Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Dallas

Free community for business owners who want to simplify compliance, reduce risk exposure, and protect their profits. No BS. Pure strategy.

Memberships

19 contributions to Risk Management Made Simple

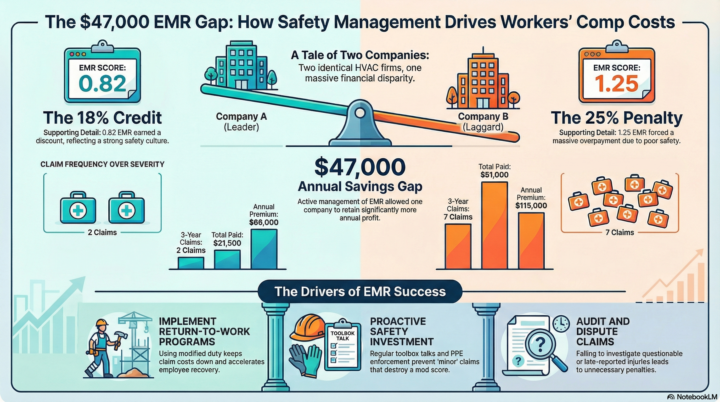

The $47,000 Difference: How Two Nearly Identical Companies Pay Wildly Different Workers' Comp Premiums

Let me tell you about two businesses I worked with in 2024. Both in HVAC installation. Both with about 17 to 20 employees and $3 million in annual revenue. Company A paid $68,000 in workers' comp premium. Company B paid $115,000 in workers' comp premium. Same industry. Same size. Same city. $47,000 difference. The reason? Experience Modification Rate (EMR). Company A: EMR 0.82 (Below Average Risk) This company had an EMR of 0.82—meaning they paid 18% less than the industry baseline for workers' comp. Their base premium was $83,000, but their mod brought it down to $68,000. Here's what they did right: 1. They managed claims frequency, not just severity. Over the past three years, they had two claims: - One $18,000 shoulder injury (employee slipped on a roof) - One $3,500 minor laceration (resolved quickly) Total claims: 2 - Total paid: $21,500 2. They invested in safety upfront. - Monthly toolbox talks on fall protection and ladder safety - Required PPE (hard hats, harnesses, gloves) on every job - Pre-job safety huddles before any elevated work - Incident reporting system (near-misses logged and reviewed) 3. They had a return-to-work program. When the shoulder injury happened, they immediately got the employee into modified duty. He couldn't climb ladders for 6 weeks, so they put him on equipment inventory, job site prep, and dispatch support. He never fully stopped working, which kept the claim cost down and sped up recovery. Result: EMR dropped from 0.95 to 0.82 over two years. Annual savings: $10,800/year. Company B: EMR 1.25 (Above Average Risk) This company had an EMR of 1.25—meaning they paid 25% more than the industry baseline. Their base premium was $92,000, but their mod pushed it to $115,000. Here's what went wrong: 1. They treated small claims like they didn't matter. Over the past three years, they had seven claims: - Three minor back strains ($4K, $6K, $5K) - Two hand injuries from power tools ($7K, $8K) - One knee injury from kneeling on concrete ($9K) - One slip-and-fall in a client's driveway ($12K)

0 likes • 1d

Do You Know Your EMR Situation? Answer these honestly: - I know my current EMR (and I've seen the worksheet in the last 6 months) - I know how many claims I've had in the last 3 years - I have a formal safety program and return-to-work plan - I track near-misses and proactively address hazards - I review my mod calculation annually with my broker or consultant 0-1 checked: You're likely overpaying and don't know it. 2-3 checked: You're aware, but not actively managing your mod. 4-5 checked: You're treating your EMR like the financial lever it is. Which company are you closer to—A or B? And if you're closer to B, what's one thing you could implement this month to start moving toward A?

Monday Risk Tip - EMR ER

If you've never heard of an EMR, an Experience Mod, or you don't know what the heck I'm even talking about, you need to watch this video.

