Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Albert

Free swing‑trading school for 9–5 pros who want clear levels, rules, and less screen time using the No‑Chase Swing Method.

Swing trade U.S. stocks & crypto around your 9–5 in ~10 minutes a night with a rules-based no-chase method so you stop staring at charts.

Memberships

WavyWorld

45.1k members • Free

AI Automation Society

254k members • Free

Creator Accelerator

233 members • $80/month

150 contributions to Free Swing Trading Watchlist

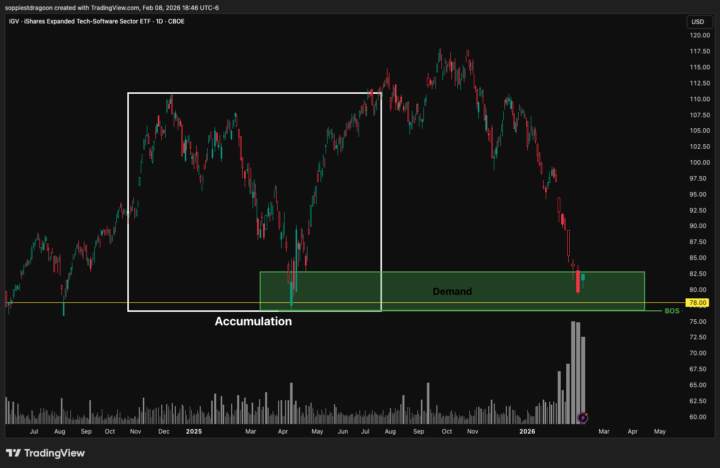

IGV — SOFTWARE ETF

IGV is trading inside a higher-timeframe demand zone after an extended drawdown. Recent sessions printed unusually high volume for this index — the largest on record — occurring after prior imbalance was fully resolved. Historically, that combination tends to show up when downside risk starts compressing, not when downside momentum is accelerating. This does not imply a confirmed bottom, and it does not rule out further downside. It does suggest that risk is no longer expanding the same way it was at higher prices, and that forward outcomes from this area are likely to be more balanced than they were earlier in the decline. From here, the focus is less on prediction and more on how price behaves from this zone. Watching for acceptance or failure at current levels.

0

0

Updating Charts Tonight – Drop Your Requests Below

Quick heads up: I’m updating my charts tonight for the No‑Chase Swing levels on U.S. stocks and major crypto. If you want me to prioritize something you’re watching, drop your request below with the Ticker

0

0

Start Here: Trade Around Your 9–5 In Under 30 Minutes A Day

If you want to trade but you also work a real 9–5, this community is built for you. You won’t see 20 random tickers a day or hype plays here. You’ll see a simple, rules‑based way to swing trade U.S. equities and major cryptos in under 30 minutes a day using the No‑Chase Swing Method. Here’s how to get the most value from this free group: Step 1 – Introduce yourself (2 minutes) Comment below with: 1) What do you do for work? 2) How long have you been trading? 3) What’s your biggest struggle with trading around your job? Step 2 – Learn the basics (10–15 minutes) Go to the Classroom and watch the “No‑Chase Swing Method Overview.” This is the framework everything here is built on. Step 3 – Use this week’s watchlist (10–15 minutes) Go to the “No‑Chase Watchlist” tab and read the pinned post: “How To Use This Week’s Watchlist In 30 Minutes Or Less.” Follow it before the market opens. Step 4 – Ask for help Post your chart or plan in “Trade Reviews & Q&A.” I’d rather you ask a “basic” question than blow up your account guessing. If you like the clarity and structure here, the next step is the full Swing Trading Desk, where we go deeper with more setups, live support, and tighter execution. Details are in the “Join Swing Trading Desk” tab. Welcome in. Let’s make your trading fit your life, not take it over.

