Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Business Builders Club

635 members • Free

Free Skool Course

14.9k members • Free

Real Estate Note Investors

640 members • Free

Scaling School

1.1k members • Free

6 contributions to Real Estate Note Investors

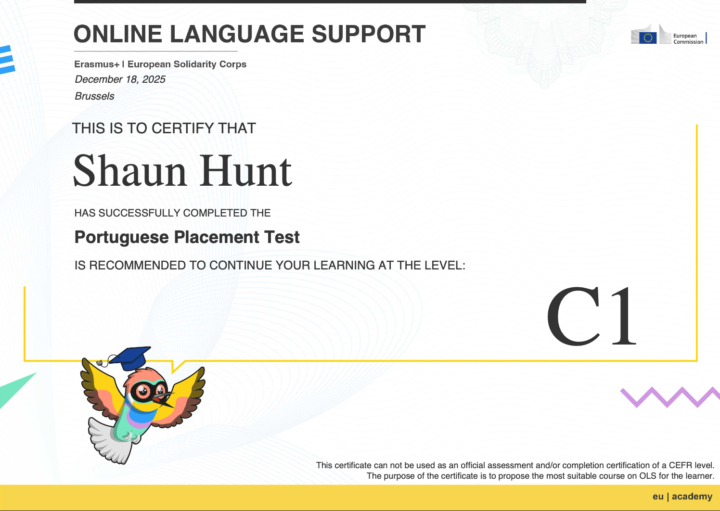

Climbing the Tower of Babbel

When I turned 18, I was faced with the sophisticated choice every American teenager is meant to make with extreme clairvoyance and levelheadedness. Go to college or Go to work In the contemporary professional climate, both choices are laden with their own respective risk. Over-qualification seems to be a phenomenon in the developed world, while higher education offers unparalleled social & educational development, it continues to be framed as the “safe bet” in the prevailing narrative. Influenced by my father's "get up & go" old school American bootstrap values, I decided take the road less traveled and get to work. I moved around the continental US for a while, exploring different career paths trying to find my place. I held a couple different jobs, I was: - a bouncer at a famous Jersey Shore nightclub - a Los Angeles mailroom clerk - a roadie for a Hasidic DJ for weddings in Brooklyn - a hillbilly carpenter - an assembly-line worker in a solar panel factory But after a while, I eventually got my "big break." At 21, I was hired as a junior project manager for a residential construction company in the upscale neighborhood of Rumson, NJ. I was making what felt like serious money at the time: $16.50 an hour. Very quickly in my new position, I realized that I had a lot to learn. I had some experience with woodwork & light electrical, but I was employed by a general contractor. I needed to know a little of everything to communicate between subs, keep track of projects, and be a point of contact for the homeowner. I had no particular edge, so I got to looking. I began to realize that (at least within the northern Jersey shore area) different cultures occupied different trades in the construction industry. It tended to loosely follow this structure: - Millwork & Finishing: Eastern European (Slavs, Poles, Slovaks) - Framing, Gypsum, & Roofing: Latinos (Mexicans, Guatemalans, Salvadorians) - Flooring: Brazilians - Masonry: European Portugueses - HVAC, Electrical, Plumbing, & Insulation: Americans

Intro

Grateful to be here. I’m a former bond broker with a background in distressed and non-performing fixed-income securities. I’ve long been drawn to the ABCs of investing: Assets Below Cost, and am now shifting from the securities world to become a private note matchmaker. I look forward to applying my experience with NPN restructuring to help move some paper and build solid relationships. Glad to connect with the group.

Introducing.....

Hi everyone! Excited to join the community. I’m a visionary thinker who already has a stable income stream in place, and stepping into property feels like the next big move. Looking forward to learning, growing, and connecting with like-minded people.

Closing first deal

Pretty excited guys I’m about to close my first deal as a matchmaker!

November Winner (Cash Prize - One Payment Partial)

Wow what a race we had this month for the top of the 30-day leaderboard!! October's winner @Iván Terrero & @Kareem Aaron were back & forth all month - with Kareem just squeaking out the win on the last day of the month (190 points to Iván's 187) Special recognition to @Jordan Adamczyk for the 3rd place with 45 points - nice work everyone! Kareem - check your email to share your Venmo/Paypal and get your "one payment partial" of $129.97. What is a one payment partial? One of the reasons mortgage notes are so powerful is their divisibility: you can split a performing, cash-flowing note into separate assets and sell ownership of current or future payments. Note investors use "Partials" (contract template here for VIP Accelerator members) to sell a slice of the future cash-flow of a mortgage note. For example, you might buy a non-performing note for $10k, modify it with the borrower for monthly payments of $300 for the next 7 years (84 payments) and then sell the next 48 payments (4 years) to an investor for ~$10k to recoup your investment. In 4 years, your buyer's partial payments will be over and you'll get the $300 per month again for the next 36 months (or until the loan is paid off). In this case, we're using a "one-payment partial" as a hands-on learning opportunity to give the winner of our 30-day leaderboard a monthly payment of $129.97 (the exact monthly payment of one of our modified loans that recently paid off). And how do you win it yourself in December? Don't be intimidated by the big numbers on the leaderboard! These totals reset every day to only reflect the last 30 days of activity. So if you start posting, commenting & participating today - you'll have a good chance of being the top of the leaderboard in 30 days!

1-6 of 6

Active 20h ago

Joined Oct 2, 2025

INFJ

Puyallup, WA

Powered by