Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

AI Automated Wholesaling(Free)

1.7k members • Free

WholeScaling Free

872 members • Free

Auction Property Academy

216 members • Free

Big Deal University

181 members • $29/m

Big Deal Mastermind

247 members • Free

1 contribution to Auction Property Academy

The Inside Scoop with Auction.com 👀

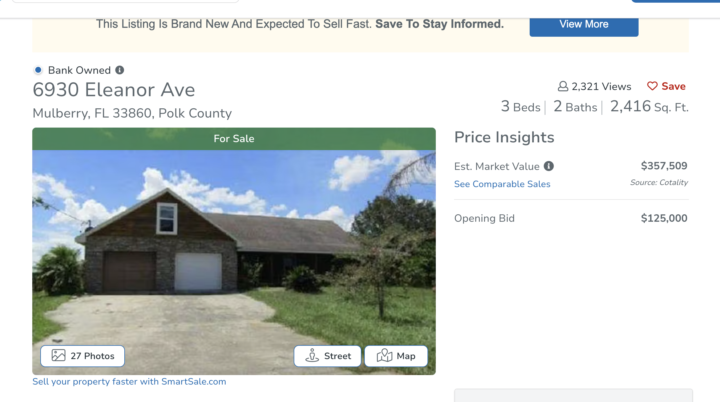

💥 Happy Saturday, everyone! As you all know, Auction.com is one of my favorite places to find auction deals — especially ones like these that have made me $100K+ in profit. 💰 I recently got in touch with my personal rep over there (you get one once you’ve done a few deals 👀), and she gave me some exclusive insider info that I knew I had to share with the community. Here’s what I learned 👇 🏠 1️⃣ The “Estimated Market Value” Is Actually a Hint at the Reserve Price This is HUGE. Normally, when you’re bidding on an auction property, you have no idea what the bank’s reserve (minimum acceptable price) is — which leads to bidding wars, re-auctions, and wasted time. But now that we know the Estimated Market Value closely reflects that reserve, it’s like knowing the sales price before you buy. This helps you make faster, more strategic offers without overpaying. 💵 2️⃣ 97% of Bank-Owned Auctions Allow Non-Conventional Financing Yup — you don’t need to buy all-cash! Most bank-owned auctions on Auction.com accept: - DSCR Loans - Fix & Flip Loans - Non-QM Loans That means investors can leverage financing to scale their portfolios instead of waiting to save up huge amounts of cash. 🏗️ 3️⃣ The More You Buy, the Easier It Gets Once you’ve built a track record with Auction.com, banks start recognizing you as a serious, credible buyer. According to my rep, repeat buyers often have their offers accepted faster — and banks may even negotiate lower prices directly because they trust you’ll close. 🔍 4️⃣ You Can Use a Realtor to Access Bank-Owned Properties For many bank-owned auctions, you can actually work with a realtor to: - Schedule inspections - Get an appraisal - Access property details before bidding This gives you a major advantage in doing due diligence — especially on occupied or unknown-condition homes. 🚪 5️⃣ “Occupied” Doesn’t Always Mean Occupied This is a tricky one… just because a listing says “occupied” doesn’t mean someone’s living there.

1-1 of 1

@trinece-diaz-6559

I am a real estate investor. I have completed a flip and currently own 2 doors. My goals are to learn, network, and provide value where I can.

Active 1d ago

Joined Oct 6, 2025

Tampa, Fl