Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Farah

https://slktxt.io/11UMi Get the funding you need for any business no matter how your credit is at the moment. We can get you where you want to go.

Memberships

Creative Capital Network

15 members • $99/month

Manifestation Accelerator

781 members • $49/month

Capital Connectors

2.7k members • $97/month

RM

Referrals Made Easy!

1.8k members • Free

Preforeclosure Real Estate

2.9k members • Free

8 contributions to Capital Connectors

Raising capital

Good morning everyone, I am looking to raise capital for a 12 door apartment building in Lakeland Fl. I am asking for $400,000.00 (this is for down payment, closing costs, holding costs, and minor renovations) at 15% interest or profit split of 30%. Please let me know if you’re interested in details.

2

0

You Don’t Need Cash Flow to Quit Your 9-5. You Need Cash.

Most people think financial freedom means $10K/month in passive income. That’s $120K/year in cash flow. Which means you’d need millions in real estate just to cover your bills. That’s slow. What if you could replace your income in one deal instead of waiting years for rental properties to compound? The real key to quitting your job isn’t building cash flow—it’s generating cash in chunks big enough to fund your next move. But before you say: ❌ “I don’t have the credit.” → You don’t need credit. You’re not taking the loan. ❌ “I don’t have the money.” → You’re not using your own money. You’re raising it. ❌ “I don’t have experience.” → Then you borrow it. Lack of experience? Partner with someone who has it. Investors don’t care if you have a track record—they care that the deal and team do. How Much Do You Really Need to Quit? If your expenses are $8K/month, you don’t need passive income to cover it. You just need $192K to last you two years. Now ask yourself—how long would it take to save that at your 9-5? 5 years? 10 years? Now… what if you could make that in one deal? Most people try to save their way to freedom. That’s the slow lane. The faster path? Create the cash upfront and buy yourself the time to scale. And yes—I can hear the objections: ❌ “This only works if you have rich friends.” → Most investors aren’t billionaires. They’re normal people who want a better return. ❌ “This sounds too good to be true.” → Tell that to every real estate syndicator, fund manager, and dealmaker who’s been doing this for decades. ❌ “But I have no track record.” → Then leverage someone else’s. When I first started raising capital, I didn’t have a massive track record. I partnered with people who did. I leveraged their experience until I built my own. The Funds First Formula—Make 2 Years of Income in 1 Deal Here’s how you get $200K+ in cash without using your own money: Let’s say you raise $2M from investors to fund a $5M deal. 🔹 You structure a 2% acquisition fee on the full $5M purchase price.

Multifamily Real Estate Summit: Smarter Investing with Less Tenant Risk

Hey guys, anyone interested in attending an Event on March 25th from 5:30-8:30 pm. The event is a Multifamily Real Estate Summit: Smarter Investing with Less Tenant Risk. Here is the link if you would like to attend (Free Event) https://www.eventbrite.ca/e/multifamily-real-estate-summit-smarter-investing-with-less-tenant-risk-tickets-1274174563419?utm-campaign=social&utm-content=attendeeshare&utm-medium=discovery&utm-term=listing&utm-source=cp&aff=ebdsshcopyurl

EASY Framework for Capital Raising

Ever feel like raising capital is harder than it should be? The truth is, a great deal isn’t enough—investors need to see the value before they say yes. That’s why I’m teaming up with Danielle Chiasson and Kory MacKinnon to share the exact framework that’s helped me raise over $100 million in private capital. Join us for this FREE webinar and learn how to attract investors, structure deals, and secure funding with confidence. Spots are limited—register now! https://www.eventbrite.ca/e/easy-framework-for-capital-raising-free-webinar-tickets-1278021038329?aff=oddtdtcreator

Happy Friday!

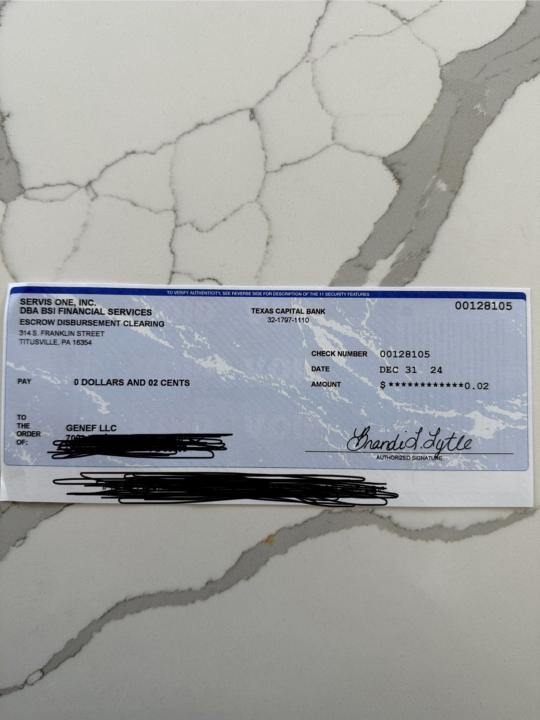

Good morning everyone, I have been holding this big check! Can anyone tell me what I should purchase? Should I buy an apartment building? I was thinking maybe it’s time to retire? Let me know your thoughts, have a great weekend.

1-8 of 8

Active 10d ago

Joined Feb 20, 2025

Florida

Powered by