Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Tinocode

1.8k members • Free

AndyNoCode

24.6k members • Free

Brendan's AI Community

21.6k members • Free

AI Automation Mastery

21k members • Free

The AI Advantage

64.1k members • Free

Data Alchemy

38.1k members • Free

Wealth Through Funding

211 members • Free

Eyes on Finances

129 members • Free

Finance with Mark

46 members • Free

27 contributions to Energy Data Scientist

Data Science + ML + Optimisation Careers

Can you share some combinations of Online Courses to take, for the career pathway of Data Science for Energy and/or ML for energy and/or Optimisation for energy?

New video on Quantitative Finance (Energy/Oil): Risk Free Rate

In the Classroom, a new video has been added to the online course 5.20. This is a quantitative finance (energy) course with a focus on Option Contracts for crude oil. This video explains the concept of risk free rate in this context. We need to learn what the risk free rate is because later in the code (in a future video) we will use the risk-free rate for finding the price of the option contract. Every option contract has a 'price' which is known as the 'premium', which we evaluate (later on) using Black Scholes. An input parameter in Black Scholes is the risk-free rate. The video explains that to find the risk-free rate we need to first check what our Option Contract is priced at. So, it is priced in US dollars because the Crude Oil is priced in US dollars. Therefore we look at the United States. Then we need to find the time-to-maturity. In our case, the Option expires 1 month from today. This is the example in our code. With this information , we use our financial source like Bloomberg. And we check the 1-month yield of the U.S, Treasury Bill. The US Government has zero risk of default (going bankrupt). Ofcourse In the real world, nothing is truly zero risk. But this is the assumption, which is widely accepted in finance. A numerical example explains what our return will be one month after we invest in this zero-risk investment vehicle.

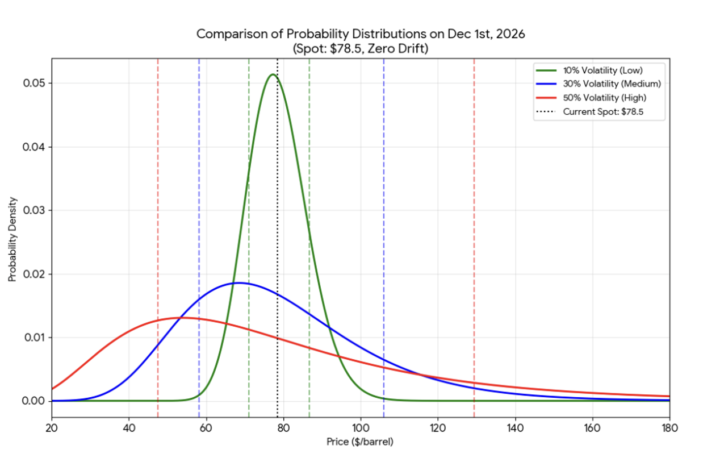

New Video: Volatility in Option Pricing for Crude Oil

A new video has been uploaded in the Online Course 5.20 in the Classroom. This course focuses on option contracts for crude oil, where the underlying asset is the spot price. An option contract is signed between two parties/ companies . Every option contract applies to an asset . This asset is known as “underlying”. So this course is about option contracts that have the crude oil as their underlying asset. The company that owns the option contract can exercise it until it expires. There is no obligation to exercise it. This is why it is called “option contract”. The company will exercise it only if it makes economic sense ie if it makes a profit. The video focuses on the “volatility” concept of option contracts . The video explains that the spot price of crude oil follows a probability distribution called : lognormal distribution. The attached plot, explained in the video, visualizes this concept. It shows how higher volatility (the red line) creates a much wider range of possible spot price outcomes compared to lower volatility (the green line). So a higher volatility means that in the future , the spot price of crude oil is more uncertain than if the volatility was lower. So volatility is similar to uncertainty . And it is visualized as a probability distribution that is wider. This plot shows the spot price of crude oil one year from today. One year from today this price is uncertain . The spot price of oil follows the log normal distribution . This distribution has a different shape depending on the volatility . Here we look at values for volatility of 10%, 30% and 50%. This is a fundamental plot and analysis for any quantitive finance / energy career . This specific plot has been part of multiple interviews for years . This plot is analyzed in the video using simple language. If you have any questions please contact me. I want this concept to be as clear as possible .

🚀 AI Engineer Seeking New Collaboration

Hi everyone, I am excited to join this community. I’m an AI Full-Stack Developer specializing in building scalable, intelligent applications powered by modern AI technologies. I’ve worked across the full product lifecycle — from system architecture and backend development to frontend interfaces and AI-driven automation. I’m currently looking for new opportunities where I can contribute my expertise in: - AI integration & LLM-powered applications - Full-stack web & mobile development - Automation, agents, workflows, and system design - MVP development and rapid prototyping I’d also love to collaborate with US-based professionals and teams working on innovative products and forward-thinking AI initiatives. If you’re building something exciting in AI, SaaS, or automation, I’d love to connect. 📌 Portfolio: https://oleksandr-zamrii.vercel.app/ 📌 Linkedin: https://www.linkedin.com/in/oleksandr-zamrii-3a6496361/

Hello everyone! I'm new here.

Hi everyone, I’m a Senior Software Engineer with over 10 years of experience in the IT field. I’m currently working with a U.S. based client, focusing on building scalable and high-performance web applications. I’m excited to be here and look forward to connecting and learning with you all.

1-10 of 27

Active 12h ago

Joined Sep 23, 2025

INFJ

USA/Boston