Short & powerful

Win of the week E-commerce took me from zero income to consistent 5 figures/month and gave me the capital to invest into my other businesses. No shortcuts just learning, testing, and staying locked in. If you’re curious how I got started or what I’d do differently, happy to share 💬

0

0

Humble + curiosity trigger

Not posting this to flexjust to be transparent. E-commerce is what helped me go from $0 to building steady five-figure months, and it’s now the backbone funding my other business moves. I’m still very much in the process, but it’s been one of the most valuable skills I’ve learned. If anyone here is thinking about starting or wants clarity on the basics, feel free to ask.

0

0

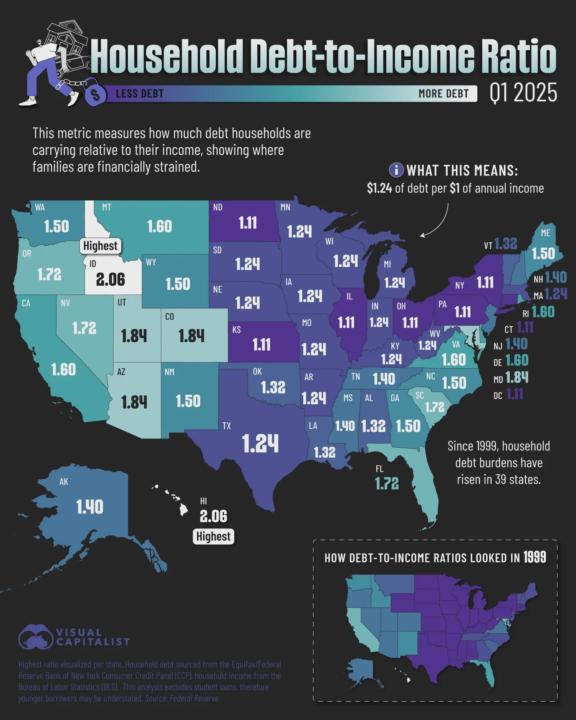

The American Debt Map: 4 Surprising Truths the National Average Hides

Here's a Credit Avenger–style Skool post revision. Same intelligence, sharper edge, easier to read, built for engagement, The American Debt Map 4 Surprising Truths the "National Average" Hides We hear it all the time: "The average American household has X amount of debt." Sounds official.Sounds comforting.Also… wildly misleading. Debt in America isn't a national story. It's a local battlefield. Here's what the data really shows. Truth #1: The National Average Is Basically Fiction There is no such thing as an “average” debt household. Before the Great Recession, some counties carried more than 3 times their annual income in debt, while others had less than 1 time. Same country. Totally different realities. National numbers smooth out pain. Real people live in ZIP codes. Truth #2: Local Debt Predicts Local Pain High household debt isn't just uncomfortable; it's dangerous. Research shows that areas with higher debt experienced: • larger spending cutbacks • higher job losses • slower recoveries. When families are maxed out, the moment life punches back, the whole local economy feels it. Truth #3: High Debt ≠ Bad Habits Some of the highest-debt states today include places like Hawaii and Idaho. Why?• Expensive housing markets• Fast population growth• New mortgages, not luxury splurges. Debt levels often say more about where you live than how "responsible" you are. Truth #4: Student Loans Aren't Even Counted Here's the part nobody talks about. This data excludes student loans. That means trillions in real-world debt aren't showing up at all. For younger households, especially, the picture is far worse than the numbers suggest. Credit Avenger Takeaway Debt is not a moral Failure. It's math + environment + timing. That's why we don't compare ourselves to national averages here. We build personal strategies that work where you actually live. Drop your state or region in the comments. Let's talk about the real financial terrain you're navigating. One country. Thousands of debt realities. Your plan should match your battlefield.

“If I retired today, my pension would cover…

A pension is powerful, but it was never meant to carry retirement alone. Real security comes from stacking income, planning for inflation, and building a strategy that gives you freedom, not just survival.

Poll

6 members have voted

1-30 of 95

skool.com/credit-avenger

For overwhelmed people in debt who want peace of mind, a clear path forward, and up to $6,000 less debt in 3 months.

Powered by