Write something

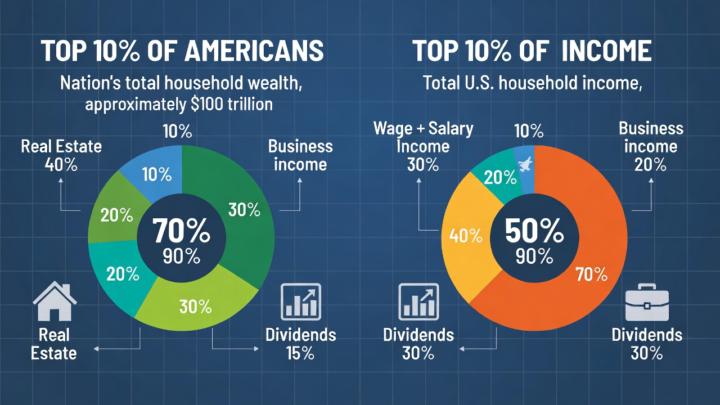

What the top 10% do for Income that the Middle and Lower don't

The top tier of American society, often referred to as the wealthy or affluent class, typically sources their money from a variety of assets and income streams that distinguish them from middle and lower-income earners. Here are some key points regarding their sources of wealth and spending habits: 1. **Investment Income**: Wealthy individuals usually benefit from substantial investment portfolios. This can include: - **Stocks and Bonds**: Earning dividends and interest. - **Real Estate**: Rental income and appreciation in property value. - **Private Equity and Venture Capital**: Investments in startups or private companies. 2. **Business Ownership**: Many affluent individuals own businesses or have stakes in companies, providing them with income that isn't tied directly to a salary. 3. **Inheritance**: A significant portion of wealth among the wealthy is inherited, maintaining and sometimes increasing their financial resources over generations. 4. **Income from Intellectual Property**: This includes royalties from books, patents, or music that generate ongoing revenue. 5. **Tax Strategies**: Wealthy individuals often utilize tax planning and strategies that lower their tax liabilities, allowing them to retain more of their income and assets. Differences from Middle and Lower-Income Americans: - **W-2 Income Dependence**: Middle and lower-income earners are typically reliant on salaries or wages from employment, which can be limited in terms of growth and stability. - **Access to Capital**: The affluent often have easier access to credit and capital, allowing for more investment opportunities that can generate additional income. - **Financial Literacy and Resources**: Wealthy individuals often have better access to financial education, advisors, and investment opportunities, leading to more informed decision-making about their money. - **Asset Accumulation**: Wealthy individuals are more likely to invest in appreciating assets, thereby increasing their net worth over time, while middle and lower-income individuals may focus on consumption or may not have the means to invest similarly.

0

0

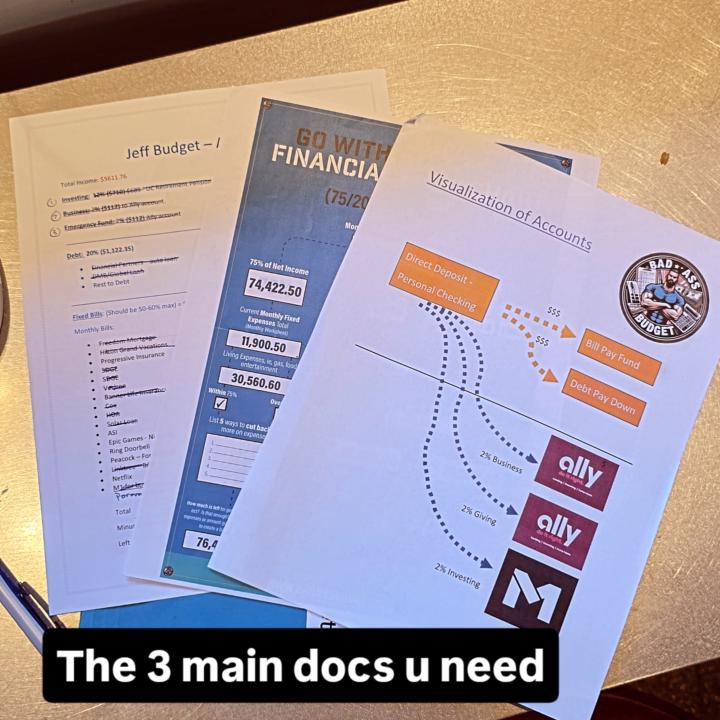

The 3 main documents you need.

The three main documents you need to budget like a boss. No spreadsheets! And printable so you can communicate your budget. Simple! Love it. ❤️

0

0

Sold my fist Cash Secured Put! Yeah

I sold my first cash secured put on $BBAI. I'm in the Wheel Warriors discord group. Fantastic group. $4/month on X. Tesla Groupie is the main moderator. She has only six main stocks she sells cash secured puts and covered calls on. Very straight forward and simple. You sell the options, get the premium up front and then just watch them decay. Beautiful. No stress and high win rate. No day trading and you dont have to be behind your computer all day. I made $12.99 profit, which is 60% profit and I closed out the trade early.

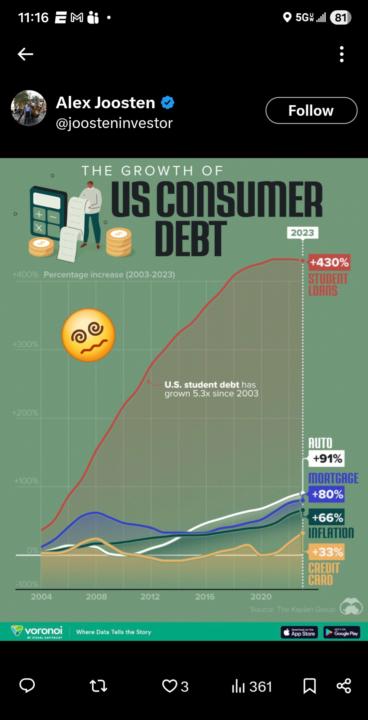

US College Debt hits all time highs.

College debt is bananas! Its crazy. At least now there is an acceptance that you dont need a degree to succeed. Starting out in life with fat loan is not freedom.

0

0

1-9 of 9

powered by

Suggested communities

Powered by