Pinned

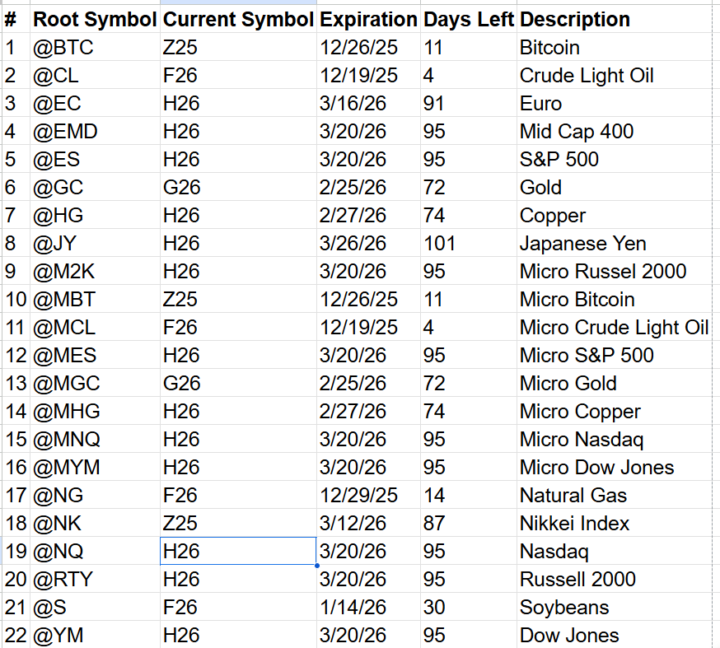

12/15/26: Contract Rollover Quad Witching

If you're running your own VPS, be sure to roll all charts ASAP Cheat Sheet: https://docs.google.com/spreadsheets/d/1AGPB2fiu1PbFHUOivOeQRi7yHNUC7IJmzBT8CrDDf5Y/template/preview

3

0

Pinned

A Case Study of 3 Successful Traders From 5-Minute Futures

🥇Best PNL YTD: FireKing 🥈 Best PNL/DD YTD: M-ray 🥉 Best PNL Last 3 Mo: SlyFox Congratulations to @Adam King @M-Ray Basar @Steve Reich! Please share in the comments any tips or tricks that helped you achieve the top results so far this year!

Pinned

Nasdaq is moving to 23hr a day, 5 day a week trading

This is excellent news for futures algotraders! Low liquidity outside of NY session on NQ has made a lot of algorithms unable to scale past a few million bucks in capital. Now, our algorithms will be even more powerful because slippage on overnight edge will go down. "Nasdaq is moving to 23hr a day, 5 day a week trading & will file with the SEC on Monday to get it approved The plan is for a day session from 4am to 8pm ET & a night session from 9pm to 4am, with the trading week running Sunday 9pm to Friday 8pm and a launch targeted for 2H'26" Source: Reuters

The one rule that would have saved my client from a 50% drawdown.

Words I Like: “The mistake wasn’t in pulling the tooth, it was in watching it decay and calling it patience.” – Alex Hormozi 5-𝙈𝙞𝙣𝙪𝙩𝙚 𝙁𝙪𝙩𝙪𝙧𝙚𝙨: 𝙏𝙝𝙚 𝙤𝙣𝙚 𝙧𝙪𝙡𝙚 𝙩𝙝𝙖𝙩 𝙬𝙤𝙪𝙡𝙙 𝙝𝙖𝙫𝙚 𝙨𝙖𝙫𝙚𝙙 𝙢𝙮 𝙘𝙡𝙞𝙚𝙣𝙩 𝙛𝙧𝙤𝙢 𝙖 50% 𝙙𝙧𝙖𝙬𝙙𝙤𝙬𝙣. Most traders don’t blow up from taking bad trades. They don’t even blow up from refusing to cut losses. I’ve seen it over and over: - Trading without a stop loss - Suddenly down −10% to −20%, hold and hope for breakeven - Unrealized loss spirals out of control - Forced to liquidate emotionally, usually at −40% to −50% The mistake wasn’t in holding the trade. The mistake was never defining the risk beforehand. Every strategy has a point where the odds are no longer in your favor. That’s where your stop loss should go. The problem is most traders don’t know how to properly back test their strategies. They lost the moment they started trading by hand without a system. Imagine this. 1. A kid walks in with a brutal toothache. Hasn’t been brushing. Sugar all day. No routine. 2. The dentist says:“If we don’t pull this one tooth, the rot spreads… and you’ll lose more teeth.” 3. They start. The kid feels pain and blames the dentist, vowing, “I’m never going to the dentist again.” He learned the wrong lesson. He associates the pain with visiting the dentist instead of the lack of a system for prevention. In trading, the painful emotions you feel around drawdowns are just symptoms of a bigger issue. They stem from not having a proven trading system with predefined risk. The pain and uncertainty doesn't come from taking a single bad trade. Its the cost for trading without a system. Once you get stuck holding a losing trade, you’re forced to choose between: A) Ignore the pain - Hold. Hope. Pray it “comes back to breakeven.” - Watch the position constantly. - Let trading control your mood and emotional state. B) Pull the tooth - Cut the loss. - Put out the fire now to protect the rest of your capital. - Set up systems to prevent it from happening again.

High WinRate & DD or Low WinRate & DD?

If you had to pick, which type of trading strategy would you prefer to trade for you? Option A: You make 5% a month consistently 11 out of 12 months of the year. But every year there's one day where you lose -90%. - Winrate: 90% - MaxDD: -90% Option B: 6/12 months are negative, but maxDD rarely exceeds 30%. Sometimes losing streaks lasts weeks or months on end, but 1 or 2 big wins make up for it. - Winrate: 40% - MaxDD: -30%

Poll

4 members have voted

1-30 of 487

skool.com/futures

A simple path to automated futures trading. Try 45+ algos for 30 days.

Powered by