Write something

Pinned

Welcome to Risk Management Made Simple

I'm Dallas Downey, and I built this community because I got tired of watching business owners get blindsided. I spent years in the trenches doing what most brokers do—slinging policies and grinding to grow my book of business in a field that's, honestly, boring as hell. I'd sit down with business owners, explain coverages until I was blue in the face, and watch their eyes glaze over. They didn't care about deductibles or limit structures. They cared about one thing: Am I paying for useful protection? But here's the problem—most didn't understand the difference between having insurance and actually managing risk. They thought a policy meant they were safe. So they'd get hit with a lawsuit, an OSHA violation, or a massive claim they thought was covered, and suddenly we'd both be scrambling. That's when I realized the real issue: I wasn't solving their problem. I was just selling them a product. That's when everything changed. I stopped focusing on policies and started focusing on why businesses get exposed. I learned auditing. I studied compliance frameworks. I built processes to uncover the gaps that insurance alone can't fix. And the moment I started teaching business owners about total cost of risk—not just premiums, but lawsuits, downtime, regulatory fines, and operational chaos—everything shifted. They got it. They engaged. They protected their business. That's why this community exists. This isn't a place for sales pitches. It's a place where you get the frameworks, the checklists, and the straight talk that keeps you out of trouble. You'll see case studies from businesses that got exposed—and how they fixed it. You'll get templates you can actually use. And when you have a specific question, you'll get expert feedback, not corporate jargon. Here's what I want from you: 1. Show up. The value here only works if you're engaged. Comment on posts. Ask questions. Share your biggest risk concerns. 2. Be honest about where you're vulnerable. The more real you are, the better advice I can give. 3. When you're ready to go deeper—whether that's a mock OSHA audit, a comprehensive risk plan, or just expert guidance on a specific problem—you'll find those options inside. But there's zero pressure. This community is genuinely free, and it's genuinely valuable on its own.

2

0

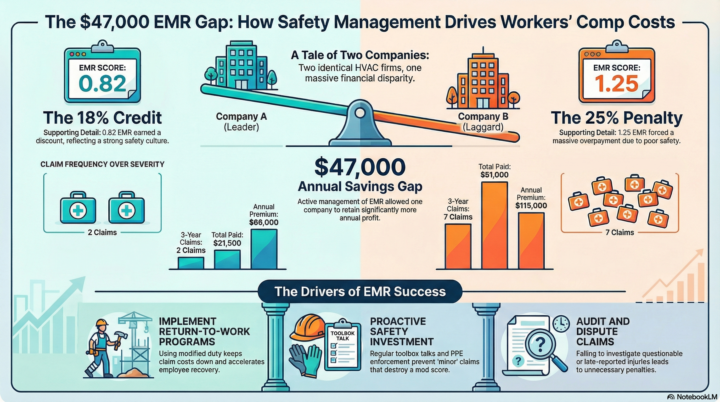

The $47,000 Difference: How Two Nearly Identical Companies Pay Wildly Different Workers' Comp Premiums

Let me tell you about two businesses I worked with in 2024. Both in HVAC installation. Both with about 17 to 20 employees and $3 million in annual revenue. Company A paid $68,000 in workers' comp premium. Company B paid $115,000 in workers' comp premium. Same industry. Same size. Same city. $47,000 difference. The reason? Experience Modification Rate (EMR). Company A: EMR 0.82 (Below Average Risk) This company had an EMR of 0.82—meaning they paid 18% less than the industry baseline for workers' comp. Their base premium was $83,000, but their mod brought it down to $68,000. Here's what they did right: 1. They managed claims frequency, not just severity. Over the past three years, they had two claims: - One $18,000 shoulder injury (employee slipped on a roof) - One $3,500 minor laceration (resolved quickly) Total claims: 2 - Total paid: $21,500 2. They invested in safety upfront. - Monthly toolbox talks on fall protection and ladder safety - Required PPE (hard hats, harnesses, gloves) on every job - Pre-job safety huddles before any elevated work - Incident reporting system (near-misses logged and reviewed) 3. They had a return-to-work program. When the shoulder injury happened, they immediately got the employee into modified duty. He couldn't climb ladders for 6 weeks, so they put him on equipment inventory, job site prep, and dispatch support. He never fully stopped working, which kept the claim cost down and sped up recovery. Result: EMR dropped from 0.95 to 0.82 over two years. Annual savings: $10,800/year. Company B: EMR 1.25 (Above Average Risk) This company had an EMR of 1.25—meaning they paid 25% more than the industry baseline. Their base premium was $92,000, but their mod pushed it to $115,000. Here's what went wrong: 1. They treated small claims like they didn't matter. Over the past three years, they had seven claims: - Three minor back strains ($4K, $6K, $5K) - Two hand injuries from power tools ($7K, $8K) - One knee injury from kneeling on concrete ($9K) - One slip-and-fall in a client's driveway ($12K)

