Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Jayme

Learn real estate investing with simple, practical lessons that build confidence, connections, and long-term wealth.

Memberships

Multifamily Wealth Skool

14.5k members • Free

AI Automation Society

249.7k members • Free

Skoolers

190.1k members • Free

15 contributions to ProSphere REI

📊 ProSphere Underwriting Tip: Always Stress Test with the 50% Rule

One of the smartest ways to review a T-12 (trailing 12 months of income & expenses) is to compare it against the 50% expense rule. 🔍 Here’s how pros do it: Take the gross rental income and assume: 👉 50% goes to operating expenses (taxes, insurance, repairs, management, vacancy, utilities, CapEx, etc.) Then compare it to what the T-12 actually shows. ✅ If T-12 expenses are LOWER than 50% → great, but still underwrite at 50% for safety ⚠️ If T-12 expenses are HIGHER than 50% → dig deeper (there may be deferred maintenance, poor management, or rising costs) 💡 Why always use the 50% rule? Because it protects you from: • Overly optimistic seller numbers • Unexpected repairs & vacancies • Cash flow surprises after closing Smart investors underwrite conservatively — profits come from the margin of safety. 📈 Want to learn how to analyze deals like a pro? Join the ProSphere Community where we break down real deals step-by-step. www.skool.com/prosphere-1303

0

0

🔍 Underwriting Tip: Always Run the Numbers as a Long-Term Rental First

When underwriting a deal, always start with long-term rental (LTR) numbers…every time! 🚫 Never base your deal on: • Section 8 rents • Airbnb / short-term rental projections • Best-case or “pro forma” rent assumptions Why this matters 👇 ✅ LTR is the baseline reality It’s the most stable, lender-accepted, and market-tested income source. ✅ Protect your exit strategies Regulations change. Markets shift. Airbnb and Section 8 can vanish. LTR demand stays. ✅ True risk exposure Short-term and Section 8 numbers often mask vacancy, regulation, and management risk. 🧠 The Pro Rule If it doesn’t cash flow as a long-term rental, it’s not a deal, it’s a gamble. Once it works as an LTR, then you can layer in: ✔️ Section 8 ✔️ Airbnb ✔️ Mid-term or furnished rentals

0

0

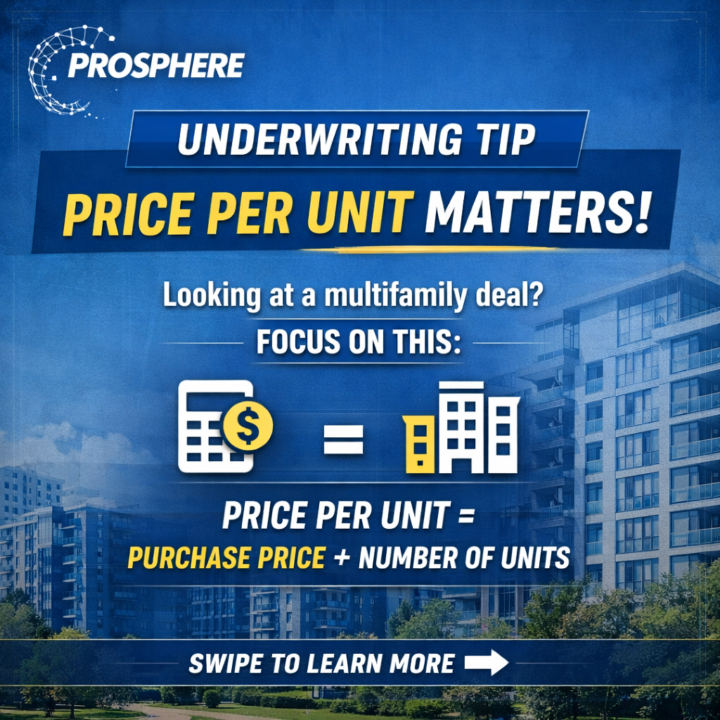

📊 Underwriting Tip: Price Per Unit (PPU) Matters More Than You Think

When analyzing a multifamily deal, don’t just focus on the purchase price, break it down to price per unit. 👉 Price Per Unit = Purchase Price ÷ Number of Units Why it matters: • It lets you quickly compare deals apples-to-apples • Helps you spot overpriced assets in “hot” markets • Reveals upside when rents don’t justify the seller’s ask • Keeps emotions out of the deal and numbers in control 💡 Pro Tip: If the PPU is higher than similar properties but rents aren’t stronger, the deal is already telling you something — your exit may be capped before you even buy. Smart investors buy the numbers, not the story. If you want to learn how to underwrite deals like a pro and spot pricing red flags fast, join our ProSphere Skool Community and check out the Underwriting Accelerator Masterclass 🚀 www.linktree.com/prospheremo 📌 Numbers don’t lie. Sellers sometimes do.

