Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

BNB MADE EASY

208 members • Free

Wealth University

3k members • Free

Private Wealth Global

131 members • Free

Conscious Business Accelerator

18.4k members • Free

49 contributions to Wealth University

Suggest you DON'T Miss this Weekly Wealth Strategy - Understand the financial lingo - CRITICAL for anyone who wants to be an Investor!

Dear Wealth University members As we move into the festive season, I want to share a gift with you. Every Friday, we run our Weekly Wealth Strategy session, where I focus on adding real value and helping you build the mindset and skill set of an investor. At the moment, we are working through the Wealth Transformation Pack, and today we had a fascinating session on Investor Language – the acronyms, the terminology and the lingo that every investor needs to know if they want to invest with confidence. Many of you are not yet part of Wealth Hackers or the Mastermind, which means you cannot join these sessions live. I want to give you a window into the experience and the depth of insight you receive when you are part of the paid community. So here is my gift to you. You will find below an hour-long recording from today’s session that goes deep into investor language and how to think like an investor. I have also attached a white paper that you can read and use as a reference guide. These two resources may give you clarity, confidence, and that “aha moment” that moves you forward on your journey. What I would ask in return is simple: 1. Leave a comment in the group once you have watched or read it. Let me know your thoughts, your key takeaways, and what stood out for you. Your feedback helps us learn how to serve you better. 2. If this resonates with you and you want to be part of these sessions live as we head into 2026, consider joining Wealth Hackers or the Mastermind. You can watch recordings all day long, and they are valuable, but it is never the same as turning up live, asking questions, interacting, and shaping the session with your input. Join Wealth Hackers to join live - https://www.skool.com/wealthhackers/about Enjoy the gift, and thank you for being part of Wealth University. Warm regards Scott and the Wealth University Team

5 likes • Dec '25

Thank you Santa Scott - as usual you have the biggest heart and offer the greatest value. This is very appreciated and I'll start working my way through this PDF with Kai soonest. Best wishes to you and your family for a joyful Christmas and also to everyone at the WU and Wealth Going Global Team. Love Lecia and Kai

🌟 Top 5 Reasons People Become Extremely Successful

1. Relentless Consistency Successful people show up every day—especially on the days they don’t feel like it. Small, repeated actions compound into massive results over time. 2. High Personal Standards They set the bar high for their habits, work quality, and behavior. Mediocrity simply isn’t acceptable to them. 3. Resourcefulness Instead of waiting for opportunities, they create them. If they lack money, knowledge, or connections, they find a workaround. 4. Extreme Ownership They don’t blame circumstances, people, or luck. They act like everything is their responsibility, which gives them full control over their outcomes. 5. Long-Term Focus They make decisions for the future, not for momentary comfort. They think in years and decades—not days.

1 like • Nov '25

@Natalie Date Chong wonderful - I was chatting with my mom yesterday and we were saying how different I am in this respect to my brother - he first sees obstacles and then doesn't pursue things - whereas I always think - there must be a way to solve this or get this to work for me. Sometimes I do dive in head first but I'd like to think that now that I'm a bit older and wiser (fingers crossed) I tend to check if there's actually water in the pool before I dive in! haha

This is our last live event for the year

Discover the 5 fundamentals the world’s wealthiest investors use to grow and protect their portfolios — from trend analysis and risk management to structuring and global diversification. You’ll learn: The diversification principles that can 5× your returns while cutting risk by 80 % Use the link below to register https://www.diversificationmasterclass.com/register

5 likes • Nov '25

You guys have achieved incredible outcomes this year - sorry we will be missing this one - but we have done Diversification 5.0 a few times so now it’s a matter of implement - implement - implement 😃 Thank you @Alex Oosthuizen for all your amazing service to this community alongside Scott and the rest of the team.

