Business Credit versus Corporate Credit

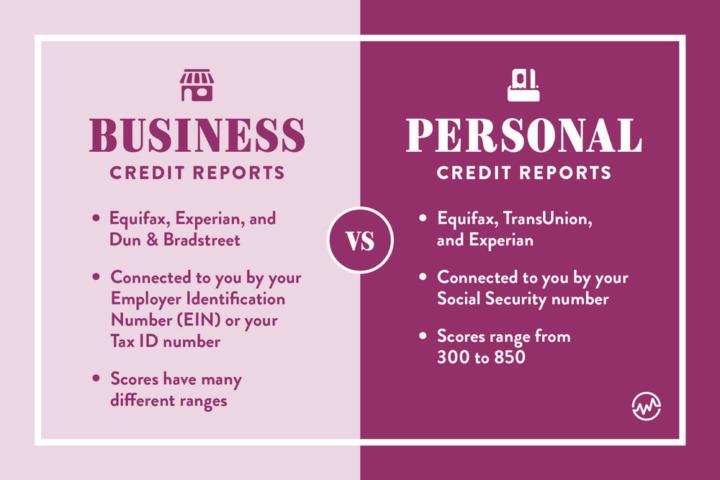

I see a lot of people interchanging the terms business credit and corporate credit as if they meant the same thing. They do not. Business credit and corporate credit are two different types of business credit lines. Business credit is a form of credit that uses your personal credit file but issues the credit lines to your business. These are considered recourse credit lines which require your personal guarantee. Lenders use your personal credit file to determine the size of your credit line, interest rates, and terms but issued in your business name and attached to your business tax ID number (EIN#). They do not show up on your personal credit reports and only report to the business credit bureaus. When you use these credit lines they do not hurt or affect your personal credit. They are business credit lines. Corporate credit is also issued in your business name and attached to your business tax ID number (EIN#). But your personal credit is not reviewed or considered when determining the size of your credit line, interest rates, and terms. They are determined solely by your business information and standing. They are considered non-recourse credit lines and require no personal guarantees. They also do not show up on your personal credit and only report to the business credit bureaus. When you use these credit lines they do not hurt or effect your personal credit. They do however affect your business credit. When using corporate credit lines, you are building credit histories and business credit scores with Dun & Bradstreet, Experian business bureau, and Equifax business bureau. Vendor credit lines, both Net 30 and revolving credit lines, are generating the business information establishing your business credit file and business credit scores from vendors that report positive payment history. Once your business has been around for a few years, and you have developed strong business credit scores, and you are showing growing revenue, you can start getting many non-personal guaranteed corporate credit lines. You can start obtaining business equipment, business vehicles, and even real estate using corporate credit.

0

0

Is this YOU?! 👀

Raise your hand if you’ve disputed the same charge-off, like, 47 times. 🙋🏾♂️🙋🏾♂️🙋🏾♂️ You’ve sent every “magic” letter TikTok promised, waited 30 days, and got hit with that same “verified” response again. Brutal. If that’s you, it’s time to switch tactics. Enter: the CFPB. In our CFPB Complaint Framework, we’re walking you through exactly how to remove charge-offs and collections by using the same system creditors fear most, the Consumer Financial Protection Bureau. Because if one well-written complaint can get stubborn accounts deleted? You should probably stop wasting stamps and start filing smarter. Here’s what you’ll learn: 👉🏾 How to identify charge-offs that are eligible for CFPB escalation 👉🏾 The exact complaint wording that gets attention (without triggering automated denials) 👉🏾 What to say when the company “confirms” info they never verified 👉🏾 How to document your paper trail so you look 10x more credible than the furnisher PLUS, we’ll show you how to track responses and follow up until the account’s gone. We’re calling this an “intensive” because the goal is to get actual results, not just another round of letters collecting dust. Success rates are sitting at 80%. So if your disputes keep looping in circles, this is your sign to file like a pro and finally break the cycle. Drop the word “SKOOL” to get the link.. 👇🏾

1

0

Did You Know Credit Card Limits are Often Listed Incorrectly on Purpose?

