Pinned

🎸 Meet the Band: Introductions for Our Internet Strangers

Let’s get to know each other a little! If you’re new here, take a minute to drop an intro in the comments. Nothing fancy -- just share: - Who you are / where you’re from - What brought you here - Something fun or unexpected about you (hobby, favorite food, weird talent, etc.) I’ll go first so you don’t have to be the guinea pig. Can’t wait to meet you all!

If I had to start budgeting all over again

This is what I'd do. Budgeting gets a bad reputation because most people treat it like punishment. Like it’s a diet. Like it’s a list of all the things you’re “not allowed” to have. But here’s the truth most people never get taught: a budget isn’t restriction... it’s direction. And if I had to start all over again, rebuild my entire financial system from scratch, this is exactly how I’d do it. Step 1: I’d Get Brutally Honest About My Income Not the “I think I make around…” number. The real number. Take-home pay. After taxes. After insurance. After retirement contributions. Most people fail at budgeting because they start with a fantasy income and then wonder why the math keeps punching then in the throat. If I had to start again, I’d sit down with every pay stub, every deposit, and calculate exactly what’s coming in each month. No guesswork. No rounding up. No delusion. Step 2: I’d List Every Single Fixed Expense (Without Judgement) Rent, utilities, insurance, car payment, phone bill, subscriptions (yes, even that sneaky one you forgot about), debt payments, childcare, pet care... everything that hits the same time every month. I wouldn’t label anything “good” or “bad.” I wouldn’t shame myself for the totals. I’d just write the truth down. Because a budget built on lies collapses fast. Step 3: I’d Get Realistic About My Variable Expenses Groceries, gas, eating out, Target runs, Amazon “oops,” random kid emergencies, dog emergencies... basically, life. This is where most budgets die. People try to become a brand-new person in one month: “I’m going to spend $30 on groceries and never eat out again!” Yeah… no. If I were starting over, I’d look at my actual spending for the last 90 days and average it. Because you can’t change what you refuse to look at. Step 4: I’d Add Sinking Funds Immediately (Not ‘Someday’) Future expenses are real. Pretending they aren’t is why people swipe the credit card every December and cry on January 2nd. Christmas happens every year.

For funsies, because I know you've thought about it.

Yesterday I drove passed a lottery billboard heading to Louisiana that said the jackpot was 10 Billion. It's a typo I believe because the website said 1 billion. Anyway out of curiosity, what's your fantasy scenario if you had the winning ticket for that much. And how big of a dog shelter would you build? What house would you walk up to and ask them how much and say deal? What business would you buy? I'm not kidding about the dog shelter. And all the rescues I could find would get large donations. And I would traipse around the country to all the friends I still talk to and play pick a briefcase. Then vanish to Japan for a month.

🎄 Merry Christmas 💚🌟❤️

It really is the most wonderful time of the year! There’s something about the snow, the lights, the quiet magic that settles in after dark. Whether that's decorating the tree, baking Christmas cookies, sipping eggnog, sitting by the fire, replaying old memories and making new ones with the people we love -- it’s a season that invites us to slow down, gather close, and remember what matters. And yet, I know this time of year can also be incredibly difficult. For many, it brings grief, loneliness, complicated family dynamics, or reminders of what’s missing. If today feels heavy or bittersweet, please know you’re not alone. Reach out to me or someone you trust. Even a small connection can help. Last night I attended Christmas Eve service, which felt especially meaningful. I’m adopted and reconnected with my birth mom and her family about 8 years ago, and I had the opportunity to attend service with her and her husband. The message was centered on peace, something that feels deeply needed right now. Jesus is called Mighty Counselor and Prince of Peace, and the idea of a peace that surpasses all understanding feels especially relevant right now. Even if you’re not religious, it’s hard to ignore the amount of turmoil in our world. I truly pray that each of you is able to find peace, not just today, but in the year ahead. Also, a big reason I even got into financial literacy and real estate investing was also about peace. Financial peace. Fewer sleepless nights. Less stress. More margin. That desire was sparked years ago thanks to Dave Ramsey, and it’s been a guiding thread ever since. My sincere hope is that I'm able to help you have peace around your finances as well! Anyway... Today I’m spending the day with my family and heading to my aunt and uncle’s house for Christmas dinner. Still very full from Christmas Eve and actively trying to not overdose on sugar cookies 😅 What's on your agenda today? Wherever this day finds you, I hope there’s a moment of warmth, calm, or joy tucked in somewhere. Sending love to all of you ✨️

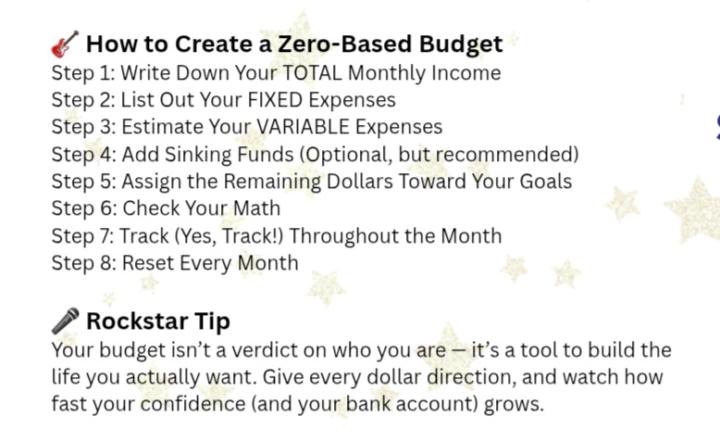

Ready to Rock Your Budget? 🤘

Shout out to @Jeff Baer and @Demetra Lambros for hopping on the call tonight! I'm not dropping the recording in here because I was having technical difficulties -- but I did promise you a worksheet, so here's that! As I've been working with people over the years, what I've learned is most people don’t actually have a spending problem -- they have an ambiguity problem. A Zero-Based Budget fixes that because every dollar gets a job. It means there's no confusion, no guilt and no “where did my money go?” moments. This one covers: 💰 Income streams 🏡 Housing & utilities 🚗 Transportation 👗 Clothing 🍔 Food 💊 Medical 📚 Personal 🛡️ Insurance 💳 Debts 🎉 Recreation …and sinking funds (the secret weapon nobody teaches you). If your money feels like it’s leaking out of 100 tiny holes, this is the fix. Clarity = confidence and Zero-Based Budgeting isn’t about restriction. It’s about intention. It’s about giving every dollar direction so your life stops feeling chaotic and starts feeling designed. Your homework for the week is to either with pencil and paper, or a spreadsheet, write down all the categories you want in your budget and all of the line items you want added to in said category. Then, we will walk through this live on next week's call. Drop a ⭐ below if you'll be there.

1-30 of 72

skool.com/every-day-rockstars

Money, mindset, real estate, resumes & real talk. Learn to level up your life and your confidence --without selling your soul or staying stuck.

Powered by