Write something

Pinned

Replace those New Year's Resolutions with Action

How many of you are still keeping up with your resolutions? Most people have already fallen off by now... a large portion of you even gave up by the second Friday of the month! 🚩Or maybe you've made it here to the very end of January and you're still going strong. If so, good for you! But there is something to be said about a measurable goal and lifestyle change, rather than just a one sentence, undefined resolution... If you were one to jump on the band wagon with everyone else, with either giving up something "bad for you", or picking up a "good" habit in the new year, and you've already given up, then maybe it's time to pivot and refresh. And there is no better time than now! We are coming up on the end of the January, and believe it or not, January is National Financial literacy month! If you were unaware, or unable to put time and energy into your own financial literacy at the beginning of this month, then you will be glad to know that it is NOT too late to start now. And what's even better, is you still have 11 more months ahead of you in 2026. And you can still say you began your educational journey into finance while still in month one! So what steps should we take first? ✅If you want to set a measurable goal to understand your own personal finance and investments, and take some time to set clear financial goals for the year, then let us help you get there through these 8 steps. 💸Maximize your potential through the resources available to you: 1. Schedule and attend a free financial education webinar (or two). 2. Utilize an online retirement calculator to play around and calculate your own potential financial needs in retirement. Figure out how you want to live. A lavish, expensive life full of travel? Or maybe a simpler lifestyle, where less income is needed later in life... Knowing this is important in understanding how you need to save for retirement now. 3. Read our tips and tricks below and learn more about financial literacy through our educational posts. 4. Look to our book recommendations to continue your financial literacy with some of the best published authors out there. 5. Respond, with your own questions and feedback on some of our posts. Join a discussion that resonates with you and see how other people are saving for retirement. 6. Schedule a complimentary financial needs analysis to better understand your own finances. 7. Find the best accounts that match your risk tolerance and financial needs that are available to you. Some types of accounts and ways to save are not common knowledge, and what is available may surprise you. Learn how to save where the ultra wealthy (or the 1%) save regularly saved to maximize the growth on your investments. 8. And finally, set up automations in these accounts that will help you reach your financial goals.

2

0

Pinned

Introduce yourself & what you hope to gain from being here.

Hello! Welcome to our community of education and personal growth. Not just in finances, but also in family, faith, and your future. 🌠 With joining this community, what would you say are your top two goals? 🗾 What are your go to resources for your personal financial education? 🏦 How financially savvy do you see yourself? On a scale of one to ten, (one = you know little to nothing, and ten = you know all there is to know). 🎭 And finally, share a quirky, fun fact about yourself!

🧠💰 A Quick Story About Money (That Might Hit Home)

Let me tell you something that happened the other day… I was talking to someone who said, “If I could just make a little more money, everything would finally calm down.” Sound familiar?I smiled because — whew — I used to believe the exact same thing. But here’s the truth I had to face (and it wasn’t cute):It wasn’t about making more.It was about learning how to grow what I already had… and stop letting money boss me around like a bad toddler with a juice box. The real shift happened the moment I stopped asking,“Why don’t I have enough?”and started asking,“What could my money become if I treated it like a seed instead of a bill-payer?” 🌱 Seeds grow.⚠️ Bills just repeat.Big difference. So here’s my question for you — and I genuinely want to hear your answers: 👉 What’s ONE money lesson you learned the hard way… that ended up growing you the most? Drop it below ⬇️Your story might be the thing someone else needed today. And if you read this thinking, “Yeah… I’m ready for my money to stop stressing me out and start working FOR me,” say ME and I’ll reach out. Let’s grow together. 💛✨

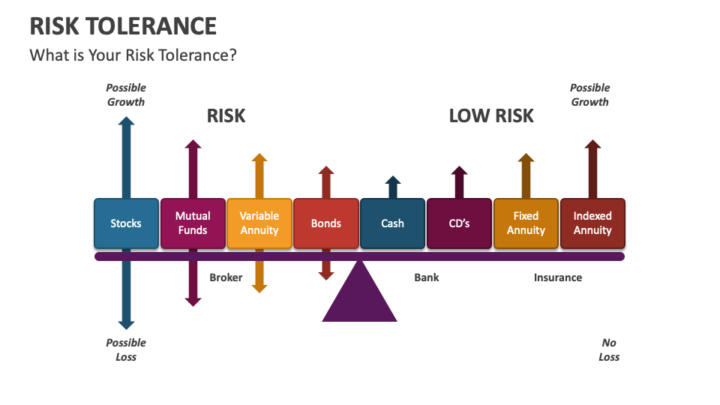

Risk Tolerance

Risk Tolerance: When it comes to your savings, how much risk can you tolerate? 🔴Are you someone who likes to put your money in super high-risk stocks, were you could potentially lose a LOT if the market crashes, but there is also a high reward when the market is up? 🟢Or do you prefer to have extreme protection where your money is locked into a CD (Certificate of Deposit), where it is growing at a much lower, fixed interest rate for a guaranteed amount of time? With no surprises, not much growth, and potentially higher taxes... 🟡Or do you fall somewhere in between those two extremes with some risk being tolerated, but you aren't willing to gamble your investments and lifetime savings at a higher cost? Reassessing every so often, especially at different stages in your life can guarantee that you, your finances, and your financial goals are well aligned. How aligned would you say your current investments are with your financial goals? Keeping in mind that your risk tolerance can change over time, with age and your priorities, how would you rate yourself now on scale of 1 to 10?

Turning $5 into $20 while you sleep

What if I told you that for every 💸 five dollar bill you gave me; I'd give you twenty dollars back? How many would you give me? Would you run to the bank and remove all the money in your checking account and have them cash it out in $5 bills? I think most of us would!! Well, what if you had to wait sixteen years to get your money back? Now that we are 3 days into 2026, let's make this year the example in this scenario. Let's say you have all of 2026 to give me as MANY $5 bills as you want, and in 2042, 16 years from now, you will get back $20 for every $5 bill you invest now. Would you still empty out all of your savings? Maybe you would need to strategize a little better... but how much money would you dedicate to this investment? Let's say you get paid every week, and you decide to invest $20 from every paycheck you receive. ☑️$20 x 52 (weeks) = $1,040 sixteen years later, you would receive $4,160. Not bad... but what if you could do more? You may have to give up that daily Starbucks run, or maybe cut going out to that fancy restaurant or meeting your friends for cocktails one night a week... But what if you were able to put away $300 a month instead? ☑️$300 x 12 (months) = $3,600 sixteen years later, you would receive $14,400. What if you did this every year, for the next 10 years, and each year, that same money could continue to grow for an additional sixteen years? Hey, if you've already changed your daily habits to incorporate monthly savings for one whole year, then why not keep it up?! By doing this, you are now able to save up and grow over $300,000! And all because you chose to save $75 a week, instead of going out to eat and spending that same $75 bucks. Many people say they would love to have such an opportunity. To have this money grow while they're sleeping, playing, hanging with family or friends, working, vacationing, etc. What if each and every one of us DOES have this opportunity? We just need education on where to save, and how to save so that our money can compound and grow interest.

1-30 of 30

powered by

skool.com/the-prosperity-project-9756

Built to empower you to not only take charge of your personal finances, but to grow a community focused on lifestyle, family, faith, & future.

Suggested communities

Powered by