Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

DeFi University

159 members • $97/m

7 contributions to DeFi University

The Pendle Point Printer

Something I have been cooking up with the help of AI. Take a look and let me know if I am missing something: 💥 “The Pendle Point Printer™” Zero-Delta. Zero-Leverage. 10–40X Point Efficiency. Works With $50–$500. The most capital-efficient Pendle points strategy that almost nobody is running correctly. 🔥 WHAT IS THE PENDLE POINT PRINTER™? A PT-dominant split–merge loop that: ✔ Earns Pendle points from every action✔ Costs pennies on Base / Mantle✔ Requires no hedge✔ Requires no YT exposure✔ Can be scaled from $50 → $5,000✔ Produces 10–40X more points per dollar than passive LPs✔ Is completely safe and cannot liquidate you This is the closest thing to a risk-free Pendle points exploit that still follows every rule. 🧬 THE INNER MECHANISM You earn points for: - Buying PT - Holding PT - Splitting PT → PT + YT - Swapping YT → PT - Merging PT → Asset This loop hits every scoring multiplier without exposing you to yield-token volatility. YT exists only for seconds (if that). You always end each loop holding 100% PT. 🛠️ THE FULLY OPTIMIZED LOOP: Step-by-Step PREP (Base Chain recommended) Start with: - USDC - Gas buffer: 0.002–0.003 ETH on Base - Gas buffer: 1–3 MNT on Mantle Recommended markets: 1. PT-stETH (short maturities, 15–90 days) — BEST 2. PT-weETH 3. PT-mETH or PT-ezETH on Mantle These have: - deepest liquidity - highest Pendle score multipliers - tightest spreads - cheapest slippage - highest rolling APY - 🚀 THE LOOP (The Pendle Point Printer™ Method) 1. Buy PT (Principal Token) Size: $25–$200 per buyThis action gives you: - PT buy points - PT hold points - Trade/volume points 2. Split PT → PT + YT You now temporarily hold YT, which triggers: - Split points - Additional volume points YT exposure is held for only a few seconds → no hedge needed. 3. Swap 100% of the YT back into PT Use the “swap YT → PT” route: You earn: - YT volume points - PT buy points - Trade score - Fee generator score - Market health boost score

0 likes • 14d

@David Zimmerman I am looking at USD Midas for blended point exposure (including some lighter point), sENA (blended exposure including sats), and degen multipliers (ibgt, x33, AIUSD, etc...). I need to do more research on the LRT/LST assets as they accrue protocol and pendle season points. If I make the choice to be on Pendle all day, I might just do all of them based on how close to expiry I can buy. It would probably give me the greatest velocity of capital. I had chat query the Pendle API for active programs. I haven't vetted them all but here is what it returned: (1) LBTC — Lombard (2) iUSD — InfiniFi (3) alUSD — Almanak (4) mFARM / mUSD — Midas (5) rsETH — KelpDAO (6) weETH — EtherFi (7) eETH — EtherFi (8) ezETH — Renzo (9) USDe — Ethena (10) sUSDe — Ethena (11) srUSDe — Strata x Ethena (12) USD0++ — Pills / USD0 ecosystem (13) csUSDL — Coinshift (USDL) (14) hakHYPE — Harmonix (HyperEVM) (15) hbUSDT — Hyperbeat (HyperEVM)

Nvidia perp live on Hyperliquid

Flood on X: "NVDA-PERP live on Hyperliquid. The first ever truly permissionless perpetual swap on single name equities in Crypto. The most important company in the world, trading on the most important exchange in Crypto. Hyperliquid https://t.co/q9xyLxhzOu" / X 40% funding rate if you are short.

