📊 ProSphere Underwriting Tip: Always Stress Test with the 50% Rule

One of the smartest ways to review a T-12 (trailing 12 months of income & expenses) is to compare it against the 50% expense rule. 🔍 Here’s how pros do it: Take the gross rental income and assume: 👉 50% goes to operating expenses (taxes, insurance, repairs, management, vacancy, utilities, CapEx, etc.) Then compare it to what the T-12 actually shows. ✅ If T-12 expenses are LOWER than 50% → great, but still underwrite at 50% for safety ⚠️ If T-12 expenses are HIGHER than 50% → dig deeper (there may be deferred maintenance, poor management, or rising costs) 💡 Why always use the 50% rule? Because it protects you from: • Overly optimistic seller numbers • Unexpected repairs & vacancies • Cash flow surprises after closing Smart investors underwrite conservatively — profits come from the margin of safety. 📈 Want to learn how to analyze deals like a pro? Join the ProSphere Community where we break down real deals step-by-step. www.skool.com/prosphere-1303

0

0

🔍 Underwriting Tip: Always Run the Numbers as a Long-Term Rental First

When underwriting a deal, always start with long-term rental (LTR) numbers…every time! 🚫 Never base your deal on: • Section 8 rents • Airbnb / short-term rental projections • Best-case or “pro forma” rent assumptions Why this matters 👇 ✅ LTR is the baseline reality It’s the most stable, lender-accepted, and market-tested income source. ✅ Protect your exit strategies Regulations change. Markets shift. Airbnb and Section 8 can vanish. LTR demand stays. ✅ True risk exposure Short-term and Section 8 numbers often mask vacancy, regulation, and management risk. 🧠 The Pro Rule If it doesn’t cash flow as a long-term rental, it’s not a deal, it’s a gamble. Once it works as an LTR, then you can layer in: ✔️ Section 8 ✔️ Airbnb ✔️ Mid-term or furnished rentals

0

0

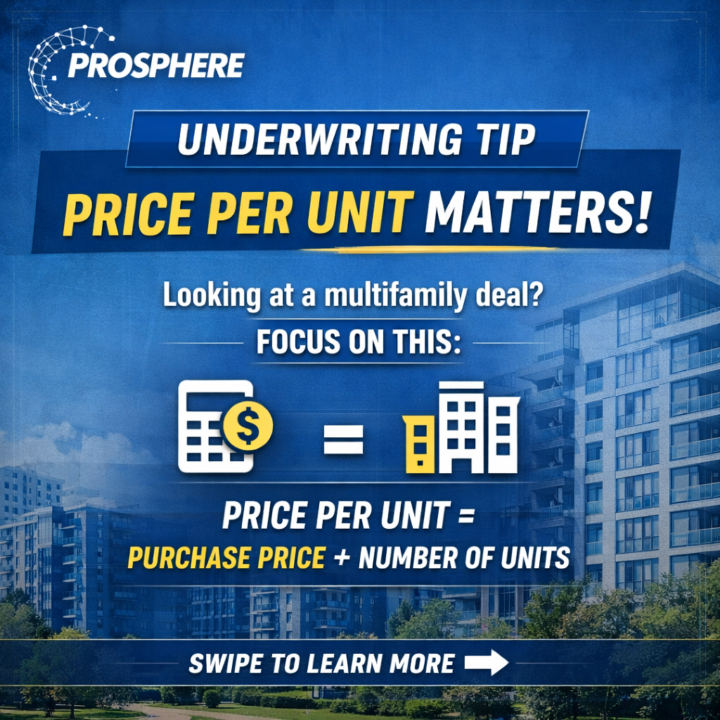

📊 Underwriting Tip: Price Per Unit (PPU) Matters More Than You Think

When analyzing a multifamily deal, don’t just focus on the purchase price, break it down to price per unit. 👉 Price Per Unit = Purchase Price ÷ Number of Units Why it matters: • It lets you quickly compare deals apples-to-apples • Helps you spot overpriced assets in “hot” markets • Reveals upside when rents don’t justify the seller’s ask • Keeps emotions out of the deal and numbers in control 💡 Pro Tip: If the PPU is higher than similar properties but rents aren’t stronger, the deal is already telling you something — your exit may be capped before you even buy. Smart investors buy the numbers, not the story. If you want to learn how to underwrite deals like a pro and spot pricing red flags fast, join our ProSphere Skool Community and check out the Underwriting Accelerator Masterclass 🚀 www.linktree.com/prospheremo 📌 Numbers don’t lie. Sellers sometimes do.

