Write something

Pinned

Start Here: Trade Around Your 9–5 In Under 30 Minutes A Day

If you want to trade but you also work a real 9–5, this community is built for you. You won’t see 20 random tickers a day or hype plays here. You’ll see a simple, rules‑based way to swing trade U.S. equities and major cryptos in under 30 minutes a day using the No‑Chase Swing Method. Here’s how to get the most value from this free group: Step 1 – Introduce yourself (2 minutes) Comment below with: 1) What do you do for work? 2) How long have you been trading? 3) What’s your biggest struggle with trading around your job? Step 2 – Learn the basics (10–15 minutes) Go to the Classroom and watch the “No‑Chase Swing Method Overview.” This is the framework everything here is built on. Step 3 – Use this week’s watchlist (10–15 minutes) Go to the “No‑Chase Watchlist” tab and read the pinned post: “How To Use This Week’s Watchlist In 30 Minutes Or Less.” Follow it before the market opens. Step 4 – Ask for help Post your chart or plan in “Trade Reviews & Q&A.” I’d rather you ask a “basic” question than blow up your account guessing. If you like the clarity and structure here, the next step is the full Swing Trading Desk, where we go deeper with more setups, live support, and tighter execution. Details are in the “Join Swing Trading Desk” tab. Welcome in. Let’s make your trading fit your life, not take it over.

Pinned

How To Use This Week’s Watchlist (In 30 Minutes Or Less)

This watchlist is not financial advice or a signal service. It’s a short list of high‑probability swing ideas so you don’t have to stare at charts all day. Here’s exactly how to use it: 1) Pick your planning time (5–10 minutes) Either: - Night before the market opens, or - Morning before work. Open this week’s watchlist and: - Scan the tickers - Note the key levels (entry, stop, target zones) - Ignore everything that doesn’t fit your schedule or risk 2) Choose 1–3 trades max (10–15 minutes) For each trade you like, write down: - Ticker - Entry zone from the levels - Invalidation / stop level - First target - Position size that fits your risk (small enough you can sleep) 3) Set it and walk away Use alerts or limit orders so you’re not chasing candles intraday. If price never comes to your level, you skip the trade. No FOMO, no revenge trading. 4) Review and improve After the trade plays out, log what happened and, if you want feedback, post it in “Trade Reviews & Q&A.” Desk members get deeper coverage, more names, and live breakdowns, but if you follow this process each week, you can already reduce noise and screen time a lot on the free tier.

1

0

Pinned

Join The Swing Trading Desk: The Full No‑Chase System For 9–5 Traders

If you like the structure in this free group and you’re ready for the full system, this is where it happens. The Swing Trading Desk is my premium membership for busy 9–5 professionals who want to swing trade U.S. equities and major cryptos in under 30 minutes a day using the rules‑based No‑Chase Swing Method. Who it’s for: - You work a full‑time job - You can’t (or don’t want to) watch charts all day - You want fewer, higher‑quality trades with clear rules What you get inside the Desk: - Full No‑Chase Swing Method training, step‑by‑step - Priority swing watchlists with my best setups and levels - Deeper breakdowns of the exact trades I’m watching - Private Desk community for faster Q&A and feedback - Ongoing updates so you’re not trading last month’s playbook Free tier vs Desk: - Free: Sample watchlists, light training, group support - Desk: Full system, more detail, more support, tighter execution Pricing & guarantee: - 7‑day free trial to test it out - Then $59/month (or $499/year) - If you do the work and don’t feel clearly more confident after 30 days, I refund your first month. No drama. If you’re a 9–5 trader who’s tired of guessing, chasing, and staring at screens all day, the Desk is built for you. 👉 Click the link on this post to start your 7‑day free trial. https://www.skool.com/the-trading-desk-2388/about?ref=85ece149906849f6825500a492585d6d

0

0

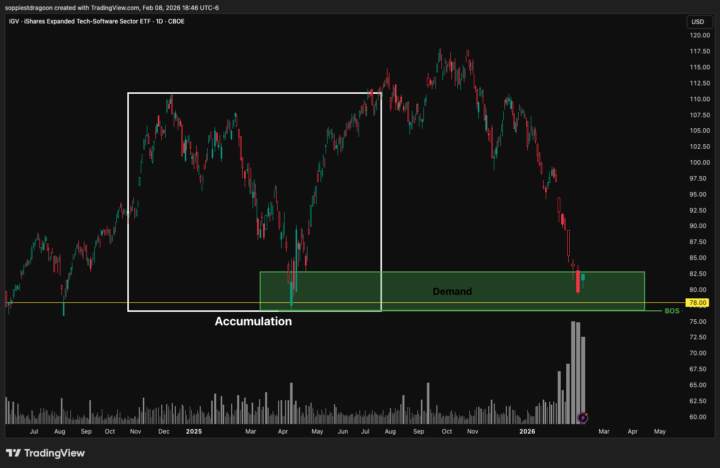

IGV — SOFTWARE ETF

IGV is trading inside a higher-timeframe demand zone after an extended drawdown. Recent sessions printed unusually high volume for this index — the largest on record — occurring after prior imbalance was fully resolved. Historically, that combination tends to show up when downside risk starts compressing, not when downside momentum is accelerating. This does not imply a confirmed bottom, and it does not rule out further downside. It does suggest that risk is no longer expanding the same way it was at higher prices, and that forward outcomes from this area are likely to be more balanced than they were earlier in the decline. From here, the focus is less on prediction and more on how price behaves from this zone. Watching for acceptance or failure at current levels.

0

0

Updating Charts Tonight – Drop Your Requests Below

Quick heads up: I’m updating my charts tonight for the No‑Chase Swing levels on U.S. stocks and major crypto. If you want me to prioritize something you’re watching, drop your request below with the Ticker

0

0

1-30 of 150

powered by

skool.com/nochase-swing-watchlist-2326

Free swing‑trading school for 9–5 pros who want clear levels, rules, and less screen time using the No‑Chase Swing Method.

Suggested communities

Powered by