Pinned

Do You Need a Deal this Year?

Hey MFS Family! We’re officially 17 days from year-end, and I know some of you still need to place capital into a deal before the year closes. I have one final opportunity to do that before we roll from 2025 into 2026. If that sounds like you, fill out the link below 👇 https://api.leadconnectorhq.com/widget/survey/xC7omAiSiKrcXXTNCvAe

Pinned

WELCOME!

We are going to be running a ton of deals, Opportunities , Exclusive offers, Education, and more here. If you are expanding a multifamily portfolio Stay Tuned. For any issues with Skool or access email admin@multifamilystrategy.com This years Goal is $100M in deals are Found, Funded, and Negotiated, from this community in 2025!

Pinned

New to the Mentorship??

If you have already joined the mentorship there is an email sent that has my number and a calendly link. Book a call there to get up to speed. Excited to get you started!

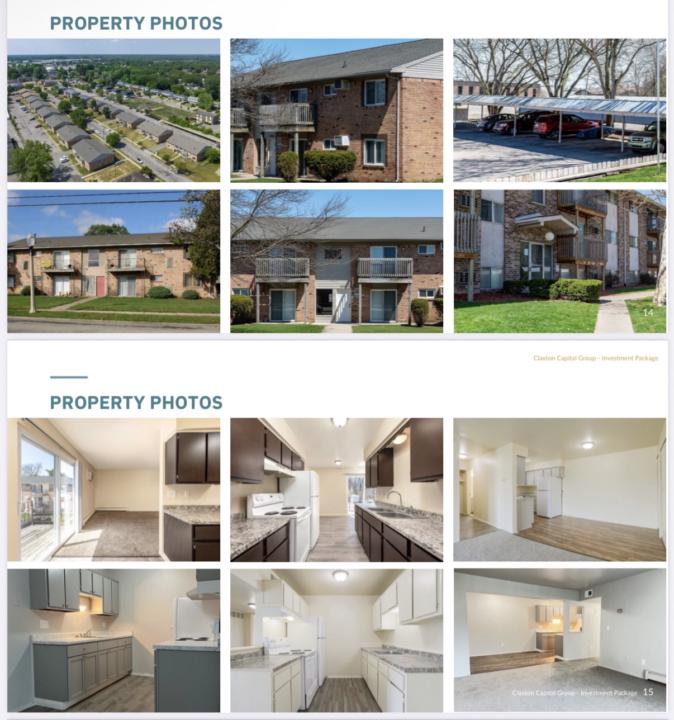

260-Unit Lansing Multifamily Deal — 19% IRR

One of my partners brought me this 260-unit deal in Lansing, MI and it's exactly the kind of opportunity I'm sourcing for my investor network 🎯 Class B- property. Owner's overextended. 94% occupancy. The fundamentals are solid. What jumped out at me: Rents are below market. Operations aren't optimized. There's real value waiting to be unlocked. The sponsor team (Katie Claxton, Sandeep Pradhan, Jinil Patel) has a clear thesis: Interior and exterior upgrades. Rent optimization. Operational tightening. Move this from B- to B+ and the numbers speak for themselves. **Investment Details:** $250K minimum | 5-year hold | 8% preferred return **Projected Returns:** → 19% IRR → 2X equity multiple → 22% AAR → 9.5%+ cash-on-cash Undervalued. Executable. Transparent sponsors. Real projected returns. If you're looking to deploy capital into multifamily that actually performs, let's connect. 🦍 #MultifamilyInvesting #DealFlow #RealEstateCapital CLICK ON LINK FOR PITCH DECK 👇🏻 https://drive.google.com/file/d/1aGSEMtISoLAAsUEHiVnn6sJupYig6EaM/view?usp=drive_web

0

0

1-30 of 781

skool.com/multifamilystrategy

Find, Fund, Discuss, & Network on Multifamily Deals

Powered by