Write something

SPY Call Ratio: Trading When the Market Gives You Almost Nothing

Let's be very clear about the current environment. The market is not blessing us with classic short-premium opportunities. Implied volatility is compressed. Realized volatility is low. Option sellers are fighting for scraps. And historically, this is exactly when traders get hurt. There are volatility regimes that have repeatedly proven to be toxic for naive premium selling: - Low VIX combined with elevated SKEW - High VVIX / VIX relationships The message is the market is calm on the surface, but convex tail risk is being quietly priced underneath. This is not the environment for short straddles, naked strangles, or heavy short gamma exposure. These structures look safe, until they aren't. And when they break, they break fast! So What Do We Do When Volatility Is Low? I do less, not more. And when I do trade, I remove the downside first. That is the key principle. In low-volatility regimes, the objective is not to maximize premium, but to stay alive while extracting small, structural edges. This is where call ratio spreads become extremely valuable. Why call ratios are the tight tool here? A properly constructed eliminates downside risk entirely, sells overpriced upside volatility, benefits from time decay, does not require a bearish view, and survives quiet, grinding markets. In other words: it allows us to stay engaged without selling our soul to tail risk. - My trade structure: SPY Feb 20, 43 DTE, Buy 1 x 715 Call, Sell 2 x 720 Calls. - Net Credit: $101, Probability of Profit: 82%, Max Profit: $601, Theta: +$5.4 This structure is intentionally placed above spot, where call demand is strongest, and where upside fear is most overpriced. Despite low realized volatility, upside calls remain rich. This is classic late-cycle behavior: fear of missing out, not fear of loss. I sell that fear. Downside risk is removed, this is the most important part. No matter what happens on the downside, there is no gamma crash risk. In today's regime, that alone is worth giving up premium. However, this trade does not have a capped upside loss! This is not a "set and forget" trade. It is a campaign component, exactly as outlined in the Trading Plan.

Microsoft Is No Longer an AI Hype Trade, but It's Still an Opportunity

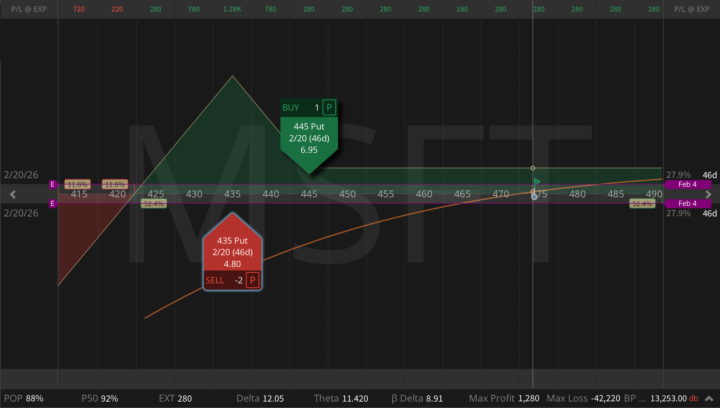

Microsoft is quietly transitioning from an AI hype stock into an execution-constrained business, and the options market has probably not fully priced that shift yet. The key insight most investors are missing is that AI capex is no longer limited by capital or demand, but by electricity, grid access, and deployment timelines. This is a bottleneck. This creates a narrow window where expectations compress faster than price moves, the exact environment where option sellers get paid. Volatility is elevated (IV Rank 29), but nowhere near panic. So, below is the structure I'm using to exploit that disconnect. Asymmetric MSFT Put Ratio Spread: Buy 1 x 445 put, Sell 2 x 435 puts for $280 net credit, >88% Probability of Profit, max profit $1.28k near 435, positive theta and slight bullish delta, risk only on sharp break below 430. The preferred approach is to exit before the January 28 earnings release, or intentionally hold through earnings to capture IV crush if you accept gap risk. This trade is designed to monetize elevated downside volatility while keeping risk not directional. If the short puts are breached, the position is managed according to the Trading Plan.

0

0

My Personal 2026 Market Playbook as an Options Seller and Hedge Fund Manager

As we start 2026, I want to share a few very personal market views and investment ideas I'm going to actively explore this year. This is not a recommendation and not a directional forecast. It's simply how I currently see market structure, volatility, and opportunity from the perspective of an active options seller and short-volatility hedge fund advisor. 1) Metals: the parabolic move may be behind, but volatility lingers Gold and silver already had their most emotional, parabolic phase. The important nuance is that implied volatility rarely normalizes as fast as price action does, and that lag is where options sellers get paid. So, I'll be very active in GLD, SLV, PALL, and URA, both in my personal portfolio and in our hedge fund. The specific edge I'm watching is post-spike IV that stays sticky after the trend fades, especially when the surface flips into volatility backwardation. That's a perfect setup for short-dated and 0-DTE premium harvesting. 2) Crypto: stagnation is the edge My base case for crypto is not another explosive trend, but prolonged consolidation. That's exactly why IBIT, the iShares Bitcoin Trust ETF with liquid options, is so interesting. Implied volatility remains structurally rich, often well above realized volatility. I don't trade crypto directionally, but I sell premium strategically. Compared to the industry's obsession with upside narratives, this approach is far less exciting, but it creates a much more consistent income engine. 3) Rate cuts shift income opportunities If rate cuts continue, my famous "yield engineering" trades like SPX box spreads and risk-free butterflies become less attractive. At the same time, they open a different door. Lower rates support REITs (Realty Income - O - remains my personal favorite), utilities (XLU), healthcare (XLV, UNH), and dividend growth ETFs (SCHD). I consistently combine these with aggressive call writing, creating my Triple Income Strategy. This approach targets an additional 11-18% per annum, with extremely low volatility and zero vega risk!

