PSA if you got rekt on Friday, your algos are too correlated

Let me know if this sounds familiar: 1. You had multiple algos all lose money yesterday. 2. All of your stocks and crypto all lost money yesterday. 3. Your overall portfolio was red yesterday, and it wasn't just a small loss, it was magnitudes larger than what you normally experience when it comes to drawdowns. These are symptoms of the root problem that your portfolio is too correlated. When you have multiple algos that are too correlated to the underlying market they trade Then you expose yourself to large single day losses like yesterday. Correlated market groups: 1. S&P, Nasdaq, Dow Jones, Russell 2. Bitcoin, Ethereum 3. Gold, Silver, Platinum, Copper 4. Oil, Gasoline, Nat Gas These groups of markets are all similar, right? Now, what happens is when there's a black swan event like the one that we had yesterday, all of the correlations line up, so all of these markets tend to fall at the same time during a black swan event. Now if you're just buying and holding assets like AI stocks, tech stocks, S&P 500, NASDAQ, these are all in the same group. So, of course you're going to be exposed to correlation risk if you only invest in one asset group. One way we can diversify risk is to trade different industries like: metals, energy, crypto, indexes, currencies. But as you saw yesterday, when there is a black swan event, when there's panic selling that occurs, even assets in different industries can become correlated. So how we diversify further is by trading different directions: Both Long & Short Yesterday, we had profits from GC going long and ES going short. And sometimes even this is not enough, so we have to diversify even further by varying the bar type that we trade. Our Zeus strategy trades gold to the long side on Kase bars, which is a volatility-based bar. So the edge on an exotic bar type is going to be very alien to just a traditional time-based bar, for example. And then our final line of defense, and perhaps the best tool in our arsenal, is to use different strategy types.

How to download algo backtests from Tradestation

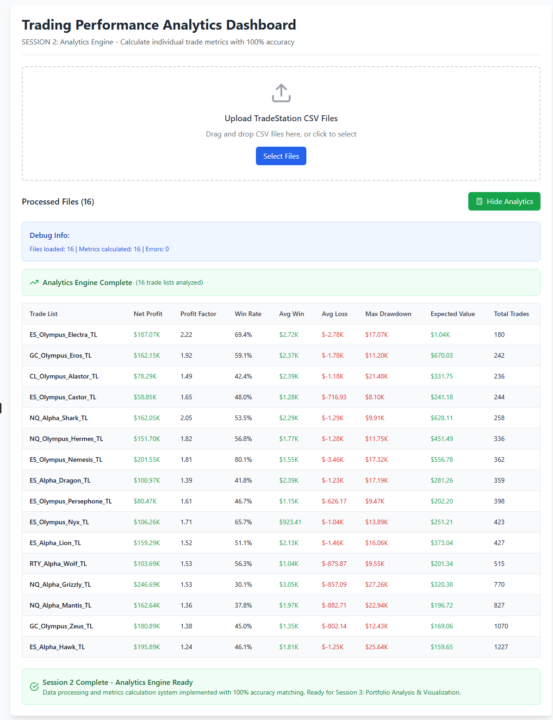

This dashboard visualizes equity curves, performance metrics, and portfolio statistics for multiple algorithms. It's currently over 2,700 lines of code and capable of loading trade lists from TradeStation, calculating combined portfolio performance, and analyzing metrics like drawdown, win rate, and profits across different time periods. How to download algorithm back test data from TradeStation: - Refreshing charts in TradeStation to ensure data accuracy - Loading individual algorithm charts and turning status off/on to update data - Downloading trade lists as CSV files - Importing updated CSVs into the dashboard Labeled all algorithm entries with unique names (like Hawk, Lion, Shark) to easily identify which algorithm generated which trades in the trade lists. Algorithm Performance Analysis The dashboard enables detailed performance analysis: - Current data shows the portfolio has been flat since August, after making about $300K in April-May - Q3 2025 (July-Sept) showed modest gains of $37K with a $25K max drawdown - Q2 2025 (April-June) was extremely profitable with $297K gains and 17% max drawdown - Year-to-date performance shows 114.8% return with a 14.8% max drawdown - The portfolio demonstrated resilience during a challenging period in Feb-Mar Future Development Plans: - Add a monthly P&L matrix feature (requested by a client) - Several other features planned before public release - Estimating 60 more hours of development work - Plans to release the dashboard for free to their community - Currently hitting context limits in Claude for code revisions

Gold Short August 2025

This is a mean reversion trade that I placed on 8/8/25 on my iphone and I got filled. Let me know if you have any interesting ideas on how to determine when a market is consolidating like this that could be back tested and coded!

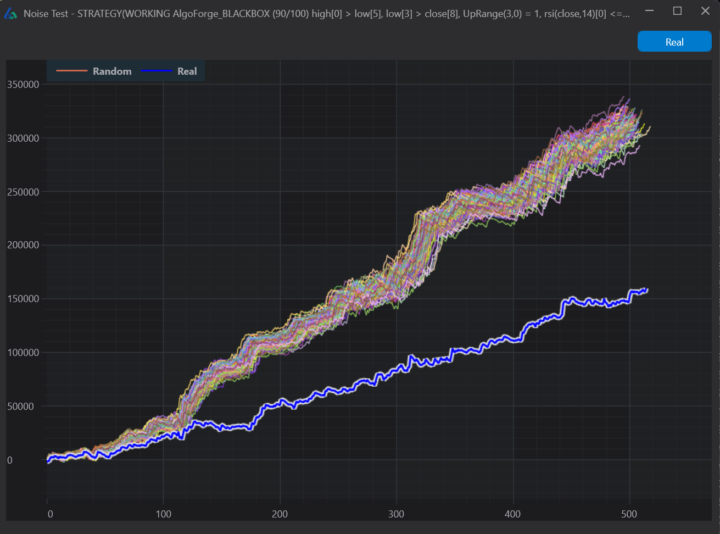

What makes a good noise test?

Hey @Kevin Gong . Just doing some strategy building right now. I know before you mentioned you like the noise test to be right around the mid-point for a "PASS" in your book. What does a noise test like this tell you? Is it really bad?

Claude is Great for Portfolio Analysis

Currently in progress of building a portfolio analysis Claude artifact that anyone can use that repurposes my complex python portfolio analysis script from raw Tradestation10 tradelists. Claude pro is cracked, would highly recommend over Grok, ChatGPT, for this type of coding.

1-30 of 56

skool.com/futures

A simple path to automated futures trading. Try 45+ algos for 30 days.

Powered by