Pinned

🚀 Welcome to the Credit & Funding VA Hub! 💫

You made it! 🎉 This is your space‼️ 🙌🏽 Built for Virtual Assistants who power credit repair and funding businesses. The behind-the-scenes pros that make the systems run, the clients smile, and the numbers move. Here, you’ll find: 💻 Real systems that make your work easier 💼 Tools to boost your income 💬 A community that actually gets it Let’s kick things off 👇🏽 Drop your name, what you do, and one goal you’re chasing this month. Who knows.. your next collab or client might be right here waiting. ✨

Pinned

🧠 How can We Focus and Flow Together?

🫱🏾🫲🏽 Every Thursday night from 7:30PM EST - 8:30PM EST in the Resourceful Palace Skool community we are keeping each other accountable. 🎥 Cameras on, distractions off. ☝🏽 Bring one task your partner just yelled at you for procrastinating on (or that’ll move your community forward), share it at the start, then mute and grind. 🧐 We’ll do focused work sprints with short breaks to check in, celebrate, and reset. What to Expect: - 5-min kickoff (declare your goal) - 45-min deep work sprint - 10-min regroup + wins share 🙌🏽 You’ll leave lighter, clearer, and actually done with something. 💻 Bring: laptop, water, good vibes, and one small thing you refuse to keep avoiding. See you soon!

Pinned

🚨 New Skool Categories Are Live! 🚨

🤓 Courses are cool for Skool, but let’s be honest…you’re a smart cookie. You’re not here just to consume, you’re here to contribute. You want a community that lets you flex your expertise, connect, and collaborate with other power players. 💪🏽 So, I rebuilt this space with you in mind. No more course clutter, just clean categories where you can drop gems, share wins, and build real momentum together. Here’s a quick list of some of the top categories.. 💳 Credit Corner: Everything credit-related like tips, disputes, score building, and strategies that boost your leverage. 💸 Funding Formula: Drop your funding questions, wins, lender experiences, and anything that helps you secure the bag faster. 👩🏽💻 VA Wisdom: For our Virtual Assistants and operational experts. Share tools, systems, and workflows that keep businesses running smoothly. 🏆 Winners’ Circle: Celebrate your success! Whether it’s a new approval, milestone, or breakthrough, let the community show you love. …And much more, so before you post 👀 check which category fits best, then share your insight. I’ll probably be living in the Prompt Engineering and Quotes categories (fair warning, I plan to overuse them). 💬 Now your turn: Which category are you diving into first and what topics do you think we should add next? 👇🏽

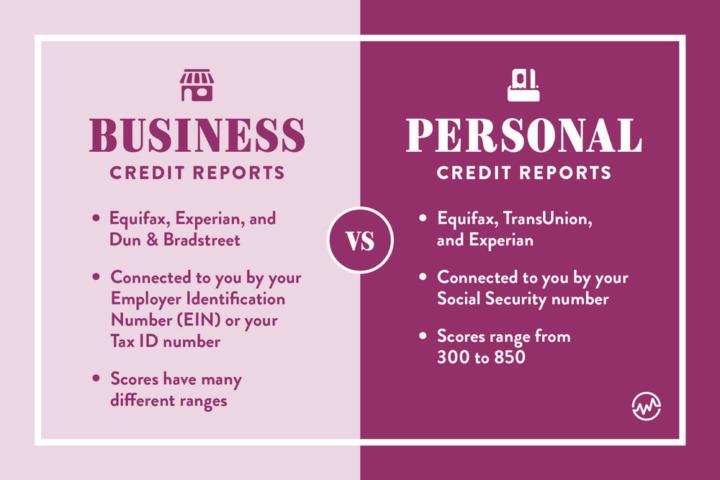

Business Credit versus Corporate Credit

I see a lot of people interchanging the terms business credit and corporate credit as if they meant the same thing. They do not. Business credit and corporate credit are two different types of business credit lines. Business credit is a form of credit that uses your personal credit file but issues the credit lines to your business. These are considered recourse credit lines which require your personal guarantee. Lenders use your personal credit file to determine the size of your credit line, interest rates, and terms but issued in your business name and attached to your business tax ID number (EIN#). They do not show up on your personal credit reports and only report to the business credit bureaus. When you use these credit lines they do not hurt or affect your personal credit. They are business credit lines. Corporate credit is also issued in your business name and attached to your business tax ID number (EIN#). But your personal credit is not reviewed or considered when determining the size of your credit line, interest rates, and terms. They are determined solely by your business information and standing. They are considered non-recourse credit lines and require no personal guarantees. They also do not show up on your personal credit and only report to the business credit bureaus. When you use these credit lines they do not hurt or effect your personal credit. They do however affect your business credit. When using corporate credit lines, you are building credit histories and business credit scores with Dun & Bradstreet, Experian business bureau, and Equifax business bureau. Vendor credit lines, both Net 30 and revolving credit lines, are generating the business information establishing your business credit file and business credit scores from vendors that report positive payment history. Once your business has been around for a few years, and you have developed strong business credit scores, and you are showing growing revenue, you can start getting many non-personal guaranteed corporate credit lines. You can start obtaining business equipment, business vehicles, and even real estate using corporate credit.

0

0

Do You Have a Lender Friendly Business Name?

Most credit applications are now done online and with AI underwriting. A cursory review of your business name could place you in a high-risk industry and get you an instant credit denial. You don’t want a business name that indicates a high-risk industry (like real estate investing or money lending) . You want generic lender friendly names such as “ABC Enterprises”, “ABC Solutions”, ABC Holdings”, or ABC Ventures”. Nothing that indicates any particular industry, especially a high-risk one. If you already have formed a business (LLC or Corporation) with a high-risk industry designation name you can try creating a “DBA” (doing business as) and use that name on credit applications. Use your EIN number for the LLC or Corp and use the DBA name on the application. Both are filed and will show up on the Secretary of States website or Department of Corporations website depending on what state you are domiciled in. https://www.secstates.com/ Example: corporate name = “ABC Real Estate Investments”. Create a DBA name like “ABC Enterprises or ABC Holdings”. If a DBA name won’t work, I suggest starting a whole new LLC. Don’t be caught with a high-risk industry indicated in your business name. Note: Not all lenders find the same industries as high-risk or unacceptable. It varies from lender to lender. Certain alternative finance lenders actually cater to high-risk industries. Of course, their funding options will come at a premium cost. Do you have a high-risk business name? (See attachment).

0

0

1-30 of 32

skool.com/a-resourceful-palace-6621

Our mission is simple: empower financial professionals to grow profitable, compliant, and community-centered businesses with the help of VAs‼️

Powered by