Flyagonal: Advanced But Powerful Structure for the Current Low-Volatility Market

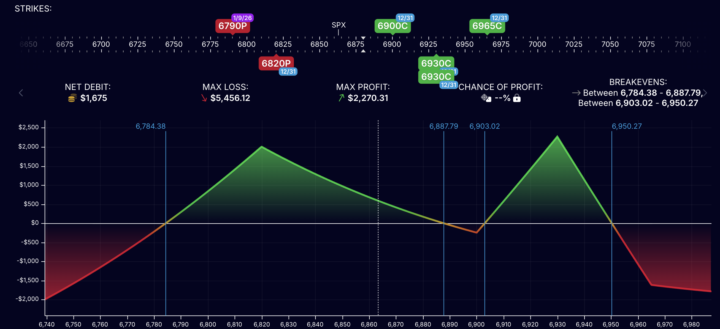

Recently you probably noticed I publish much less trade ideas than usual. This is intentional. We short volatility, and over the last weeks our volatility indicators have been flashing very mixed signals. There are not many clean opportunities, and when the edge is not obvious, we don't force trades. Knowing when not to trade is a real advantage. Today, in this low-volatility, messy environment, I want to introduce something more advanced and genuinely useful for experienced traders: Flyagonals. A Flyagonal is one of my favorite options structures, and one of the most powerful ways I know to trade volatility when the market gives no clean directional edge. In both backtests and real trading, Flyagonals have shown a win rate around 95%, which is extremely rare for a defined-risk structure. What makes a Flyagonal special is how it's built; it combines two parts that are meant to protect each other. On the upside, there's a broken-wing call butterfly placed slightly above spot. It works best when the market drifts, and volatility stays calm. On the downside, there's a put diagonal sitting below spot. That leg is more relevant if the market drops and volatility expands. When these two pieces are combined, something interesting happens: instead of fighting the Greeks, they start to rebalance as market conditions change. You also end up with unusually wide profit zones, which makes the structure far more forgiving than most standalone flies or diagonals. Now to my version today (SPX), based on the same logic but adapted to the strikes and expirations I want. Put diagonal: - Long 6790 put, expiration 9 Jan 2026 - Short 6820 put, expiration 31 Dec 2025 Call broken-wing butterfly: - Expiration: 31 Dec 2025 - Structure: +1x 6900 / -2x 6930 / +1x 6965 calls Important: in practice, in platforms like Tastytrade or IBKR, this position is usually entered as two separate orders (the put diagonal and the call butterfly), but it should always be managed as one combined trade. The interactions between the legs are what create the edge, so managing them in isolation misses the point. As with most Flyagonals, I'm not looking to hold this to expiration, profits are taken early at 25%!

1

0

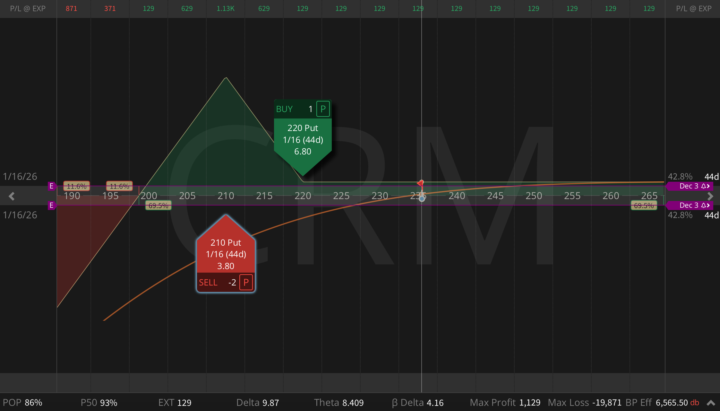

CRM Earnings Put Ratio Into Agentforce Test

CRM reports after the bell, and the setup is actually fascinating. The stock sits around $235, down 36% from highs and 30% YTD. Growth has slowed, but fundamentals aren't broken. They're just… less sexy. IV is pricing a 7-8% move, skew is modest, and this is exactly the type of environment where I want to be slightly long CRM and short rich downside vol, with a wide cushion if we get a controlled pullback. Let's see what Marc Benioff brings us tonight!

1

0

1-11 of 11

powered by

skool.com/options-jive-1159

STOP trading market direction. Start using options strategies to turn volatility into steady income. We sell premium, and think in probabilities.

Suggested communities

Powered by