0

0

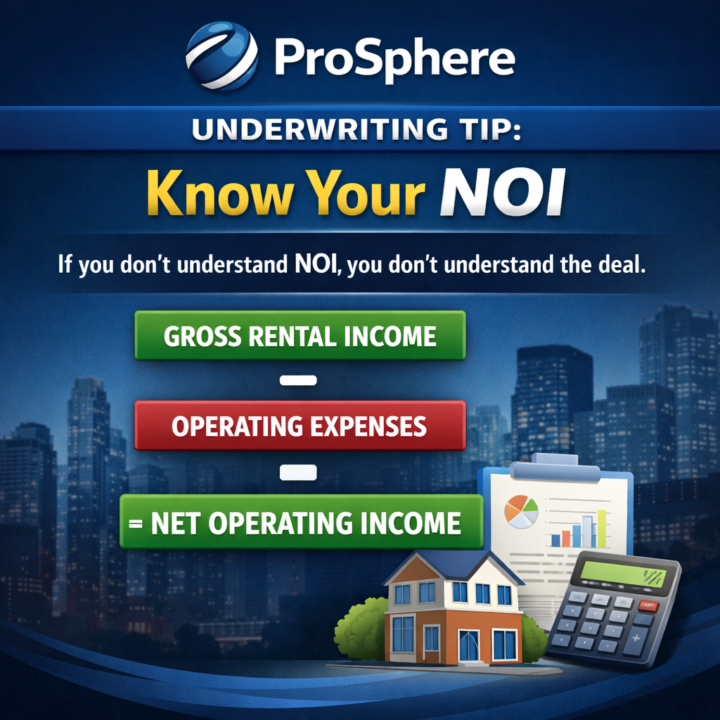

📊 UNDERWRITING TIP: Know Your NOI

If you don’t understand NOI, you don’t understand the deal. NOI (Net Operating Income) is the income a property produces after operating expenses, but before debt service and taxes. NOI = Gross Rental Income – Operating Expenses = Net Operating Income ✔️ Includes: rents, other income, management, maintenance, insurance, taxes, utilities ❌ Excludes: mortgage payments, depreciation, income taxes 💡 Why NOI matters: • Determines property value • Drives cap rate calculations • Shows the true performance of the asset • Helps you compare deals apples-to-apples If the NOI doesn’t support the price — the deal doesn’t work. Period. Want to learn how to underwrite deals like a pro and avoid bad numbers? 👉 Join the ProSphere Skool Community and get access to our Underwriting Accelerator Masterclass (lifetime access) 🔗 www.skool.com/prosphere-1303

0

0

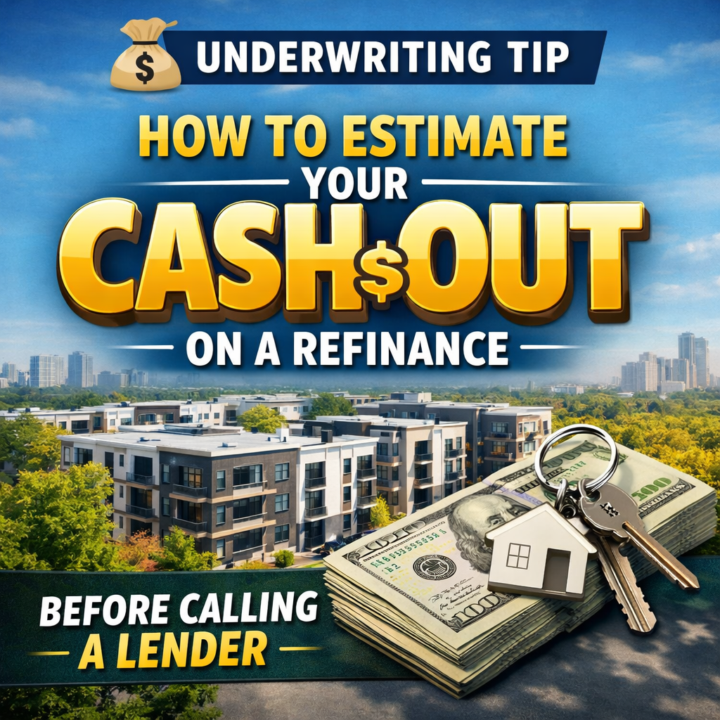

💰 UNDERWRITING TIP: How to Estimate Your Cash-Out on a Refinance (Before Calling a Lender)

Want a quick way to know about how much cash you can pull out on a refi? Use this simple framework investors rely on: Step 1: Estimate Value NOI ÷ Exit Cap Rate Example: $150,000 NOI ÷ 7.5% = $2,000,000 value Step 2: Apply Conservative LTV Most refis land around 65%–75% LTV $2,000,000 × 70% = $1,400,000 new loan Step 3: Subtract Your Current Loan $1,400,000 – $1,050,000 = $350,000 Step 4: Account for Refi Costs & Reserves Closing costs, fees, escrows ≈ $300,000 estimated cash-out Pro Tip: If your NOI increase doesn’t exceed refi costs, you’re not ready yet. Force appreciation first. Then refinance. If you’d like to underwrite deals like a pro, join the ProSphere Skool Community and get access to our Underwriting Accelerator Masterclass! Designed to help you analyze deals confidently, accurately, and lender-ready. Join here: www.skool.com/prosphere-1303

0

0

1-10 of 15

@jayme-uberto-7084

Real Estate Investor 🏡 | Business Owner 📈 | Proud Father 👦 | Port Orange, FL 🌴

Active 6d ago

Joined Oct 29, 2025