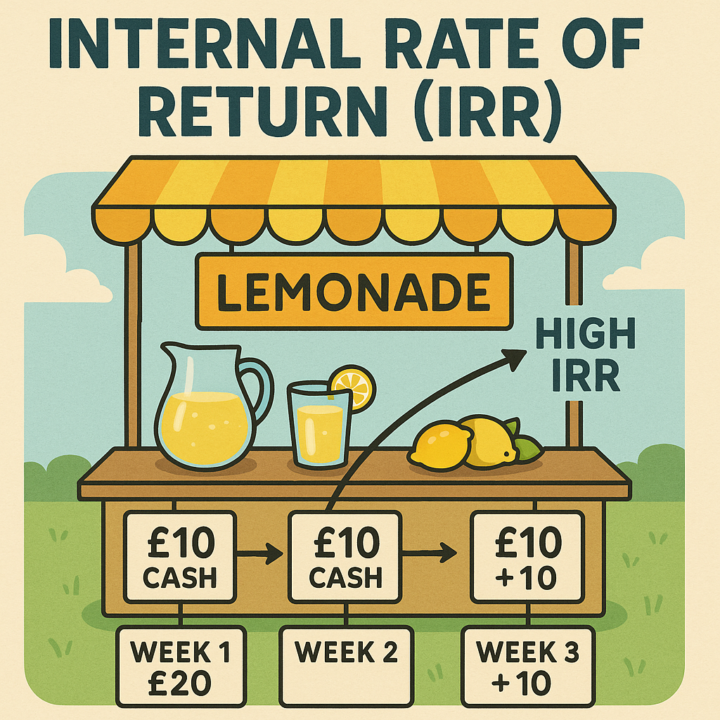

'IRR explained simply with basic analogies for kids, grandkids & newbies'

Hi friends...after the weekend I realised that if sophisticated investors are also wrangling with fully grasping IRR then I needed to simplify it right down...then Scott said, 'Simplicity is the ultimate sophistication' so that gave me the courage to share this VERY SIMPLE example which really helped me. Most of us were taught IRR backwards — through jargon, formulas, and technical explanations, instead of everyday intuition. We hear words like *discount rate*, *net present value*, *capital efficiency*, *time-weighted returns*… and it feels like trying to grab smoke. But here’s the truth: 💡 **IRR isn’t actually a complex concept — it’s a simple idea that’s been explained in a complicated way.** So I started breaking it down using simple everyday analogies — not to patronise anyone, but to finally make it click. And I want to share that with you here. 🍋 The Lemonade Stand Analogy (surprisingly powerful) Imagine you spend £20 today to set up a lemonade stand. Then over the next three weeks you receive: Week 1 **£10** Week 2 **£10** Week 3 **£10** Forget “profit” for a moment. IRR doesn’t look at profit. It looks at **cash coming back**. That’s it. IRR asks: “How fast did my £20 *return to me*, and how quickly did it start growing beyond that?” It’s simply a speedometer for money. * You get half your money back in the first week * All your money back in the second week * And profit begins in the third That makes the IRR surprisingly high — not because this is an amazing business, but because the cash comes back quickly. And that’s exactly what IRR measures. 🍦Now swap lemonade for an ice cream truck… * Initial cost: **Money out** * Weekly sales: **Money in** * Timing: **Early money counts more than late money** Suddenly the same IRR logic applies. 🏢 And now swap lemonade for a property syndication deal… * Acquisition cost = **initial cash out** * Rental income = **cash inflow** * Operating expenses = **cash out** * Refinancing / sale / distributions = **cash in**

Workshop - Know your numbers - 2025

Dear Scott Accolades to you, Alex, Diane & the Wealth Migrate team. Remarkable effort & energy expended by all. Wow what an incredible practical hands on learning session you facilitated this past weekend, 15 & 16 November 2025. Thank you for sharing your expertise and making the topic so engaging and informative. Your passion and energy really made a difference, and I walked away feeling inspired and equipped to apply new skills. Great job, and thank you again for an amazing life long insightful value added experience!" 😊. I can reassure you my sentiments are shared by the rest of the community who attended🙏. Cheers

2 likes • Nov '25

@Bhagwandas Chibba this really means so much to me Chibba- I was concerned that some might find this patronising and I was nervous to share. Thank you for the encouragement. I’d also love to explore Monaco! I’m going to start a podcast next year to do with Visa Free Holidays for South Africans inspired after our recent trip to Georgia (the country) which was absolutely incredible and the best part was hanging over our passport and within less than a minute being welcomed into their beautiful country. First time I’ve experienced this in my entire life and feel more South Africans should feel this and explore other options outside the usual ☺️

1 like • Nov '25

@Henk Swanevelder hi Henk. Yes, I needed to understand IRR as simply as possible so I asked Chat Gpt to explain it to me like I was 12 and give me simple everyday examples like a lemonade stand or ice cream truck… I’m a kid on the inside. When I received answers I asked deeper questions and as the penny started to drop I started understanding the fundamental reason why IRR was so important to investors and when I shared my insights with ChatGPT it agreed with me, which was fun! I asked it to create graphics for me to better portray the concepts visually and I asked it to compare the basic analogy to a more complex sophisticated investor model side by side. I realised that if people are not understanding financial jargon… you need to give it to them in simple English. I’m glad you enjoyed it. My brain came up with IRRational and IRResistable because I like easy ways of learning and remembering. I think the pictures explain very well. 🙏🏻

1-10 of 49

@lecia-broughton-3617

Life learner, visionary connector. Skilled in communication, collaboration & engagement. Proactive in spotting opportunities, adapting & upskilling.

Active 20d ago

Joined Jul 25, 2024

Powered by