Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

BuilderAccelerator

844 members • $197/m

5-Minute Futures

7.4k members • Free

Trading Boss VIP

48 members • Free

17 contributions to 5-Minute Futures

PSA if you got rekt on Friday, your algos are too correlated

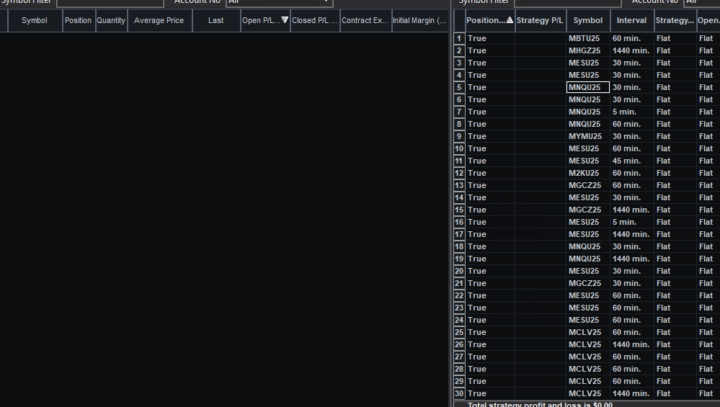

Let me know if this sounds familiar: 1. You had multiple algos all lose money yesterday. 2. All of your stocks and crypto all lost money yesterday. 3. Your overall portfolio was red yesterday, and it wasn't just a small loss, it was magnitudes larger than what you normally experience when it comes to drawdowns. These are symptoms of the root problem that your portfolio is too correlated. When you have multiple algos that are too correlated to the underlying market they trade Then you expose yourself to large single day losses like yesterday. Correlated market groups: 1. S&P, Nasdaq, Dow Jones, Russell 2. Bitcoin, Ethereum 3. Gold, Silver, Platinum, Copper 4. Oil, Gasoline, Nat Gas These groups of markets are all similar, right? Now, what happens is when there's a black swan event like the one that we had yesterday, all of the correlations line up, so all of these markets tend to fall at the same time during a black swan event. Now if you're just buying and holding assets like AI stocks, tech stocks, S&P 500, NASDAQ, these are all in the same group. So, of course you're going to be exposed to correlation risk if you only invest in one asset group. One way we can diversify risk is to trade different industries like: metals, energy, crypto, indexes, currencies. But as you saw yesterday, when there is a black swan event, when there's panic selling that occurs, even assets in different industries can become correlated. So how we diversify further is by trading different directions: Both Long & Short Yesterday, we had profits from GC going long and ES going short. And sometimes even this is not enough, so we have to diversify even further by varying the bar type that we trade. Our Zeus strategy trades gold to the long side on Kase bars, which is a volatility-based bar. So the edge on an exotic bar type is going to be very alien to just a traditional time-based bar, for example. And then our final line of defense, and perhaps the best tool in our arsenal, is to use different strategy types.

2025 September Performance: -5.81%

Starting Balance: $300k Net PNL: - -$17.43k - -5.81% Date Range: - 9/1/25 to 9/30/25 Portfolio: B (concierge tier 16 algos) Note: September is the weakness month for this portfolio from a seasonality perspective. Q4 is the strongest. PS. I share these updates to normalize transparency in the trading industry. If you'd like to join me on this mission. Share your 3rd party verified trading performance!

FREE copy of Hormozi's new book ($100M Money Models)

I have 199 FREE QR codes to give away for Hormozi's new Money Models book, so if you need one comment below "Me" and I'll DM it to you. Prioritizing clients first, first come first serve for all members of 5-Min Futures! Happy Money Models Launch Day & Birthday Weekend to Alex Hormozi :) P.S. Free Money Models Audiobook here PSS. Free Money Models Course here 👉(must own a skool community 1st)

1-10 of 17

Active 11h ago

Joined Dec 16, 2024

Powered by