Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

High Ticket Premium Agent

683 members • Free

Women's Business Community

973 members • Free

Lifewave Champion Makers Team

9.6k members • Free

The Solopreneur Initiative

2.9k members • Free

Highways2Home Pro

3 members • Free

The Prosperity Project

14 members • Free

Wholistic Productivity

40 members • Free

21 contributions to The Prosperity Project

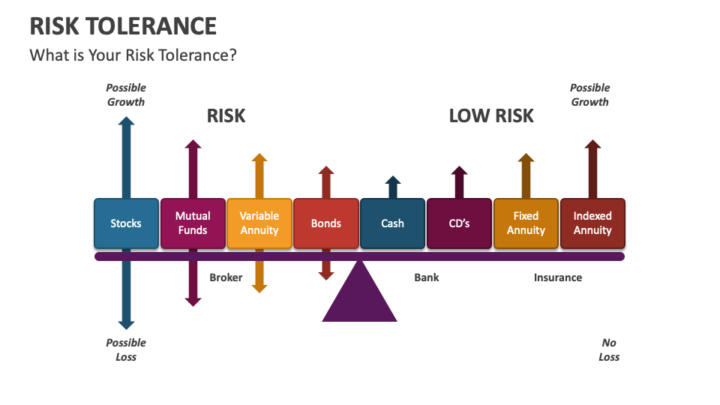

Risk Tolerance

Risk Tolerance: When it comes to your savings, how much risk can you tolerate? 🔴Are you someone who likes to put your money in super high-risk stocks, were you could potentially lose a LOT if the market crashes, but there is also a high reward when the market is up? 🟢Or do you prefer to have extreme protection where your money is locked into a CD (Certificate of Deposit), where it is growing at a much lower, fixed interest rate for a guaranteed amount of time? With no surprises, not much growth, and potentially higher taxes... 🟡Or do you fall somewhere in between those two extremes with some risk being tolerated, but you aren't willing to gamble your investments and lifetime savings at a higher cost? Reassessing every so often, especially at different stages in your life can guarantee that you, your finances, and your financial goals are well aligned. How aligned would you say your current investments are with your financial goals? Keeping in mind that your risk tolerance can change over time, with age and your priorities, how would you rate yourself now on scale of 1 to 10?

0 likes • Jan 12

This is such a good question, because my own risk tolerance has changed SO much over the years. There was a time where I thought I had to go “all in” on something risky just to catch up financially… and let me tell you, that kind of stress will chew up your sleep, your peace, and your confidence real quick. 😂 Then I swung the opposite direction — super safe, super protected, everything locked up tight… and while that felt comfortable, it definitely didn’t help my money grow. Now? I fall right in that sweet spot in the middle.I want my money protected (because no thank you to stock-market heart attacks), but I also want growth that actually moves the needle for my future and my family. That balance just feels right for where I am in life. And honestly — that’s the whole point.Your risk tolerance isn’t one-size-fits-all, and it isn’t permanent. It changes with your responsibilities, your goals, and the season you’re in. Mine did. Getting clear on it was the moment things started making sense for me financially. It helped me pick accounts that matched ME — not just whatever someone told me was “good.”

Turning $5 into $20 while you sleep

What if I told you that for every 💸 five dollar bill you gave me; I'd give you twenty dollars back? How many would you give me? Would you run to the bank and remove all the money in your checking account and have them cash it out in $5 bills? I think most of us would!! Well, what if you had to wait sixteen years to get your money back? Now that we are 3 days into 2026, let's make this year the example in this scenario. Let's say you have all of 2026 to give me as MANY $5 bills as you want, and in 2042, 16 years from now, you will get back $20 for every $5 bill you invest now. Would you still empty out all of your savings? Maybe you would need to strategize a little better... but how much money would you dedicate to this investment? Let's say you get paid every week, and you decide to invest $20 from every paycheck you receive. ☑️$20 x 52 (weeks) = $1,040 sixteen years later, you would receive $4,160. Not bad... but what if you could do more? You may have to give up that daily Starbucks run, or maybe cut going out to that fancy restaurant or meeting your friends for cocktails one night a week... But what if you were able to put away $300 a month instead? ☑️$300 x 12 (months) = $3,600 sixteen years later, you would receive $14,400. What if you did this every year, for the next 10 years, and each year, that same money could continue to grow for an additional sixteen years? Hey, if you've already changed your daily habits to incorporate monthly savings for one whole year, then why not keep it up?! By doing this, you are now able to save up and grow over $300,000! And all because you chose to save $75 a week, instead of going out to eat and spending that same $75 bucks. Many people say they would love to have such an opportunity. To have this money grow while they're sleeping, playing, hanging with family or friends, working, vacationing, etc. What if each and every one of us DOES have this opportunity? We just need education on where to save, and how to save so that our money can compound and grow interest.

