Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

NoCodeDad

76 members • $19/m

Milos Crypto Academy (Free)

244 members • Free

Degen Dads

120 members • Free

26 contributions to Degen Dads

Bull vs Bears Clash as Bitcoin Desperately Tries to Find Support!

Right now were in a classic bulls vs bears market with bears currently winning the tug of war but how long will it last? We could possibly see Bitcoin bounce of $92k following by and end of year rally but Bears have another plan as major Bitcoin OG's are rotating out of Bitcoin as they possibly try to scoop it up at lower prices. However the global supply of money and money printing has ramped up and the Fed has indicated an end to QT in December. We could possibly see the market ramp back up as we move forward to the end of November and as we get closer to Congress possibly passing the digital asset market clarity act before Thanksgiving. This is the perfect time to figure out a strategy like DCA or simply do nothing and let the market decide the next clear trend before you make a trade. Either way its a day by day type of market and also paying close attention to major drivers of macro economics like tariffs, trade and Congress right now.

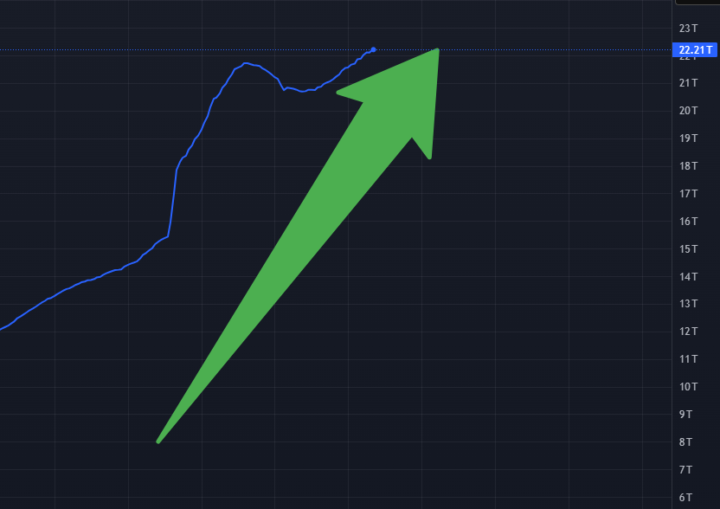

Bitcoin is STILL Bullish End of Year? Here's Why!

Long term holders of BTC seems to be selling while new buyers are entering at the moment. It has caused choppy sideways action. Once sellers and traders are exhausted from selling I believe we should see Bitcoin continue its late end of year rally. End of year remains one of the strongest for crypto performance historically speaking. Investors like Tom Lee from Fund Strat is still calling for a possible $150-200k Bitcoin end of year as well. Furthermore we see an increase of liquidity into the US and global economy when we look at the supply of money or "US M2" or Global M2 charts. This is usually a good indicator to watch in terms of how Bitcoin might perform in the coming weeks. So despite the short term sell pressure I think we finish the year quite strong. Here is a chart of the US Money Supply (US M2) hitting an all time high and we should see it hit even higher levels through the end of the year with the Fed cutting rates twice already and possibly a third time.

Tired of the sideways action?

Condensed Breakdown — “The Distress Is Real” Market Snapshot (as of November 2025) - S&P 500, Nasdaq, Gold: all near record highs; risk-on sentiment is strong. - Bitcoin: stagnant, diverging from traditional risk assets. - Key question: Why isn’t BTC rallying despite bullish macro conditions? Core Thesis - Bitcoin isn’t “broken.” It’s entering a distribution phase—similar to a traditional IPO, where early holders (whales) realize profits and new investors accumulate. - This phase causes sideways price action, even in strong markets. Supporting Evidence - Broken correlation between BTC and Nasdaq since Dec 2024 (see divergence graph). - Old wallets activating: dormant BTC from early years are moving gradually—indicative of controlled exits, not panic selling. - $9 B Galaxy Digital sale for a single client shows large, patient profit-taking, not liquidation. - Sentiment collapse across social media and the Fear & Greed Index mirrors post-IPO fatigue (see sentiment graph). - Bitcoin ETF inflows and strong network fundamentals contradict any bear market narrative. Market Psychology - Early believers (miners, cypherpunks) are finally liquid—able to sell without crashing price due to ETF and institutional demand. - Selling into risk-on liquidity is strategic. - New holders (institutions, funds) are accumulating slowly on dips. Cycle Comparison - Mirrors Amazon (1999–2001), Google (2004–2006), and Facebook (2012–2013) post-IPO consolidations. - Ownership transfer → volatility reduction, market maturity, and institutional stability. Implications - Consolidation window: roughly 6–18 months from Dec 2024; likely ending mid-2025 to early 2026. - Volatility moderating: 80% drawdowns shrink to 30–50%. - Long-term bullish: distribution = maturation; wider ownership = resilience. Conclusion - The OGs are exiting; institutions are entering. - Bitcoin’s “IPO moment” is nearly complete. - What follows isn’t decline—it’s graduation into a stable, globally integrated monetary asset.

New laptop or PC

What's up community, I have decided that I want to buy a separate laptop specifically for all things web 3 that will be completely separate from my current laptop that I have a lot of other important things on. Would you guys recommend a new laptop or investing in a PC setup? I hope to dive pretty deep into web3: finding work, building Dapps, and interacting with different blockchains so I'd need a decently powerful device. Any thoughts or advice would be appreciated.

2 likes • Oct 17

A lot of ppl have a separate laptop. But I always recommend a hardware wallet (cold wallet) for best security like a ledger for example. If you're using a separate laptop I don't recommend using the internet otherwise or it kind of defeats the purpose. But if you want to have a minimal set up just for crypto that is fine but be sure to still have a cold wallet like a ledger or tangem that you use with it to secure you big bags.

1-10 of 26