🎯 The Perps DEX Airdrop Quantitative Farming Framework

The old days of blindly farming points and hoping for a good FDV are over. Based on our comprehensive research across multiple EVM perpetual DEXs, we've identified a critical bifurcation in the market that every DeFi farmer needs to understand. Here's what's shifting in Q4 2025 and how we're positioning ourselves to capture the new alpha. Calculator 📊 The Bifurcation: Old Meta vs New Alpha Old Meta (Avoid): • Farm points with unknown future value • Guess at FDV and conversion rates • Examples: Variational, EdgeX • The Problem: You're spending real capital (gas, fees, time) chasing imaginary rewards while competing in a "dilution treadmill" 💸 According to our "EVM Perps DEX Airdrop Valuation Research," Variational's volume-share model shows why this is broken: you can track your volume perfectly, but with no way to price the future $VAR token, you're essentially gambling on FDV. New Alpha (Focus Here): • Only farm campaigns where rewards are priceable NOW • Two models that work: - MIV (Market-Implied Value): Points trade OTC for cash today 💰 - PRP (Priced Reward Pool): Fixed token allocations with live market prices 📈 🏆 Top Opportunities Ranked 1️⃣ Aster (Multi-Chain) - HIGHEST PRIORITY • Pool Value: $134.4M total ($22.4M per epoch) • Why It's #1: Epoch-based design = less dilution fatigue • Strategy: Focus capital per epoch, hedge ASTER exposure • Formula: Your Points ÷ Total Epoch Points × 20M ASTER × Price Per our "Perpetual DEX Airdrop Value Framework," Aster's epoch structure creates a "level playing field" where new farmers can enter mid-campaign without facing months of accumulated dilution. 2️⃣ Avantis (Base) - STABLE DEPLOYMENT • Pool Value: $20-30M floating (40M AVNT allocation) • Duration: Through Feb 28, 2026 • Strategy: Long-term XP farming with AVNT hedge • Risk Management: Short AVNT perps to lock USD value 🔒 Our analysis shows Avantis represents a "marathon farm" with quantifiable value - the 4% token allocation creates real-time pricing visibility.

1 like • 24d

Snapshot Day Clarification: Unless a specific date or “end of season” snapshot is listed in the chart, all snapshot days refer to weekly recurring snapshots on that weekday (e.g., Paradex → every Friday, Extended → every Tuesday, etc.). - “Weekly” means that each DEX typically records open interest and trading activity once per week at that day’s UTC cutoff. - If a one-time snapshot is noted (e.g., Blum – June 7 2025 00:00 UTC or Avantis – Feb 28 2026), that is an end-of-season or single snapshot for token distribution. - Keeping positions open through that DEX’s snapshot time is generally required to qualify for weekly point credit.

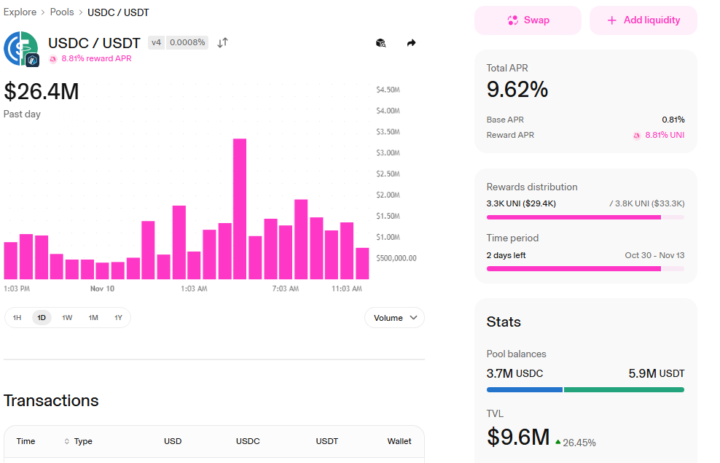

Uniswap News from November 10 2025

Uniswap’s “UNIfication” proposal is a token-value reset. - Activate protocol fees and route them to a perpetual UNI burn—plus a one-time ~100 M UNI retro burn to close the historic value gap. - MEV Protocol Fee Discount Auctions (PFDA): auction fee discounts to internalize MEV and deepen LP returns. - No more front-end fees (Labs UI/wallet/API) to push usage on the open protocol. - v4 “aggregator hooks”: turn Uniswap into an on-chain aggregator that can collect fees from external liquidity, expanding revenue surface. - Why it matters: This is the long-awaited path to direct value accrual for UNI holders—aligning protocol usage with token economics and widening revenue via MEV capture + aggregation. If passed, UNI becomes structurally deflationary while LPs may see stronger economics from PFDA. @David Zimmerman I would be interested in your thoughts on what a reasonable Mcap would be relative to the fees they generate. From an investment banker friend of mine: "Today on November 10th, 2025, Hayden Adams - the CEO of Uniswap - put forward a proposal to “turn the fee switch on.” The most salient points here: 1. 1/6 of future v2 fees & 1/4 of future v3 fees to go toward burns 2. all sequencer fees to go toward burns 3. to compensate for a lack of fee switch in the past, 10% of UNI (currently held by the Foundation) to be burnt on the spot To date, v2 and v3 have earned ~$2B and ~$3B in fees to-date. Therefore, at the flagged rates above, that would compose ~$330M and $550M respectively of retroactive fees to token-holders (will simplify here and assume burn = buybacks) - therefore, at today’s price, point 3) is quite fair in terms of “making UNI holders whole.” In regard to valuation as a derivative of fees shared with token-holders, we will adjust for a common heuristic which we believe is mistaken: using upfront “annualized” fee numbers at face value." The UNI token is being used as an incentive for some pools. the USDC/USDT pool on ARB only has 2 days left before incentives reallocate however, it is a good representation of incentives.