0 likes • Jan 12

WOW… this hit home for me because this is exactly the kind of mindset shift that changed everything in my own financial life. For the longest time, I told myself “I’ll save when things calm down” or “I’ll start when I make more.”But the truth? Things never calm down on their own — and waiting never magically creates extra money. I had to decide to take control of it. For me, the turning point was realizing how much I was spending on the little things… the “I deserve this” moments… the quick food runs… the small comforts that add up FAST. Once I shifted that same money into actual growth instead of instant gratification, everything started to change. And honestly? I wish someone had talked to me about this YEARS ago. Now I look at my money like seeds. 🌱Every $20… every $75… every little deposit is future Erin being taken care of. My family being protected. Stress slowly disappearing. This post is such a good reminder:We already HAVE the opportunity.We just need the right education and the consistency to follow through. For me personally, the first habit I changed was cutting back on unnecessary “little” spending and paying my future self first. That one shift made a bigger impact than any raise or bonus ever did. I’m curious — what’s ONE habit you could swap out this year that would move you closer to the future you actually want?

🧠💰 A Quick Story About Money (That Might Hit Home)

Let me tell you something that happened the other day… I was talking to someone who said, “If I could just make a little more money, everything would finally calm down.” Sound familiar?I smiled because — whew — I used to believe the exact same thing. But here’s the truth I had to face (and it wasn’t cute):It wasn’t about making more.It was about learning how to grow what I already had… and stop letting money boss me around like a bad toddler with a juice box. The real shift happened the moment I stopped asking,“Why don’t I have enough?”and started asking,“What could my money become if I treated it like a seed instead of a bill-payer?” 🌱 Seeds grow.⚠️ Bills just repeat.Big difference. So here’s my question for you — and I genuinely want to hear your answers: 👉 What’s ONE money lesson you learned the hard way… that ended up growing you the most? Drop it below ⬇️Your story might be the thing someone else needed today. And if you read this thinking, “Yeah… I’m ready for my money to stop stressing me out and start working FOR me,” say ME and I’ll reach out. Let’s grow together. 💛✨

Black Friday Spending Predictions

Saw an interesting article this morning about predictions for Black Friday. Overall, shoppers expect to spend 4% less than last year. But the interesting numbers were in the breakdown by income. Households making 50,000 are expected to cut black Friday spending by 12%, while households earning $200,000 or more are expected to cut spending by 18%. Conventional wisdom would say the people who make less would be cutting more as the economy tightens. But it’s the higher wage earners who are reducing spending at higher percentages. It could be that higher wage earners are cutting out the extras, where lower wage earners use Black Friday as an opportunity to save on necessities. But during the recession I saw a phenomenon that I call “perceived poverty,” where donors with literally millions of dollars in the bank felt they couldn’t make a charitable contribution to my organization because they were “broke.” Anyways, this is fascinating to me. Why do you think higher wage runners are cutting back more?

2 likes • Dec '25

Black Friday this year wasn’t about chaos — it was about strategy. Online sales hit $11.8B, but here’s the real headline:Most people spent LESS and planned MORE. Why?Because groceries are up. Bills are up. Life is up.And 70% of shoppers said they’re cutting holiday spending and sticking to a budget. This year’s Black Friday winners weren’t the ones grabbing the most stuff…They were the ones who knew their numbers, set their limits, and shopped with intention.

Happy Holidays! Goodbye budget!

With this being the big “shopping weekend” I like to ask how you budget or plan for how you spend over the week of Thanksgiving? Many people talk about not having money over the holidays, but how are they preparing for it? Is it worked into the annual or monthly budget? Should it be? 🍲🍗First, people often spend more on food with Thanksgiving; many travel to be with loved ones for the holiday too. 🛍️Then there is Black Friday shopping (which now seems to fall over more than a week somehow). 🎁And finally, we have cyber Monday, and giving Tuesday! Did I miss anything? If you are interested in a free financial needs analysis to assess your budget, let us know. You can be scheduled with a licensed financial professional for a complimentary assessment.

1 like • Dec '25

I feel that moving money around for Christmas and having a monthly budget is not just appropriate — it’s smart. And here’s why… Because life doesn’t magically pause in December. Bills still come. Kids still eat. Cars still break. And Christmas? It shows up every single year like clockwork — yet somehow everyone acts surprised. A budget isn’t restriction. It’s responsibility. It’s you saying, “I’m in control, not my bank account.” And shifting money to make the holidays work? That’s called being an adult with priorities. It’s called protecting your peace. It’s called avoiding a financial hangover in January. We budget because we care about our families.We plan because we want stability.We move money because we’re smart enough to know what matters most. So yes — adjust things. Move things. Give yourself margin. Make Christmas magical without wrecking your financial future. That’s not irresponsible. That's strategy. And the people who get it… get it. 🎄💰✨

1-10 of 21

@erin-carr-9467

Focusing on building an empower with my dream life as a mom, wife, and entrepreneur

Active 1d ago

Joined Sep 25, 2025