A friendly reminder to check your subscriptions🙃

There are plenty of good tools out there to check your subscriptions and see what you're paying for each month. There are pros and cons of linking your bank to some of these apps, specifically when it comes to the security of your data, but these days everyone pretty much has all of your data anyway, so make of that what you will 😅 Recently, I did an audit of my Godaddy.com accounts, I have a few websites, only one of which is active right now, but one thing I didn't realize is that I've been paying for an email address for one of the sites that is currently not active 🫠 Now, it's only $10/month, but that's $120/year -- and this is the problem with subscriptions. We think, "Oh, it's only $xx.xx/month" but when you start to have multiple small subscriptions you are paying for each month, that starts to add up! In fact, recent research has shown that the average American is paying nearly $1,000/year in subscriptions! A few questions for you: - Do you know how many subscriptions you have? - How much are you spending per year? - Do you use an app to track your subscriptions? - Are there any subscriptions you could cancel today? Let's discuss!

If I had to start budgeting all over again

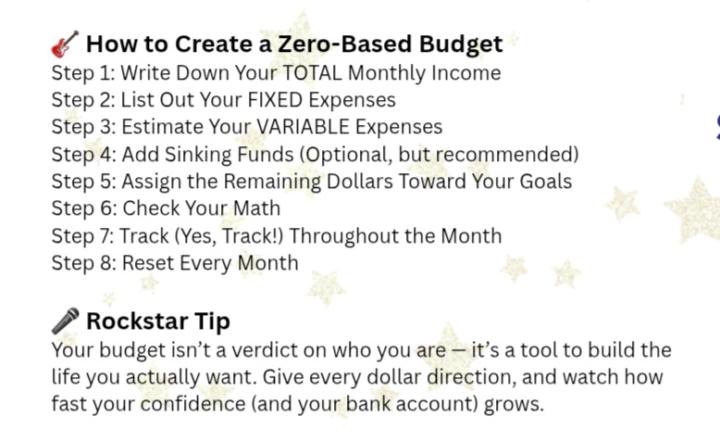

This is what I'd do. Budgeting gets a bad reputation because most people treat it like punishment. Like it’s a diet. Like it’s a list of all the things you’re “not allowed” to have. But here’s the truth most people never get taught: a budget isn’t restriction... it’s direction. And if I had to start all over again, rebuild my entire financial system from scratch, this is exactly how I’d do it. Step 1: I’d Get Brutally Honest About My Income Not the “I think I make around…” number. The real number. Take-home pay. After taxes. After insurance. After retirement contributions. Most people fail at budgeting because they start with a fantasy income and then wonder why the math keeps punching then in the throat. If I had to start again, I’d sit down with every pay stub, every deposit, and calculate exactly what’s coming in each month. No guesswork. No rounding up. No delusion. Step 2: I’d List Every Single Fixed Expense (Without Judgement) Rent, utilities, insurance, car payment, phone bill, subscriptions (yes, even that sneaky one you forgot about), debt payments, childcare, pet care... everything that hits the same time every month. I wouldn’t label anything “good” or “bad.” I wouldn’t shame myself for the totals. I’d just write the truth down. Because a budget built on lies collapses fast. Step 3: I’d Get Realistic About My Variable Expenses Groceries, gas, eating out, Target runs, Amazon “oops,” random kid emergencies, dog emergencies... basically, life. This is where most budgets die. People try to become a brand-new person in one month: “I’m going to spend $30 on groceries and never eat out again!” Yeah… no. If I were starting over, I’d look at my actual spending for the last 90 days and average it. Because you can’t change what you refuse to look at. Step 4: I’d Add Sinking Funds Immediately (Not ‘Someday’) Future expenses are real. Pretending they aren’t is why people swipe the credit card every December and cry on January 2nd. Christmas happens every year.

Ready to Rock Your Budget? 🤘

Shout out to @Jeff Baer and @Demetra Lambros for hopping on the call tonight! I'm not dropping the recording in here because I was having technical difficulties -- but I did promise you a worksheet, so here's that! As I've been working with people over the years, what I've learned is most people don’t actually have a spending problem -- they have an ambiguity problem. A Zero-Based Budget fixes that because every dollar gets a job. It means there's no confusion, no guilt and no “where did my money go?” moments. This one covers: 💰 Income streams 🏡 Housing & utilities 🚗 Transportation 👗 Clothing 🍔 Food 💊 Medical 📚 Personal 🛡️ Insurance 💳 Debts 🎉 Recreation …and sinking funds (the secret weapon nobody teaches you). If your money feels like it’s leaking out of 100 tiny holes, this is the fix. Clarity = confidence and Zero-Based Budgeting isn’t about restriction. It’s about intention. It’s about giving every dollar direction so your life stops feeling chaotic and starts feeling designed. Your homework for the week is to either with pencil and paper, or a spreadsheet, write down all the categories you want in your budget and all of the line items you want added to in said category. Then, we will walk through this live on next week's call. Drop a ⭐ below if you'll be there.

Feeling Like I'm Fired Up

I had the chance to see Mel Abraham speak this week, and to be honest I didn't know who he was prior but I've heard the name dropped over the years around financial literacy. He was teaching more about the investing first model, even when if it is small. I have always contributed to a 401k or a RothIRA from my employer, but I have never thought about making small investments from the money I earn from my business. I want to dig deeper into that in 2026 so I can have growth in the future and not just grinding. Anyhow not sure what the plans are yet, but this was just my initial thought thanks for letting me share.

See you all soon!

Hi everyone, we're going live at 7PM to kick off How to Rock Your Budget! The replay will be available after, but hope to see you soon!

1-30 of 39

skool.com/every-day-rockstars

Money, mindset, real estate, resumes & real talk. Learn to level up your life and your confidence --without selling your soul or staying stuck.

Powered by