0

0

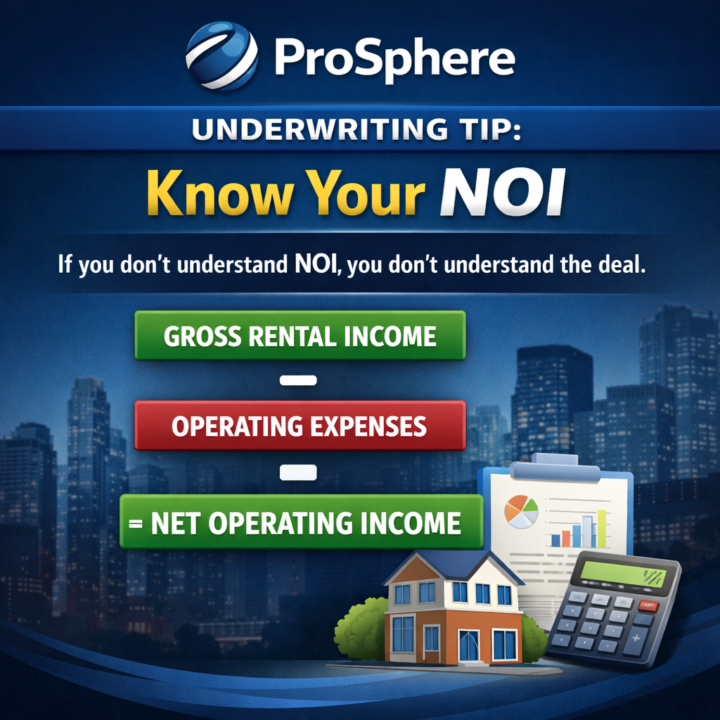

📊 UNDERWRITING TIP: Know Your NOI

If you don’t understand NOI, you don’t understand the deal. NOI (Net Operating Income) is the income a property produces after operating expenses, but before debt service and taxes. NOI = Gross Rental Income – Operating Expenses = Net Operating Income ✔️ Includes: rents, other income, management, maintenance, insurance, taxes, utilities ❌ Excludes: mortgage payments, depreciation, income taxes 💡 Why NOI matters: • Determines property value • Drives cap rate calculations • Shows the true performance of the asset • Helps you compare deals apples-to-apples If the NOI doesn’t support the price — the deal doesn’t work. Period. Want to learn how to underwrite deals like a pro and avoid bad numbers? 👉 Join the ProSphere Skool Community and get access to our Underwriting Accelerator Masterclass (lifetime access) 🔗 www.skool.com/prosphere-1303

0

0

💰 UNDERWRITING TIP: How to Estimate Your Cash-Out on a Refinance (Before Calling a Lender)

Want a quick way to know about how much cash you can pull out on a refi? Use this simple framework investors rely on: Step 1: Estimate Value NOI ÷ Exit Cap Rate Example: $150,000 NOI ÷ 7.5% = $2,000,000 value Step 2: Apply Conservative LTV Most refis land around 65%–75% LTV $2,000,000 × 70% = $1,400,000 new loan Step 3: Subtract Your Current Loan $1,400,000 – $1,050,000 = $350,000 Step 4: Account for Refi Costs & Reserves Closing costs, fees, escrows ≈ $300,000 estimated cash-out Pro Tip: If your NOI increase doesn’t exceed refi costs, you’re not ready yet. Force appreciation first. Then refinance. If you’d like to underwrite deals like a pro, join the ProSphere Skool Community and get access to our Underwriting Accelerator Masterclass! Designed to help you analyze deals confidently, accurately, and lender-ready. Join here: www.skool.com/prosphere-1303

0

0

1-15 of 15

powered by

skool.com/prosphere-1303

Learn real estate investing with simple, practical lessons that build confidence, connections, and long-term wealth.

Suggested communities

Powered by