Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

DeFi University

241 members • Free

10 contributions to DeFi University

🧠 Bittensor (TAO): The Decentralized AI Marketplace

Hey DeFi University fam! I've just completed an exhaustive deep dive into Bittensor (TAO), and what I found is a protocol that's creating something truly unique: a decentralized marketplace for AI intelligence that mirrors Bitcoin's scarcity model while incentivizing real AI development. Let me break down why TAO deserves your attention and how you can position yourself for what's coming. Bittensor TAO Interactive Web App 🎯 The Core Thesis: Why TAO Matters Bittensor is building the economic layer for decentralized AI. Think of it as: - Bitcoin's tokenomics (21M cap, halving mechanics) - Ethereum's smart contract flexibility - A marketplace where AI models compete for rewards The protocol uses something called Yuma Consensus - essentially a "market for truth" where validators stake TAO to vote on which AI models provide the most value. The more stake behind a vote, the more weight it carries. 📊 Key Metrics You Need to Know - Max Supply: 21,000,000 TAO (just like Bitcoin) - Current Emission: ~7,200 TAO/day (halving to 3,600 in December 2025) - Active Subnets: 118 specialized AI networks - Top Subnet (Chutes): Commands 7.87% of all network emissions 💰 The Money Flow: How TAO Economics Work Current State (Pre-dTAO) - 18% of emissions → Subnet Owners (define the rules) - 41% of emissions → Miners (provide AI compute) - 41% of emissions → Validators (verify quality) The Game Changer: dTAO (February 2025) This is where things get spicy. Each subnet will get its own Alpha Token with an AMM pool. Instead of centralized allocation, the market decides: - Stake TAO → Get Alpha Tokens - More TAO staked in a subnet → Higher emissions - It's literally "vote with your capital" The Virtuous Cycle: 1. Strong subnet attracts TAO stakes 2. Higher emissions fund development 3. Better product attracts more TAO 4. Repeat The Death Spiral Risk: 1. Subnet underperforms 2. TAO exits for better opportunities 3. Lower emissions = less development 4. Further decline

Two hypothetical scenarios involving our future with AI - 34min video and extremely important. Wow.

https://youtu.be/5KVDDfAkRgc?si=tSjDZZ_mYzXG9NQ0

Video on Oct 10th crash.

Hahah made my first video on the reasons why for the OCT 10th crash, very interesting! .enjoy the video! :))

The Ether Condor Strategy: A Market-Neutral(ish) Approach to ETH Yield Generation 🦅

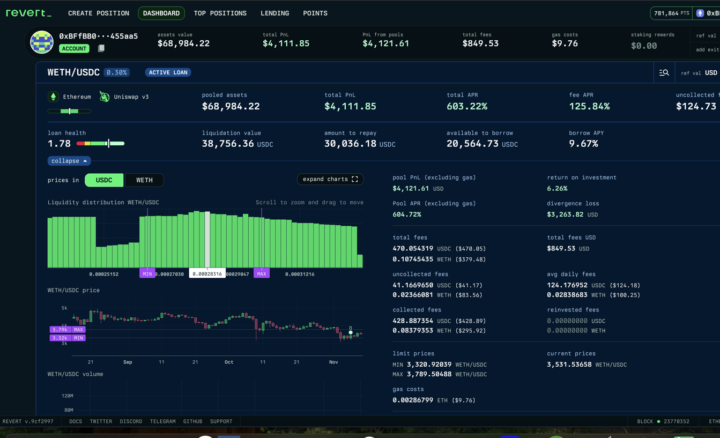

Hey DeFi fam! 👋 Today I'm breaking down an advanced strategy that combines concentrated liquidity provision with perpetual futures hedging - I call it The Ether Condor. Here's a calculator that shows all of the inputs, unfortunately the results section calculations don't work, but you can see all of the inputs for the strategy in one place. That makes it a bit easier to understand the strategy. Divergence Loss (Impermanent Loss) Research Strategy Overview 📊 This is a delta-neutral(ish) yield farming play that aims to harvest both LP fees and funding rates while minimizing directional risk on ETH price movements. The Setup (3 Steps) 🎯 Step 1: Deploy Your Concentrated Liquidity Position 💧 - Allocate 20 ETH to a WETH/USDC pool on Uniswap V3 (Ethereum mainnet) - Use the 0.3% fee tier - ⚠️ Critical: Set your range intentionally OUT OF RANGE (all in ETH) - This positioning is key to the strategy's mechanics Step 2: Leverage Your Position 💰 - Head over to Revert Finance - Borrow 40% of your LP position's USD value in USDC - This gives you working capital without selling your LP tokens Step 3: Create Your Hedge 🛡️ - Take 20% of your LP's USD value as initial margin - Open a SHORT perpetual futures position on GMX - Size = exactly the number of ETH you deployed in Step 1 (20 ETH short) The Math Behind It 🧮 Profit Conditions: Your position becomes profitable when: ✅ CLP Yield + Funding Rate Yield > Divergence Loss on the CLP Risk Profile: - 🔴 Maximum loss scenario: ETH makes a sharp move higher before your CLP fees have time to accumulate - ⏰ The key is that fees need time to offset any divergence loss from price movements Why This Works 💡 1. You're earning from two yield sources simultaneously (LP fees + funding) 💵 2. The short perp hedges your ETH exposure from the CLP 3. When funding rates are positive (longs paying shorts), you're getting paid to hedge 4. The borrowed USDC can be deployed elsewhere or used as additional buffer

0 likes • Nov '25

My mindset which I need to work on is when I see a big loss in the hedge and what to do with it if it says in the red..or having a plan not to stress me out..but I am assuming..the LP will be in the green. I really appreciate this strategy..its just I need to leaving it alone..to collect fees...hahaha thanks...:)

Historical patterns..we'll see

Just another place from a bird's eye view to see historical patterns play out.. :)

1-10 of 10

@nolen-edmonston-1862

Avid Crypto enthusiast for long time. Just on the path to learn more. Hopefully make $$ by end of the year. :)

Active 6h ago

Joined Oct 2, 2025

Powered by