Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

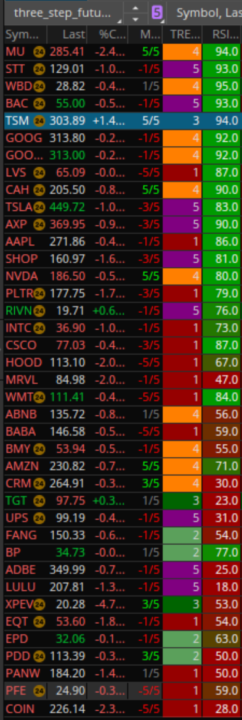

Free Swing Trading Watchlist

118 members • Free

267 contributions to Trading Growth Engine

Weekly Income Trade Recap

Weekly Income Trade Recap – TSLA & XOM Put Writing Strategy Week ending January 30, 2026 This past week was relatively quiet for me in terms of trading activity. I executed just two trades, both designed for conservative income generation through cash-secured put writing. Here's the breakdown: Trade 1: TSLA Cash-Secured Put Underlying: TSLA Trade Date: Tuesday, Jan 27 Expiration: Friday, Jan 30 Strike: 400 Premium Collected: $2.95/share Return on Risk: 0.74% in 3 days Why TSLA 400? TSLA was in pre-earnings mode with elevated implied volatility and strong gamma dynamics. The 400 strikes had the highest open interest (OI 18,675) and volume (24,169 contracts) on the put side — a clear indication of market maker positioning. Gamma exposure was heavily skewed to that strike (approximately -820, nearly 2x higher than surrounding strikes), meaning dealers had significant incentive to defend it. TSLA had been in an uptrend since the last earnings report, and although Tuesday saw a short-term decline, the 400 level was a probable support zone. I sold the put near the 9:30 AM retest of that level. With an ATR around 10–12, TSLA would have needed to drop 2–3x ATR (~$36+) in 3 days for my position to be challenged — a risk I was comfortable with. Even if assigned, I'd be willing to hold TSLA at $400. Trade 2: XOM Cash-Secured Put Underlying: ExxonMobil (XOM) Trade Date: Monday, Jan 26 Expiration: Friday, Jan 30 Strike: 130 Premium Collected: $0.50/share Return on Risk: 0.40% in 4 days Why XOM 130? XOM was trading around $136 and had strong bullish momentum YTD, supported by positive analyst sentiment (year-end targets between $140–150). The 130-strike had decent OI (~6K contracts), while the 135 strikes had significantly higher OI (~13.7K contracts), offering what I considered a protective buffer zone. The stock's volatility was elevated, historically speaking, which enhanced premium collection. Even if assigned, I viewed 130 as a desirable entry price, especially with the upcoming dividend of $1.03/share providing additional income potential.

Trade plan for Friday

TRADE PLAN for Lotto Friday SPX managed to defend the 6900 support after the gap up this morning. If SPX gets through 6945 we'll se a push towards 7000. SPX Jan 23 6940C can work above 6915 tomorrow MU if it can get through 400.. 420 coming next week. MU to 500 in play this year. MU Jan 23 405C can work above 400 TSLA close to a bigger breakout on the daily chart. TSLA to 474-480 in play if it can close above 450 tomorrow. TSLA Jan 23 455C is best above 450 Good luck tmrw everyone!

Introduction

What’s up TGE crew 👋 I’m Jordan, checking in from Northern California. I’m here for one reason: I’m obsessed with the intersection of AI, automation, and trading discipline. I’m not chasing dopamine candles, I’m chasing repeatable systems that remove emotion from the equation. Background-wise, I’m a student with a heavy interest in psychology, behavioral patterns, and how humans consistently sabotage themselves in markets. That naturally pulled me toward AI-driven strategies, bots, and rule-based execution. Let the machine stay calm while the market throws tantrums. Trading-wise, I sit in the swing trader / system builder lane. I care more about edge, probability, and execution quality than prediction. If a strategy can’t be automated, stress-tested, and survive bad weeks, I’m not interested. What I like about trading: • Turning chaos into structure • Letting data tell the truth • Watching boring systems quietly outperform flashy guesses Here to learn, test, break things, rebuild them smarter, and collaborate with people who take this seriously without taking themselves too seriously. Looking forward to leveling up inside TGE 🚀 — Jordan 🐵📊

1-10 of 267

@manj-dona-1959

We ( Shan & Dona) Help Entrepreneurs create their online brand assets. Let's build your brand!

Active 6h ago

Joined Nov 16, 2024

Thompson

Powered by