Monday Risk Tip - EMR ER

If you've never heard of an EMR, an Experience Mod, or you don't know what the heck I'm even talking about, you need to watch this video.

0

0

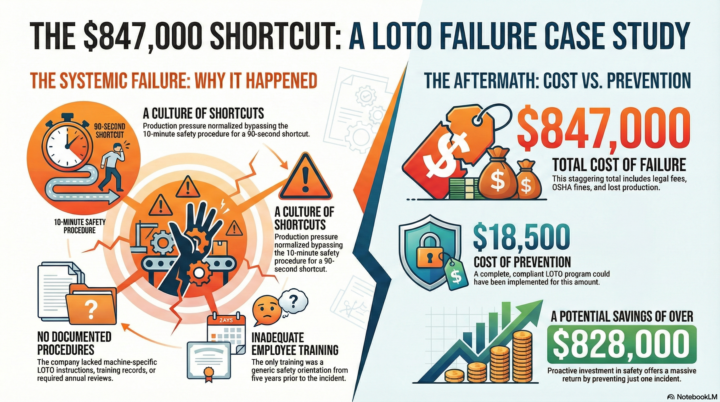

How a 15-Second Shortcut Ended up Costing $847,000

This is the story of a mid-sized packaging manufacturer in the Greater Houston area—$8M in annual revenue, 35 employees, solid safety record. They'd been in business 14 years without a serious OSHA violation. Until a Wednesday morning in March 2024 changed everything. 🔎The company ran a high-speed packaging line with an automated conveyor system. Around 10:30 AM, the conveyor jammed. Product was backing up. The production supervisor called over a maintenance technician, we'll call him Carlos, to clear the jam. This was routine—happened 2-3 times per week. Carlos knew the official procedure: shut down the line, lock out the main breaker panel, verify zero energy, clear the jam, restore energy, and restart. But the official procedure took 8-10 minutes. The shortcut version? Hit the emergency stop button, clear the jam, hit reset. 90 seconds max. The supervisor was under pressure to hit production targets. Carlos had cleared jams this way dozens of times. He hit the e-stop, opened the conveyor guard, and reached in to pull out the jammed cardboard. What Went Wrong: Another employee in the facility, unaware that Carlos was inside the conveyor, saw the line stopped and assumed it was a malfunction. He walked to the operator panel and pressed the reset button. The conveyor engaged instantly. Carlos's right hand was caught between the belt and drive roller. Three fingers were crushed. He was rushed to the ER. Two fingers were amputated. One was saved but permanently disabled. The OSHA Investigation 🔎: OSHA arrived within 48 hours. They requested: - Written LOTO procedures for the conveyor system (the company had none) - Training records for authorized LOTO employees (the company had a generic "safety orientation" from 2019) - Machine-specific energy control documentation (the company had never conducted an energy source audit) - Proof of annual LOTO procedure reviews (didn't exist) OSHA issued five separate citations: 1. Failure to develop machine-specific LOTO procedures – $18,700 penalty 2. Failure to train authorized employees – $15,400 penalty 3. Failure to conduct periodic LOTO inspections – $14,200 penalty 4. Inadequate energy control during servicing – $24,800 penalty (serious violation) 5. Failure to use lockout devices – $11,600 penalty

1-19 of 19

powered by

skool.com/risk-management-tips-7690

Free community for business owners who want to simplify compliance, reduce risk exposure, and protect their profits. No BS. Pure strategy.

Suggested communities

Powered by