Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Owned by Options

STOP trading market direction. Start using options strategies to turn volatility into steady income. We sell premium, and think in probabilities.

Memberships

OptionMasters

16 members • Free

Option4All

60 members • Free

Imperium Academy™

54.6k members • Free

Risk Management

9 members • Free

Skoolers

189.7k members • Free

University Of Traders

83 members • $5,000

PainlessTrader

370 members • $12/year

AI Stock Investing

743 members • Free

HYROS Ads Hall Of Justice

4.8k members • Free

21 contributions to Options Jive

What Content Would Help Your Trading the Most? (Quick Survey)

As some of you know, I'm currently stuck in the Middle East while the situation here is quite tense with rockets and drones. Not exactly the environment I expected to be working from. The strange upside is that I suddenly have more time to create deeper content and share more institutional insights from our hedge fund, the kind of knowledge that can genuinely improve your trading decisions and long-term investing results. So I'd like your input. What type of content would help you the most in achieving your personal trading and investing goals? Vote below or comment with the number(s) you want most. This will help me prioritize what I publish next. You can choose more than one. I'm curious what would move the needle most for your trading performance.

Poll

1 member has voted

1

0

Last Tuesday the VVIX/VIX Ratio Dropped Below 5

Most traders watch VIX. Very few watch VVIX. Last Tuesday something interesting happened. For the first time since November, the VVIX/VIX ratio dropped below 5. According to Tastytrade research, that volatility regime is extremely favorable for premium sellers. On average, strangles sold when VVIX/VIX < 5 generate about 4x higher PnL (!!!) compared to periods when the ratio spikes above 6, which is a toxic environment for short volatility.

1

0

AVGO Earnings Tonight: AI Goldmine or Margin Trap?

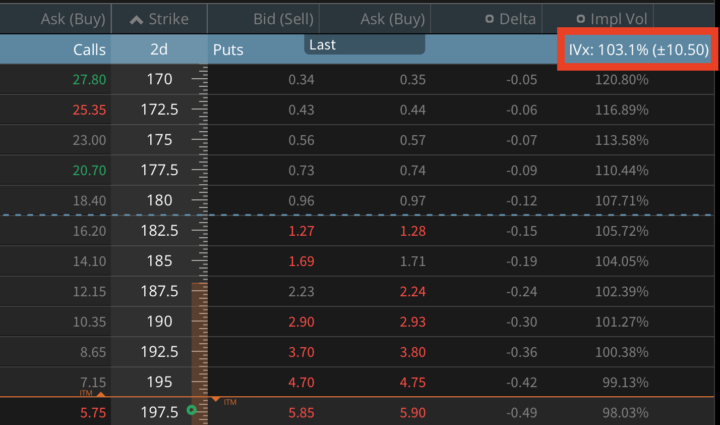

Broadcom (AVGO) reports after the bell today (March 4). Most commentary will focus on the usual metrics; revenue, EPS, maybe AI growth. But if you know my approach and trade volatility, you already know those numbers probably won't move the stock. Broadcom already guided the market. Expectations are very clear. Consensus sits roughly around $19.1-19.3B revenue, $2.02 EPS, and about +29% YoY growth. If those numbers land exactly there, the stock likely does very little. Tonight is about something much more subtle, and potentially much more explosive. The Real Question: AI Profitability For years AVGO was one of the most profitable semiconductor companies in the world. The business model was to design complex chips, sell extremely high-margin, and generate enormous operating margins. Now the company is evolving into an AI infrastructure supplier, and that transition changes the economics of the business. Last quarter Broadcom reported 78% gross margin, which is extraordinarily high even for semiconductors. But management already warned that margins could decline about 100 basis points as AI systems become a larger share of the revenue mix. Why? AI infrastructure is not just chips. It includes networking hardware, custom accelerators, and expensive components like HBM memory. These systems generate enormous revenue, but they also introduce pass-through costs that dilute gross margin percentages. The debate around Broadcom is now about how profitable demand actually is. The $73 Billion Backlog Nobody Talks About Demand risk for Broadcom is actually very small right now. Management disclosed roughly $73B of AI backlog, inside a $162B total backlog, expected to convert over roughly 18 months. That number changes the entire earnings framework; the question is no longer will Broadcom sell chips, it is: what margins will those sales actually generate once they convert to revenue. And that is a much harder variable for the market to price. What Options Are Pricing