0 likes • 1d

@Sean Gosselin Three years in is plenty of experience to work with. Most people never even get to the point where they realize “risk management + direction” are the real game, so you’re already asking the right questions. To help me point you in the right direction: 1. Are you mainly trading stocks, crypto, or both? 2. When things go wrong, what usually happens first: you chase late, you move your stop, or you size too big? Next good step:Grab 1 setup from this week’s watchlist and post your plan in Trade Reviews & Q&A with: - entry - stop - target - how much you’re risking on the trade (in dollars) Tag me when you post it and I’ll walk through it with you so we can tighten up your risk management around your 9–5.

How I’m Thinking About This “Irrational” Market (pulled from the Desk)

A lot of you have been DM’ing and commenting variations of: - “Is this the top?” - “Should I just go to cash?” - “Why does nothing make sense right now?” Rather than give you a one-liner, I wanted to show you exactly how I walked Desk members through this environment today. This is taken straight from our paid Trading Desk, but I’m sharing it here because: - The market is emotional and confusing for a lot of 9–5 traders right now - Seeing the process for how I frame risk, structure, and opportunity matters more than any one hot take Use this to slow down, zoom out, and make decisions from structure instead of fear. . . . . . MARKET CONTEXT UPDATE — HOW I’M THINKING ABOUT RISK RIGHT NOW S&P 500 vs US 100 I want to walk you through how I’m reading this market, not to predict what happens next — but to show how I frame risk, structure, and opportunity when conditions shift. __________________________________________________________________________________________ STEP 1: START WITH THE BROAD MARKET (S&P 500) Today’s session produced a clear bearish impulse on the daily candle.That matters — because impulse tells us who’s in control right now. - Sellers showed initiative, not just reaction. - This shifts my short-term mindset from “support first” to “where would supply matter?” What I’m watching: - Supply: 6945 – 7006 If price retraces here, I’m paying attention to seller behavior, not blindly shorting. - Demand:The most recent demand has already been partially mitigated. To me, that reduces its ability to act as strong support. - Next valid demand: 6524 – 6662This is where downside would begin to make structural sense, not emotional sense. Key point: I’m not bearish because price went down. I’m cautious because structure changed and prior demand weakened. __________________________________________________________________________________________ STEP 2: CHECK LEADERSHIP (US 100 / TECH) This is where the message gets clearer.

0

0

Update: 1 Celebration Founder Spot Re‑Opened

Quick update on the 100‑member milestone offer: All 5 Celebration Founder spots for The Swing Trading Desk were claimed during the 7‑day window… …but one person just canceled during their trial. That means 1 Celebration Founder spot has re‑opened at $35/month. After this is taken, the Desk is back to the regular $59/month for new members. What this last Celebration Founder spot gets (vs the free community) You keep everything you already get here in the free Skool plus: - Locked‑in $35/month instead of $59/month - Full access to The Swing Trading Desk, including: - A much more detailed No‑Chase Swing watchlist + key levels than what I post for free - My trade entries as I take them, so you can see exactly how I’m applying the method in real time - Discussion with other serious 9–5 traders using the same rules‑based process Free community = education, lighter watchlists, and general guidance. The Desk = the full implementation environment + my actual executions. Markets are messy right now, which is exactly when a rules‑based swing process matters most for 9–5 traders who can’t watch charts all day. How to grab the last spot If you want this final $35 Celebration Founder spot: 1. Send me a DM here in Skool with the word “FOUNDER”. 2. I’ll reply with the special $35/month signup link (public page shows $59). 3. You’ll still get a 7‑day free trial. If it’s not a fit, cancel within the first 7 days and you won’t be charged. Once this 1 re‑opened spot is taken: - The 100‑member celebration offer is fully closed, and - All new members are at the regular $59/month.

0

0

1-10 of 150

@albert-wang-6506

9–5 pros: swing US stocks + BTC/ETH.

No‑Chase Method.

Timestamped setups BEFORE trigger.

No scalping, penny stocks, or alts.

Online now

Joined Oct 15, 2025