Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Robert

The nationwide network for mortgage note investing: learn the best (and under-the-radar) way to profit from Distressed & Cash-Flowing Real Estate.

Memberships

81 contributions to Real Estate Note Investors

Merry Christmas & Happy New Year

Wishing everyone a great Holiday Season and a successful 2026! Take time to reflect on the good people in your life and what you're grateful for. Thanks to the group for making this a great educational page for us all to benefit from.

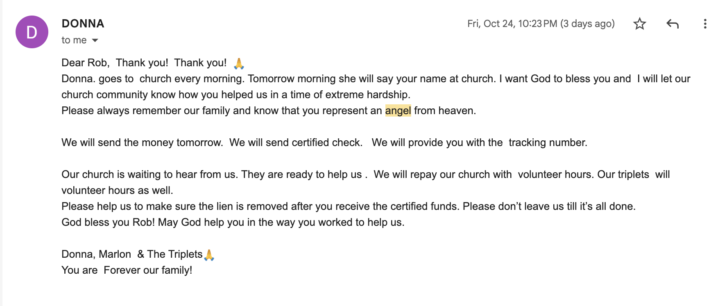

Borrower just called me an "Angel from Heaven" 👼

I helped one of our non-performing accounts negotiate a discounted payoff on Friday and received this glowing appreciation (email attached). It's pretty amazing how much we can impact our borrower's lives when we offer a little compassion & pass some of the discount along (this loan was bought very cheap because of the impact of AB 130 on 2nd liens in California). And even better - the client who I help close this deal for tripled their money on the deal 🤑

Are we connected on Linkedin?

Here's a hack to tap into a real network of real estate entrepreneurs - connect with me on Linkedin! 🌐 You'll become 2nd degree connections with the ~2,000 industry pros that follow me. All I ask in return? Like & comment on my latest post 👈 do it here pretty please 😅 Drop your profile link in the comments 👇 so we can all link up with you!

Judicial vs. Non

My question is for the states that actually have both judicial and non-judicial foreclosures. Are we typically going to get eyes in the documents in order to determine which one we are looking at before the bid process? And if that answer is a “no”, wouldn’t it be normal or expected that the bid would need to be lowered if the note is lacking a “power of sale clause”?

4 likes • 2d

Thanks @Joe Risinger - we try to provide all the loan docs during the indicative due diligence stage (the first week or so you have access to the portfolio to make your offers). Attached is a simple decision tree you can confirm with local counsel for how to proceed in states that allow both judicial & non-judicial foreclosure processes. Since the Mortgage/Deed of Trust/Security Instrument (the document that attaches the debt to the physical real estate) is recorded in the county record - you can generally get them straight from the county recorder's office (even if it wasn't available in the collateral images we provide) And as @Kareem Aaron stated, the awarded buyers will have a few weeks after accepted bids to verify & confirm in their final due diligence prior to funding.

1 like • 19h

@Joe Risinger tough to say precisely but going to be the difference between earning the same IRR (internal rate of return) within 1 year for non-judicial versus 2 or more for judicial. So you would essentially price them for the same “worst case scenario” (foreclosure and property sale) rate of return with the longer time frame accounted for. Have you used the XIRR() formula in Excel yet? #Due Diligence Overview

October Winner (Cash Prize - One Payment Partial)

Just recorded this short video congratulating the winner of our first 30-day contest and showing how note investing works in practice. This is the Paper Business and it's all about the actual collateral documents - watch the video below and learn a little about Notes, Mortgages, Assignments & Allonges. Congratulations @Iván Terrero for winning the contest this month! You've got $129.97 coming your way - a "one payment partial" so you can capitalize on a performing note deal. And for the rest of you, a new month starts tomorrow - participate in the community and get to the top of the leaderboard for our next 30-day contest - awarded on November 30th ~noon EST. Between now and then, have a happy halloween and go through the course so you have some great questions to ask in the morning :)

1-10 of 81

@robh

Making Distressed Real Estate Debt Investing Ethical, Accessible & Profitable. Helping borrowers, banks & real estate entrepreneurs since 2011.

Active 1h ago

Joined Oct 1, 2025

Philadelphia

Powered by