Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

DeFi University

241 members • Free

9 contributions to DeFi University

🚀 The On-Chain NOB Spread is HERE (And What It Means for DeFi)

Hey everyone, Just finished an intensive deep dive into something that's absolutely game-changing for DeFi traders: the convergence of TradFi and DeFi is happening right now, and the tools we need to trade like Wall Street are finally available on-chain. 💡 What's the NOB Trade? The NOB spread (Notes Over Bonds) is a classic Wall Street trade that bets on the relationship between 10-year Treasury notes and 30-year Treasury bonds. Instead of betting on whether rates go up or down, you're betting on HOW the yield curve moves. Here's the thesis: If you believe (like I do) that the yield curve is going to steepen—meaning long-end rates will rise faster than short-end rates—you can express that view through the NOB spread. 🔥 Why This Matters NOW Let me break down the macro picture: The Transfer Payment Problem California (and many other states) are functionally insolvent. They're heavily dependent on federal transfer payments to fund basic social services. These payments cannot stop without triggering state-level collapses. The chain reaction: 1. Transfer payments can't stop 2. Federal government must keep borrowing 3. Fiscal deficit cannot shrink (it's structurally impossible) 4. Borrowing must accelerate 5. Rates have to go up This isn't speculation—it's mechanical. Unless we see a massive AI-driven economic boom, the deficit continues growing and long-end rates will move higher, faster than short-end rates. ⚙️ The On-Chain Reality Good news: The infrastructure for on-chain NOB trades exists TODAY. You can buy and hold tokenized U.S. Treasury assets right now. Bad news (for now): I couldn't find any money market or perp DEX where you can get SHORT Treasury tokens. Once this becomes available, we can fully execute the yield curve trade on-chain. What's Coming: Cross-Margining The next evolution is cross-margining—imagine depositing your BEF token (or any yield-bearing asset) directly onto a platform like HyperLiquid and using it as collateral for your TLT short. This would make these trades as capital-efficient as what you see on Wall Street.

🚨 The $1.4T "Air Pocket" in the Treasury Market (And Why 2026 is the Danger Zone)

TL;DR: The SEC just finalized the deadline that effectively kills the biggest trade in the world. While the official date is June 2027, the "pre-compliance" unwind likely starts in mid-2026. If you aren't watching the repo market plumbing, you're flying blind. 1. The "Three-Body Problem" 🌍 For decades, the US Treasury market was stable because it stood on two "anchor" legs: 1. The Fed: Bought debt for policy (QE). 2. Foreign Central Banks: Bought debt for trade reserves. The Problem: Both anchors have left the building. The Fed is shedding assets (QT), and foreign demand has dried up. So who is buying the trillions in new US debt? Enter the "Third Body": The Cayman Whale 🐳 A massive $1.4 trillion "shadow inventory" of US debt is now held by offshore hedge funds. Unlike the old anchors, they are not long-term investors. They are "renters" looking for a quick arbitrage profit called the Basis Trade. 2. The Machine: Infinite Leverage ⚙️ The "Whale" doesn't use its own money. It uses a loophole in the plumbing to get 50x to 100x leverage. - Step 1: Buy the cheap cash bond. - Step 2: Sell the expensive futures contract. - Step 3 (The Key): Finance the bond in the bilateral Repo market with 0% haircuts (zero money down). This entire $1.4T structure rests on that "0% down" financing. And that is exactly what the government is about to ban. 3. The Catalyst: The SEC Mandate (Updated Timeline) 📅 The SEC has confirmed the deadline to force these repo trades into a Central Clearinghouse. - The Date: The hammer drops on June 30, 2027 for repo transactions. - The Impact: Central clearing bans "zero haircut" deals. It mandates ~2% margin. - The Result: Going from 0% down to 2% down destroys the trade's math. The "Whale" will be forced to exit because the trade is no longer profitable. 4. The Danger Zone: The "Liquidity Air Pocket" 📉 Here is the critical part: Markets don't wait for deadlines. Smart money will "pre-comply" to beat the rush. We expect the unwind to begin around mid-2026 (12 months before the deadline).

Keep your eye on Japan

According to The Japan Times, Japan’s two-year government bond yield rose to 1%, the highest since 2008, signaling market expectations that the Bank of Japan (BOJ) is nearing a rate hike. The five-year and ten-year yields climbed to 1.35% and 1.845%, respectively, while the yen strengthened 0.4% to 155.49 against the dollar. Markets now price in a 76% probability of a BOJ rate hike at its December 19 meeting, rising to over 90% for January.

Market reversal from the a severe sell off

the probability of interest rate cut in December by 1/4 up sharply this morning at 62% from 33% on John William comment for a possible cut in december.

1-9 of 9

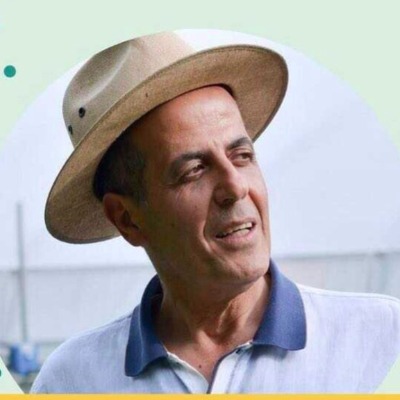

@jason-serfaty-4516

Former Institutional Equity Trader and Organic Farm entrepreneur / speaker.

Active 11h ago

Joined Jul 17, 2025

Powered by