Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by John

For overwhelmed people in debt who want peace of mind, a clear path forward, and up to $6,000 less debt in 3 months.

Memberships

Ukulele Nerds

81 members • Free

Abundance for All

9 members • Free

Tea Relief Society

204 members • Free

Chaos to Clarity Lab

49 members • Free

Business Builders Club

4.3k members • Free

141 contributions to Credit Avenger Academy

Why I Am Not Worthless

I am not worthless because I still have something powerful to give: choice. As long as I can make decisions that protect my future, I still hold the shield. ,As long as my actions—no matter how small—move me toward stability, freedom, or clarity, I am not worthless. If my life impacts even one person for the better, I matter.And if that one person is me, that still counts.Especially in this journey. If I can offer love, patience, understanding, encouragement, or even a quiet moment of strength, I’m not worthless. If I can show up one more day, try one more time, or take one more step, then I have worth. If I can trust my own judgment, respect my growing wisdom, and honor the battles I’ve survived, I’m not worthless.If others see that value too, that’s a bonus—but my self-respect is the real credit score that counts. I am not worthless. I am a work in progress. I am rebuilding. I am rising. I am a Credit Avenger.

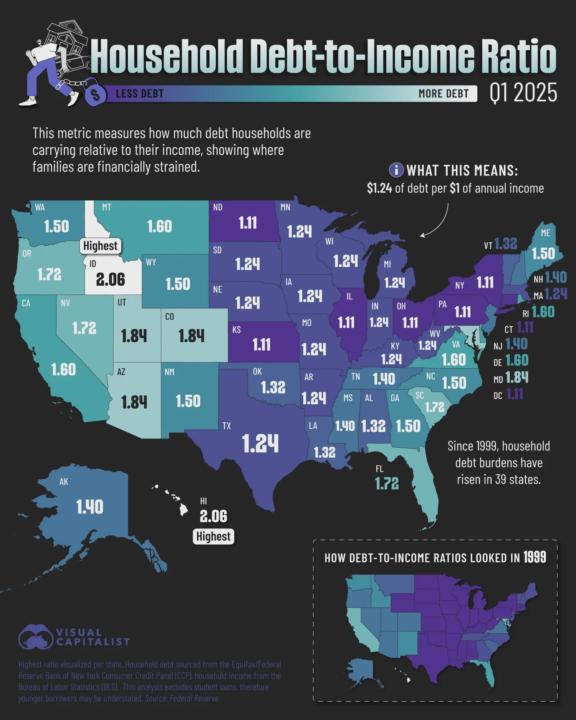

The American Debt Map: 4 Surprising Truths the National Average Hides

Here's a Credit Avenger–style Skool post revision. Same intelligence, sharper edge, easier to read, built for engagement, The American Debt Map 4 Surprising Truths the "National Average" Hides We hear it all the time: "The average American household has X amount of debt." Sounds official.Sounds comforting.Also… wildly misleading. Debt in America isn't a national story. It's a local battlefield. Here's what the data really shows. Truth #1: The National Average Is Basically Fiction There is no such thing as an “average” debt household. Before the Great Recession, some counties carried more than 3 times their annual income in debt, while others had less than 1 time. Same country. Totally different realities. National numbers smooth out pain. Real people live in ZIP codes. Truth #2: Local Debt Predicts Local Pain High household debt isn't just uncomfortable; it's dangerous. Research shows that areas with higher debt experienced: • larger spending cutbacks • higher job losses • slower recoveries. When families are maxed out, the moment life punches back, the whole local economy feels it. Truth #3: High Debt ≠ Bad Habits Some of the highest-debt states today include places like Hawaii and Idaho. Why?• Expensive housing markets• Fast population growth• New mortgages, not luxury splurges. Debt levels often say more about where you live than how "responsible" you are. Truth #4: Student Loans Aren't Even Counted Here's the part nobody talks about. This data excludes student loans. That means trillions in real-world debt aren't showing up at all. For younger households, especially, the picture is far worse than the numbers suggest. Credit Avenger Takeaway Debt is not a moral Failure. It's math + environment + timing. That's why we don't compare ourselves to national averages here. We build personal strategies that work where you actually live. Drop your state or region in the comments. Let's talk about the real financial terrain you're navigating. One country. Thousands of debt realities. Your plan should match your battlefield.

“If I retired today, my pension would cover…

A pension is powerful, but it was never meant to carry retirement alone. Real security comes from stacking income, planning for inflation, and building a strategy that gives you freedom, not just survival.

Poll

6 members have voted

Feb 10 Q&A Credit Avenger

We are live in a few minutes for the Credit Avenger answering your credit questions. https://www.skool.com/live/G2dTdjt7P34 Drop your questions below!

1-10 of 141

🔥

@johnpogue

The Credit Avenger-For overwhelmed people in debt who want peace of mind, a clear path forward, and up to $6,000 less debt in 3 months.

Online now

Joined Sep 16, 2025

Conroe Texas

Powered by