0

0

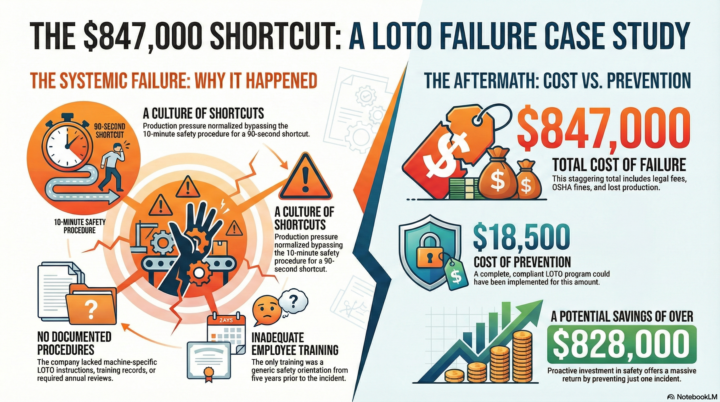

How a 15-Second Shortcut Ended up Costing $847,000

This is the story of a mid-sized packaging manufacturer in the Greater Houston area—$8M in annual revenue, 35 employees, solid safety record. They'd been in business 14 years without a serious OSHA violation. Until a Wednesday morning in March 2024 changed everything. 🔎The company ran a high-speed packaging line with an automated conveyor system. Around 10:30 AM, the conveyor jammed. Product was backing up. The production supervisor called over a maintenance technician, we'll call him Carlos, to clear the jam. This was routine—happened 2-3 times per week. Carlos knew the official procedure: shut down the line, lock out the main breaker panel, verify zero energy, clear the jam, restore energy, and restart. But the official procedure took 8-10 minutes. The shortcut version? Hit the emergency stop button, clear the jam, hit reset. 90 seconds max. The supervisor was under pressure to hit production targets. Carlos had cleared jams this way dozens of times. He hit the e-stop, opened the conveyor guard, and reached in to pull out the jammed cardboard. What Went Wrong: Another employee in the facility, unaware that Carlos was inside the conveyor, saw the line stopped and assumed it was a malfunction. He walked to the operator panel and pressed the reset button. The conveyor engaged instantly. Carlos's right hand was caught between the belt and drive roller. Three fingers were crushed. He was rushed to the ER. Two fingers were amputated. One was saved but permanently disabled. The OSHA Investigation 🔎: OSHA arrived within 48 hours. They requested: - Written LOTO procedures for the conveyor system (the company had none) - Training records for authorized LOTO employees (the company had a generic "safety orientation" from 2019) - Machine-specific energy control documentation (the company had never conducted an energy source audit) - Proof of annual LOTO procedure reviews (didn't exist) OSHA issued five separate citations: 1. Failure to develop machine-specific LOTO procedures – $18,700 penalty 2. Failure to train authorized employees – $15,400 penalty 3. Failure to conduct periodic LOTO inspections – $14,200 penalty 4. Inadequate energy control during servicing – $24,800 penalty (serious violation) 5. Failure to use lockout devices – $11,600 penalty

Monday Risk Tip - LOTO doesn't just mean "shut down"

This week we're hitting on Lock Out/Tag Out, or LOTO. Do you have machine-specific lockout/tagout procedures for every piece of equipment with hazardous energy in your facility—or are you operating on "we just turn it off and hope"? For some background, here are some of the average financial penalties for LOTO Violations: 👎$10,000–$15,000 per violation (OSHA can cite multiple violations per incident). 👎Serious injury LOTO accidents: $300,000–$500,000 in workers' comp claims 👎Willful or repeat violations: $150,000+ per violation 👎👎👎Impact on EMR: A catastrophic LOTO injury can raise your experience mod 40–60% for three years (which raises your workers comp premium by that many percent...)

1

0

1-10 of 19

@dallas-downey-7545

Risk advisor helping business owners protect profits, reduce risk, and simplify compliance through smart, practical strategies.

Active 2h ago

Joined Aug 24, 2025