One of the dirtiest tactics used by credit card issuers is to report no credit card limit to the credit bureaus. This is to prevent competitors from stealing their good low-risk clients and offering them competing credit cards. Since 30% of your credit score is decided by credit utilization, this can hurt your score considerably. How? When NO credit limit is reported, it means if you charge $1.00 on that credit card you are over the credit limit. If you charge $1,000, you are way over the limit. See the problem? We see this more often than you might expect when reviewing clients credit reports before applying for 0% business credit cards. You need to get a copy of your credit reports and verify your credit limits are being reported correctly., If you find no credit card limit being reported on your credit file, you must contact the credit card company. Get them to report your correct credit limit. Once updated, you will see your credit score increase significantly. Another note. We sometimes see incorrect credit card “length of credit history” being reported. Meaning a card you have had for five years reporting it was open two years ago. Please review your credit report for inaccuracies. It makes a difference.

3

0

A Totally-NOT-Illegal Credit Card Hack‼️🍎💯

Okay, I don’t know if this hack is either GENUIS or completely unhinged, but either way, I’m going to walk you through it.. 🤷🏾 If you feel like you’re broke and so is your credit score, try this Apple Credit Card Hack AND please do share your results‼️ Step 1: Sneak into your own Apple Wallet….. 🍎 👀 Step 2: Yes, apply for that Apple Card, but don’t put anything less than $80k for your income. Because we’re NOT broke Americans ta-day! 👑 Step 3: They’ll whisper, “You’ve been pre-approved, big spender.” 🤑 Step 4: Right after they flash your shiny new limit in your face (because you’re credit royalty now) freeze your TransUnion credit report like it’s the Arctic Tundra. 🥶 Step 5: After you freeze your TU, push the button and accept the offer.. Now there’s no hard inquiry. No trace. You were never there. 🤫 Step 6: Keep that sucker frozen for 2 weeks. Two. Weeks. Long enough for them to shrug and say, “I guess he’s still trustworthy… probably.” 🤔 BOOM 💥 Apple Card, zero inquiries, you win the game. 💳 Disclaimer (in fine print but shouted with urgency): This is for educational satire purposes only. If you try this and get clapped by Apple or TransUnion, don’t call us…we’re busy freezing our credit with ski goggles on. 😎⛷️

2

0

Why is Comparable Credit Important?

Good and Even Great Credit Scores May Not Be Enough Even if you have great credit scores, both personal and business, you still want to make sure you “build those credit files out”. What do I mean by this? An often-overlooked aspect of obtaining cash credit lines is something called “Comparable Credit”. As I said you can have great personal credit scores and great business credit scores but when seeking larger cash credit lines comparable credit comes into play. If you and/or business has credit lines of $500, $2500, $5,000 etc. and you are asking for $35,000+ you most likely won’t get that. Banks routinely provide you 1.5X to 3X your current personal limit in business credit lines if your file look good. So before going after the truly larger business credit lines, make sure your personal credit files have a few larger credit lines already reporting. Ask your vendors and credit card companies to increase your credit lines every 6-months or so as long as you are using them and paying them in a timely fashion. This is how you take $500 vendor lines and $5,000 personal credit card lines and make them $1,500 and $15,000 credit lines. Banks want to see you have handled those larger credit lines successfully before extending your business super-sized credit lines of $35K+. If you have successfully had large credit lines and paid aggressively, they are more than happy to grant you these larger credit lines. But first they want to see you or your business has had a history of making payments on time with larger credit lines. It takes time to do this right. But it’s worth it and frankly the only legit way to do so. Build out your personal credit file and business credit file before seeking that homerun credit line. Always be increasing your credit lines whether you need it now or not. One day you may!

3

0

1-8 of 8

skool.com/a-resourceful-palace-6621

Our mission is simple: empower financial professionals to grow profitable, compliant, and community-centered businesses with the help of VAs‼️

Powered by