Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Energy Data Scientist

372 members • Free

15 contributions to Energy Data Scientist

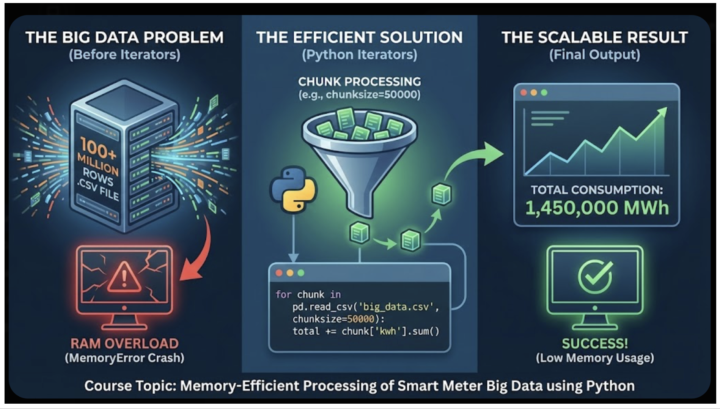

New Online Course: How Big data from Smart Meters are processed efficiently

I’ve just published a new online course about Memory-Efficient Processing of Big Data. This course teaches real-world skills as they are used in practice. Smart meters measure the electricity-consumption data every hour, and store the information in CSV files. These files eventually become very large (big data). The new online course is called "Smart Meter Big Data Efficient Processing" and it is in the Classroom in 1.36. This online course teaches a Python methodology that is used by energy companies in practice to read extremely large datasets (Big Data). Without this technique such files cannot be read because they cause a memory (RAM) error. Companies that sell electricity to consumers are known as 'Retailers' or 'Suppliers'. Such companies have CSV files with hundreds of millions of rows, where each row is the hourly kWh electricity consumption. If they try to load these CSV files, their computers will run out of RAM and crash. So these companies process these files using Python iterators, which enable a memory-efficient and fast processing method. In this course, I show you the industry-standard solution: using Python Iterators to process Big Data in "chunks". See the attached image; this is analysed in detail in the course.

The Oil Forward Contract Saudi Aramco - Sinopec Explained

The video below describes how the companies 'are thinking' before signing a forward contract. This video has also been added to the online course 5.19 in the Classroom. This process is very simple. This is also an interview question for energy + economics + finance roles of various levels. From commodities trading, to investment banking, and from energy consultants to energy quants and energy data scientists. It is a very popular question. Interview Question and an interesting case study to know: The Saudi Aramco - Sinopec crude oil forward contract. Beginner-friendly explanation (no 'scary' jargon used . No prerequisites needed). The video focuses on the forward contract that Saudi Aramco signed with Sinopec. The details of the contract are private so we are using example dates. On the 1st of December 2025 , the two companies signed a forward contract on crude oil , where Saudi Aramco agreed to produce and sell 250 000 barrels of crude oil and ship it from Saudi Arabia to China, where Sinopec is. The delivery date will be months into the future i.e. 1st of September 2026. Sinopec needs crude oil because it has refineries. These are facilities that use crude oil to produce diesel, jet fuel and other 'refined' products. Siniopec needs crude oil therefore. So they decided on the price of $77.5 / barrel. Here is how they decided on this price: a) They used machine learning to find a reasonable upper bound (maximum value) and lower bound on the spot crude oil price on the delivery date i.e. 1st of September 2026. b) In between these two bounds, they assume possible values for the spot price of crude oil. For each value they calculate the PnL index (profit and loss). PnL = (spot price - forward price)* quantity of crude oil.So if spot price on delivery date is $60/barrel and forward price is $77.5 , then we find the spread (difference) and multiply it with the 250,000 barrels of crude oil agreed in the forward contract. This is the PnL for the buyer (Sinopec) ,and it is negative (bad deal).The whole process is described in this video.

Materials needed on Intelligent Automation of Energy Audit with AI

Good morning all, Please I need any materials, suggestions and if possible some past Energy Audit reports for buildings or data centers or hospital or commercial facilities etc. That will give an idea on how the manual/traditional way works so that I can use AI Thank you

Urgent step by step code needed for the attached PDF

Please if someone could help with self explanatory code on the attached PDF I would highly appreciate. of course Dr Spyro has covered almost all aspect in his class but I have not reach there yet. This is an Assignment and also exams question in my Msc Python classes. Thank you as I await your inputs please

Senior Power System Protection Role

Good day everyone, I’ve been invited for an initial virtual screening for the above job role at EirGrid in Ireland. Anyone has an idea what they are likely to ask please? Thank you

1-10 of 15

@jalal-umar-barau-4410

Power System Engineer pursuing MSc in Sustainable Energy Futures at ECE Paris

Active 3d ago

Joined Sep 23, 2025