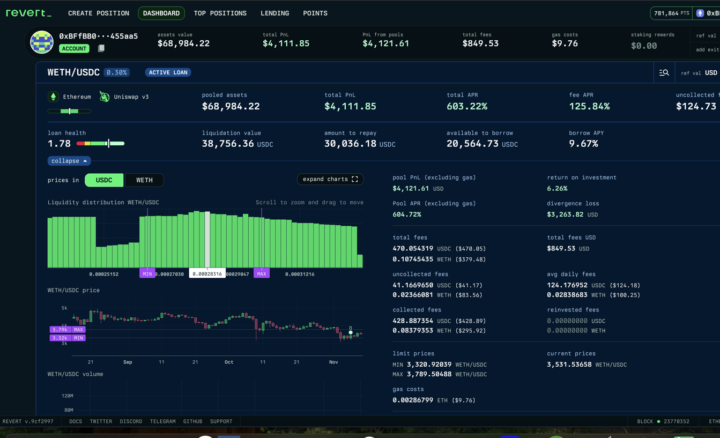

The Ether Condor Strategy: A Market-Neutral(ish) Approach to ETH Yield Generation 🦅

Hey DeFi fam! 👋 Today I'm breaking down an advanced strategy that combines concentrated liquidity provision with perpetual futures hedging - I call it The Ether Condor. Here's a calculator that shows all of the inputs, unfortunately the results section calculations don't work, but you can see all of the inputs for the strategy in one place. That makes it a bit easier to understand the strategy. Divergence Loss (Impermanent Loss) Research Strategy Overview 📊 This is a delta-neutral(ish) yield farming play that aims to harvest both LP fees and funding rates while minimizing directional risk on ETH price movements. The Setup (3 Steps) 🎯 Step 1: Deploy Your Concentrated Liquidity Position 💧 - Allocate 20 ETH to a WETH/USDC pool on Uniswap V3 (Ethereum mainnet) - Use the 0.3% fee tier - ⚠️ Critical: Set your range intentionally OUT OF RANGE (all in ETH) - This positioning is key to the strategy's mechanics Step 2: Leverage Your Position 💰 - Head over to Revert Finance - Borrow 40% of your LP position's USD value in USDC - This gives you working capital without selling your LP tokens Step 3: Create Your Hedge 🛡️ - Take 20% of your LP's USD value as initial margin - Open a SHORT perpetual futures position on GMX - Size = exactly the number of ETH you deployed in Step 1 (20 ETH short) The Math Behind It 🧮 Profit Conditions: Your position becomes profitable when: ✅ CLP Yield + Funding Rate Yield > Divergence Loss on the CLP Risk Profile: - 🔴 Maximum loss scenario: ETH makes a sharp move higher before your CLP fees have time to accumulate - ⏰ The key is that fees need time to offset any divergence loss from price movements Why This Works 💡 1. You're earning from two yield sources simultaneously (LP fees + funding) 💵 2. The short perp hedges your ETH exposure from the CLP 3. When funding rates are positive (longs paying shorts), you're getting paid to hedge 4. The borrowed USDC can be deployed elsewhere or used as additional buffer

1-7 of 7

@josh-stall-8136

Multifamily and Crypto investor. Macro driven. Business Analyst.

Active 15h ago

Joined Oct 29, 2025

Powered by