1

0

How to Trade Geopolitical Tension (Live from the Middle East)

Normally on Sunday I structure positions, map expected moves, and prepare the book for the week. Yesterday I was doing exactly that. Except missile alerts kept interrupting the work. I’m writing this from Dubai, and today UAE markets are shut, oil is ripping, gold bid, defense stocks strong, travel and banks hit. The U.S. is rotating internally rather than crashing. It's surreal to think about implied volatility while real volatility unfolds outside your window. When geopolitical tension hits, most traders do one of two things: they overpay for index puts or they freeze. Both are expensive, but here is how I think about it: 1. I trade where the shock actually lives. This shock is about energy flows, shipping routes, defense spending and regional balance sheets. Oil gamma matters more than SPX gamma right now. If you want convexity, trade it where the catalyst is direct. 2. I respect skew. Everyone wants protection at the same time. Buying panic puts into elevated skew is usually a wealth transfer. Structured downside, with defined tails, financed against long convexity elsewhere, is far more efficient. 3. Rotation beats prediction. I don't need to predict whether this escalates. I need to observe capital flows. This tape is rewarding hard cash flows (energy, materials, defense) and punishing soft demand and long duration growth. Trading from the Middle East this week changes your psychology. From Miami or New York, geopolitical volatility is only a headline. From here, you feel how thin the line is between noise and regime shift. It makes you less dramatic, more precise. Perspective changes everything. When I look at our IV vs IV Rank matrix, dispersion jumps out immediately (see attached). Now let’s zoom into my actual trade idea: actively managed, skew-aware strangle on USO. USO (United States Oil Fund) is a commodity pool structured as a limited partnership. It gains exposure through rolling WTI crude oil futures contracts. It does not hold physical oil, it holds futures and systematically rolls them forward.

2

0

The Highest-Probability Way to Trade NVDA Earnings Tonight?

NVDA reports after the bell tonight, and this is the single most important event of the week for the entire technology complex, for AI capex sentiment, and potentially for sector rotation across the market! If NVDA re-prices the AI narrative, QQQ moves, growth vs value rotation shifts, even energy and cyclicals feel it through flows. Now here’s what’s interesting. Consensus is extreme: 65-66B revenue, +66% YoY. EPS up 70%, Data Center nearly the whole engine. The base case is already beat and strong guide. You'd expect options to price this like a bomb, but they aren't! The at-the-money straddle implies roughly a 5-6% move. Over the last 12 quarters, the average implied move was closer to 7.5%. By NVDA's own standards, this event is being priced smaller than usual. That's the first non-obvious signal. The second one is even more important. Historically, NVDA's implied earnings move trades at about 1.5x the tech sector (XLK). This quarter, that ratio is closer to 0.9x. Read that again: the market is pricing NVDA as less idiosyncratic than the sector, at a moment when AI capex concentration arguably makes it more idiosyncratic than ever. Yes, front-week IV is high (72% vs 55% baseline). Yes, there will likely be IV crush. But the lazy trade "short the rich IV" assumes the event premium itself is bloated. This time, the event premium is compressed relative to history and relative to tech. That changes the game, so we're not putting on calendar spreads today. The edge, in my view, sits in: - NVDA vs sector variance - Defined-risk or asymmetric volatility harvesting The market is not overpricing fear, it's compressing NVDA's uniqueness into sector volatility, and if that assumption breaks tonight, the move won't care about your straddle math. Because the event move is priced relatively small (5-6%) and the front-week premium is not unusually fat versus history, forcing a weekly Jade Lizard would mean selling compressed event variance with thin margin for error. So instead of playing the binary print, we step out to April (51 DTE) and build a safer Earnings Jade Lizard.

3

0

1-10 of 21