Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Tax Savvy Society- USA

39 members • Free

8 contributions to Tax Savvy Society- USA

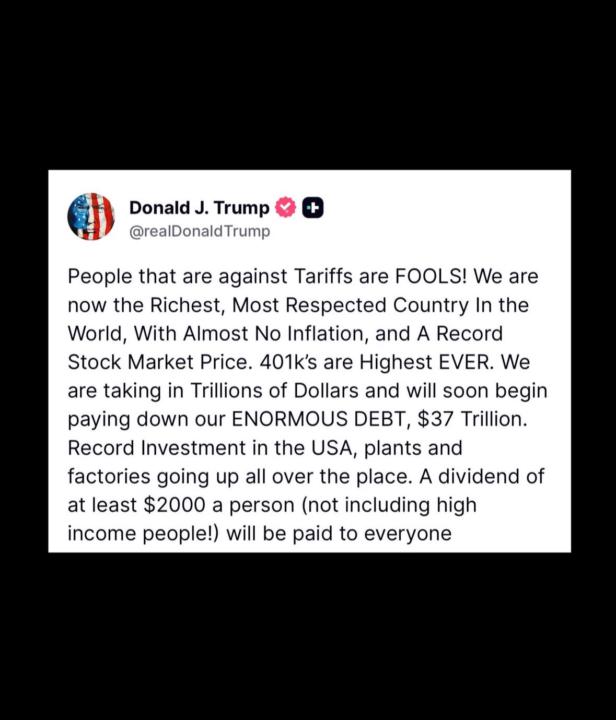

🔔 President Trump announced

that most Americans will receive "at least" $2,000 from the tariff revenue collected by the Trump administration. Trump's statement, made on his Truth Social platform, comes after the White House defended his sweeping use of tariffs before the Supreme Court, where the justices appeared skeptical of the president's broad use of the International Emergency Economic Powers Act. While this proposal would likely need to be passed by Congress, Trump has not specified who would qualify for the dividend, although he said "everyone," except "high-income people," would be paid at least $2,000 in the form of a dividend. Source: (The Hill)

Tax evasion vs tax planning.

The IRS recognizes that taxpayers can organize their affairs to minimize taxes, as long as there is substance and compliance with the law. See the landmark case: Gregory v. Helvering, 293 U.S. 465 (1935) - courts allow “tax; avoidance” but not “tax evasion.” ❌: Tax Evasion / Fraud IRC § 7201 – Attempt to evade or defeat tax - States that anyone who willfully attempts to evade or defeat any tax imposed by the Internal Revenue Code is guilty of a felony. - Penalties: up to $100,000 ($500,000 for corporations) fine, plus up to 5 years in prison. IRC § 7206(1) – Fraud and false statements - Makes it a crime to willfully make false statements on a tax return. IRC § 7206(2) – Aiding and assisting - Covers anyone who aids or assists in preparing a false return. IRC § 6662 – Accuracy-related penalties - Civil penalties for underpayment due to negligence or disregard of rules (20% of underpayment). - § 6663 – Fraud penalty (75% of underpayment if intentional fraud is proven). ✅: Legal Tax Planning: The tax code permits taxpayers to structure transactions and timing to minimize taxes: - IRC § 61 – Gross income definition; establishes what counts as taxable income. Planning can defer or exclude certain items legally. - IRC § 162 – Business expenses; allows deductions for ordinary and necessary business expenses. - IRC § 170 – Charitable contributions; permits deductions for qualified donations. - IRC § 401, § 408, § 219 – Retirement contributions (401(k), IRA, etc.) reduce taxable income. - IRC § 199A – Qualified Business Income deduction (20% for pass-through entities). - IRC § 263A / § 167 / § 168 – Depreciation and cost recovery rules; allow legal acceleration of deductions. - IRC § 7701(a)(3) / § 1361 – Entity classification rules (S-corp, LLC, partnership) for tax planning. 👩💻🍀Plan well enough and you might end up legally owing $0 in taxes. It starts with a tax plan. If this is you, I invite you to book a consult. You can do so here.

🎬 Have You Ever Considered Investing in Film Productions Here in the U.S.?

This might surprise you, but investing in film productions can actually come with some powerful tax incentives available to investors. I’m curious, have you ever looked into it or considered it as part of your portfolio? I have been learning from one of my preferred accountants currently enacting this strategy. I’ll be breaking this down in my next YouTube video, how it works, what to watch out for, and how the tax side can make or break the deal. Drop your thoughts below, have you explored this before, or is it totally new to you?

1 like • Nov '25

A friend and me did look into it about 10 years ago in SLC, UT but I decided to pass. However he moved ahead and ended up lossing about $1.2 million. All he got for his money was a fancy poster which had his name as one of the producers. It turned out to be a scam. I tend to stay away from things I have no experience.

Start Investing as Soon as Possible & Help your Family Invest.

Resist lifestyle spending until you have moved your money from earned income to assets. Influence those around you into investing too. If you don’t help your family get invested you’ll have to always help them financially. Help your family invest.

🧠 Tax IQ Check!

How many of these strategies have you heard of? (Don’t worry, this isn’t a test, it’s just to see what you’ve been exposed to so far.) ✅ Accountable Plan ✅ Augusta Rule ✅ Hiring Your Kids ✅ Late S-Corp / Income Shifting ✅ Defined Benefit Plan ✅ Charitable Gift Financing ✅ Cost Segregation ✅ Captive Insurance ✅ Charitable Gift Financing Drop your number 👇 (Don’t Google it. Let’s see what you really know 😎) Then tell me which one sounds the most interesting and I’ll do a breakdown on that one next week.

1-8 of 8

Active 70d ago

Joined Nov 3, 2025