Write something

Pinned

Your 2025 Essential Tax Documents Checklist - FREE DOWNLOAD

This guide will walk you through what forms you need, where to find them, and why they matter. By proactively guiding you, you can enhance accuracy- making tax season smoother for you.

2

0

Pinned

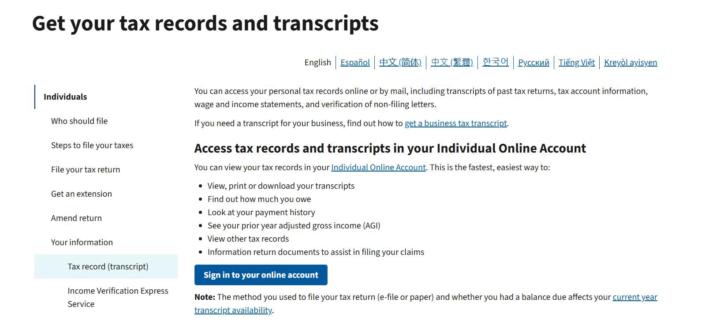

How to Access Your IRS Tax Transcripts Online

Ever wonder what the IRS actually has on file for you? Your IRS tax transcripts are like your tax “X-rays.” They show exactly what’s been reported to the IRS, your income, filings, payments, and even potential discrepancies. Here’s how to get them: Step 1: Go to Get Transcript Online Step 2: Create or log into your IRS account using Secure Access (you’ll verify your identity using your SSN, credit card, or loan info). Step 3: Once logged in, you can view, download, or print your transcripts for the past several years. 🧾 Why This Matters Pulling your IRS transcripts gives you a clear snapshot of your tax history and helps you: • Confirm what’s been officially filed and received • Catch errors or missing forms early • See how much you owe and your payment history • View your prior year’s Adjusted Gross Income (AGI) • Access income documents reported to the IRS (W-2s, 1099s, etc.) • Keep your tax records accurate and protect yourself from identity issues It’s one of the smartest habits you can build, even if you’re not doing your own taxes. 💬 Have you ever looked at your IRS transcripts before?

2

0

Pinned

New Classroom Resource: The Turnkey Tiny Home Tax Elimination Blueprint (High-Income W-2 Friendly)

One of my associate advisors just shared access to a turn-key tax elimination blueprint from his private community, and it’s now available inside our classroom. Find it here: Turn-Key Tax Elimination Blueprint This is especially relevant for: - High-income W-2 earners - Investors who don’t have time to meet material participation hours - Those looking for legitimate, execution-ready tax strategies, not theory This is structured as a potential investment opportunity, not a DIY course. The value is in the setup and execution, not just the education. ⚠️ Important: This opportunity closes at the end of the year, so timing matters. 👉 Next steps: - Review the details in the classroom - If it looks aligned, message me and I’ll connect you with more information on how execution works Feel free to share this with investor friends who fit the profile and want to have an informed discussion. Find it here: Turn-Key Tax Elimination Blueprint

5

0

IRS Announces Start To Tax Season - on Jan. 26, 2026.

Find what you need to easily file your 2025 tax return in the classroom. You can file your returns and pay any tax due until April 15, 2026, without incurring penalties. I am personally a fan of extending my filing date each year. This isn’t for payments due but for filling yes.

2

0

🚀 Updated For 2026 Now Available!

Hey you! The guide with smart strategies for high earners has been updated and is now in the classroom. These strategies are perfect if you’re already savvy with your money, think of this guide as a checklist to make sure you’re taking action and getting the most from your income. Grab it and see what you can implement today!

2

0

1-30 of 92

powered by

skool.com/pay-less-taxes-7922

Showing business owners legal ways to reduce their tax bill with IRS-backed strategies, guided by TaxSavvy Advisors.

Suggested communities

Powered by