I eat here at a Mexican restaurant and think about my tenant base. I feel like it would be a huge plus for tenants and labor market. My dad also learned/speaks some Spanish:understands a good amount just because the tenants.

Poll

3 members have voted

2 likes • 14h

This is totally market dependent, but that said, it is extremely helpful. I wish there was a third option here that said "extremely nice to have". It's certainly not the most important thing you can focus your time on. There are so many things and skills you need to learn in mobile home park investing, but being able to communicate with your tenants and potentially contractors in a more efficient way is pretty vital. Now, if you're scaling quickly, you can end up hiring staff that speak Spanish. And one of Ryan's requirements for his staff is that they're fluent in Spanish, especially in specific markets that have high percentages of Spanish-speaking residents.

Multiple streams of income

So I am currently starting to learn flipping MHs, renting MHs. I believe this will help me gain some good knowledge for MHPs as well as being in the parks locally in both of my markets, I will gain trust and leverage when the owners sell, maybe not now but down the road. This will also enable me to build some capital for either myself or potential JV partnerships down the road! This will almost pull all aspects of parks together. @Michael Pansolini @Ryan Narus @Connor Cogdill @Tiernan Laue let me hear your thoughts. I know I haven'tbeen as active as I was earlier, I'm really working more on my physical health and it's helped me light the fires again!

1 like • 24h

Happy to hear you are taking care of your health @Richard Berardinelli ! You have the absolute right idea. Bringing home refurb and sales into the equation will certainly help you fire on all cylinders when you close on a park! Itll also help fill the capital bucket so you can rely less on investors!

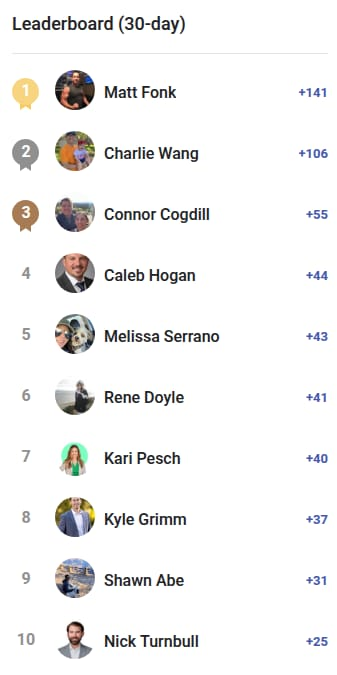

🎉 FEBRUARY LEADERBOARD RESULTS - PAID COMMUNITY 🎉

We wrapped up February strong with solid engagement across the board - great questions, shared wins, and operator-to-operator support. Here is how the leaderboard shook out. 🥇 Matt Fonk - +141 🔥 Absolutely dominated the board this month 🥈 Charlie Wang - +106 ⚡️ Consistent powerhouse, month after month 🥉 Connor Cogdill - +55 📈 Great climb, showing up and adding value 4️⃣ Caleb Hogan - +44 5️⃣ Melissa Serrano - +43 6️⃣ Rene Doyle - +41 7️⃣ Kari Pesch - +40 8️⃣ Kyle Grimm - +37 9️⃣ Shawn Abe - +31 🔟 Nick Turnbull - +25 🏆 February Prizes 🥇 @Matt Fonk - FREE 1-on-1 Coaching Call with Michael OR additional Group Session 🥈 @Charlie Wang - FREE Invite to a Group Mentorship Session 🥉 @Connor Cogdill - FREE Access to Recorded Group Mentorship Sessions for 1 Month 📬 Winners - DM Michael to claim your prize and schedule your session. Want to hit the leaderboard in March? • Post your questions • Share your wins and lessons • Help others move forward • Be active and consistent Cheat code reminder: Follow The MHP Pros and Ryan Narus on social and podcast platforms. Then DM Michael with "Followed +[#]" to get your one-time leaderboard bonus boost. Let us kick off March with momentum.

1-10 of 668

@michaelpansolini

🏡 Teaching The Proven System to Invest in Mobile Home Parks, 💪🏻 Ex-Wall Street Real Estate Private Equity 🗺️ Community Builder⚙️ Systems Builder

Active 3m ago

Joined May 7, 2024

ENTP

New York, NY

Powered by