Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

No Fluff Real Estate

1.9k members • Free

Wholesaling Houses Nationwide!

2.4k members • Free

Watch Lover | Community

2.6k members • Free

Real Men Real Style Community

13.8k members • Free

Brotherhood Of Scent

9.4k members • Free

High Value Land Group

1.1k members • Free

Wholesaling Real Estate

59.5k members • Free

Wholesaling Inner Circle

2.8k members • Free

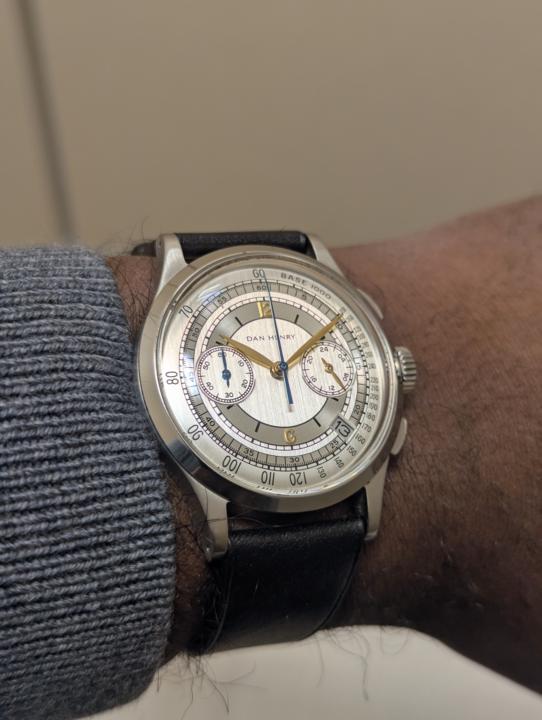

10 contributions to Watch Lover | Community

Keeping track for insurance and planning

I was sitting here and remembering when my wife and I were robbed some 15 yrs ago and how she lost all of her jewelry. 😢🤬 And I thought I would share with the group some of the things to think about when it comes to not only your watches but all things of value in your home. Every couple of years I do a new estate plan and also a full insurance audit both for my home and my business. 1 of the things we learned after the robbery is to have good documentation (and pictures) of all your items. How many of you do this? Every time I buy a new watch (in this example) I have it listed in my homeowners policy, I also keep the receipts, but I also take detailed pictures of the watch front/back etc and store them in a secure place. You would be surprised how under insured you can get without even knowing it. My wife lost ALL of her jewelry including things left to her by her grand mother that can't be replaced, but even if they could our basic insurance wouldn't have even covered 1/10th of what was lost so we had to rebuild on our own. Just thought I'd mention this to everyone as we all have things we don't ever want to lose but if you did would you be able to without the proper insurance? Just a thought

11 likes • 14d

I always use the holidays to review everything from our pensions, benefits, insurance coverages, etc. We also review and appraise our loot with a local jewelry store. I have an added bonus as the wife ran the Pearl Harbor exchange jewelry for 10+ years and really knows and enjoys the process!

Secret #4 (How To Level Up)

Leave a comment to let us know you've finished the How To Earn More Points & Level Up Classroom Course.

WOTD: Breitling Avenger

Decided to wear this beast of a watch today. Really love my Breitlings!

Happy Tuesday

I hope everyone is having a great Tuesday. I was gifted a watch by a very close friend and someone who I've known since we were kids. I value and cherish our friendship that we have built over the years. While the watch might not be a style I would have picked out for myself, I'll wear it with pride and appreciation. Like our friendship, it's something I'll always cherish. Case diameter: 45mm Thickness: 12mm Lug to lug: 52mm Band: 24mm

1-10 of 10

@tim-laun-4636

🇺🇸⚓️🐬

Cigar & BBQ enthusiast. Watch repair hobbyist. Sharpening my 🪚

HQ ATX.

🥶 📞 💬📧

pop>100K, MHP<$400K

Online now

Joined Oct 26, 2025

Bee Cave, TX

Powered by