Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Million-Dollar Trading Trial

328 members • Free

Win Academy

153 members • $47/month

Trading Fanatics

10.8k members • Free

Real Men Real Style Community

13.4k members • $9/month

SaaS University (GoHighlevel)

6.9k members • Free

The Trading Cafe

75.3k members • Free

Pip Munch

9.5k members • Free

Emerton FX (free)

3.4k members • Free

The Traders Club

1k members • Free

23 contributions to Trading Growth Engine

🚀 Next Wave of Gextron Invites Sent — Claim Yours by EOD

Quick heads-up. I just sent out the next set of Gextron invitation codes via Skool DM. These codes will be reassigned after today if unused. What to do now 1. Check your Skool DM for your code & instructions 2. If you didn't get a code but want one, drop a comment below (will be using this post a reference for the next set of invitations) Reminder: I'm hosting a Gextron training demo tomorrow @ 8PM EST on Zoom. Come see the workflow, ask questions, and get set up live. See you there!

Timing Is Everything in Trading

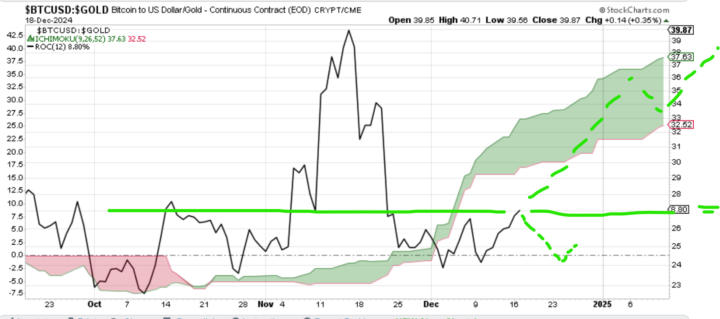

I never realized how important time is in this business. Some days the market felt like a snail, and other days it was lightning fast. The more I observed, the more I noticed patterns tied to timing. Turns out, time isn’t just important—it’s everything. Even in crypto, where the market never sleeps, understanding time has been a game-changer for me. Here’s what I’ve learned: The Phases of the Market Markets don’t just move randomly—they go through phases like accumulation, manipulation, and distribution. Spotting these stages isn’t just helpful; it’s essential. For instance, during accumulation, the market is like a quiet pond—calm, slow, and unassuming. Then comes manipulation, a stormy phase where volatility spikes and liquidity is taken. And finally, the distribution phase—where the big players exit, and everything seems to shift again. Trading Sessions Matter ever noticed how different the market feels at the open and close of trading sessions? When sessions overlap, like the New York-London overlap, volatility goes through the roof. For crypto traders like me, even global time zones play into market activity. Understanding session timing has been a game-changer. Timing for Your Style Whether you’re scalping those micro-moves, day trading the daily swings, or holding positions for weeks, your approach to time matters. Scalpers thrive on session opens. Day traders find opportunities mid-session. Swing traders know when weekly volatility peaks. Position traders? They’re timing macro trends and letting the rest play out. Times of High Volatility The market’s heartbeat is loudest during specific times—session opens, news events, or even the close. Knowing when these windows occur isn’t just about spotting opportunities—it’s about managing risk. As traders, we often focus so much on price that we forget to respect the clock. But time is as much a part of the equation as price and volume. Understanding how and when the market moves has changed the way I trade. Were you familiar with how much time impacts trading?

The Trading Symphony: Which Note Do You Play Best?

Trading is like climbing a staircase – each step is a lesson, a tool, a strategy waiting to be mastered. And the higher you climb, the clearer the view of the market becomes. Here’s the thing: understanding the market isn’t just about reading charts or spotting patterns. It’s about piecing together an entire puzzle. At every step, you’re adding a new piece: - Tools and Indicators: What helps you see the market’s heartbeat? - Trading Plan: Your roadmap for consistency. - Trading Journal: Your personal feedback loop, where every trade has a lesson. - Trading Psychology: How do you keep your emotions in check during the wild swings? - Trading Schedule: Are you consistent in showing up to the market? - Instrument Selection: Are you trading assets you understand and resonate with? - Strategy and Rules: Are you sticking to what works and cutting out what doesn’t? Trading is truly a symphony – with so many components working together to create harmony and understanding of the market’s possibilities. For me, drawing the chart is my favorite part. It’s where creativity meets strategy and where the story of the market unfolds. What about you? What part of trading is your favorite? Is it analyzing the charts, perfecting your strategy, journaling your trades, or something else entirely? Let’s hear your thoughts and make this journey together even more enriching! Let’s share and grow together – because every step up this staircase becomes easier when we lift each other up. Drop your thoughts below! 👇

1-10 of 23

@manuel-gomez-2739

Greetings, I'm Manuel, a new trader focused on Crypto and Futures. Learning PA, SMC, ICT, and eager to master advanced tools. Excited to connect!

Active 1d ago

Joined Dec 6, 2024

Toronto, Canada

Powered by