Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

DeFi University

159 members • $97/m

8 contributions to DeFi University

The Ether Condor Strategy: A Market-Neutral(ish) Approach to ETH Yield Generation 🦅

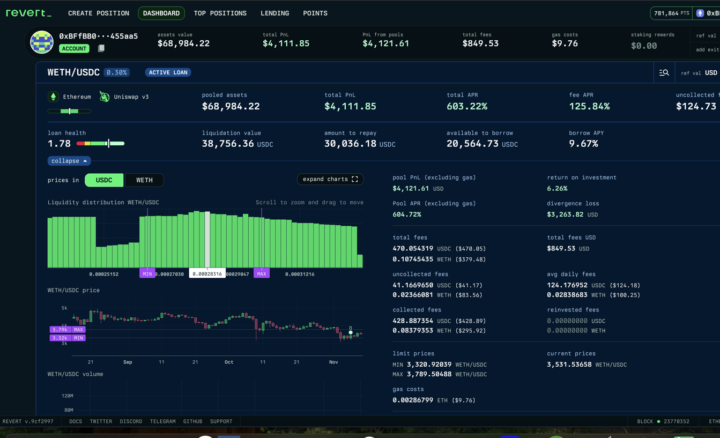

Hey DeFi fam! 👋 Today I'm breaking down an advanced strategy that combines concentrated liquidity provision with perpetual futures hedging - I call it The Ether Condor. Here's a calculator that shows all of the inputs, unfortunately the results section calculations don't work, but you can see all of the inputs for the strategy in one place. That makes it a bit easier to understand the strategy. Divergence Loss (Impermanent Loss) Research Strategy Overview 📊 This is a delta-neutral(ish) yield farming play that aims to harvest both LP fees and funding rates while minimizing directional risk on ETH price movements. The Setup (3 Steps) 🎯 Step 1: Deploy Your Concentrated Liquidity Position 💧 - Allocate 20 ETH to a WETH/USDC pool on Uniswap V3 (Ethereum mainnet) - Use the 0.3% fee tier - ⚠️ Critical: Set your range intentionally OUT OF RANGE (all in ETH) - This positioning is key to the strategy's mechanics Step 2: Leverage Your Position 💰 - Head over to Revert Finance - Borrow 40% of your LP position's USD value in USDC - This gives you working capital without selling your LP tokens Step 3: Create Your Hedge 🛡️ - Take 20% of your LP's USD value as initial margin - Open a SHORT perpetual futures position on GMX - Size = exactly the number of ETH you deployed in Step 1 (20 ETH short) The Math Behind It 🧮 Profit Conditions: Your position becomes profitable when: ✅ CLP Yield + Funding Rate Yield > Divergence Loss on the CLP Risk Profile: - 🔴 Maximum loss scenario: ETH makes a sharp move higher before your CLP fees have time to accumulate - ⏰ The key is that fees need time to offset any divergence loss from price movements Why This Works 💡 1. You're earning from two yield sources simultaneously (LP fees + funding) 💵 2. The short perp hedges your ETH exposure from the CLP 3. When funding rates are positive (longs paying shorts), you're getting paid to hedge 4. The borrowed USDC can be deployed elsewhere or used as additional buffer

1 like • 26d

Why is it critical to open an LP fully out of range (100% ETH)? What would be the downside of setting it slightly in range, for example, creating a position that’s 90% ETH and 10% USDC (e.g. 18 ETH and 10% USDC value at current price)? Would it then make sense to size the short hedge only against the ETH portion (e.g. short 18 ETH instead of 20)? Thanks.

🔥 Market Intelligence Update: Critical Week Ahead (Nov 17-23)

What's happening right now that matters for your portfolio 👇 📊 The Macro Picture We're entering a CRUCIAL data week with the September jobs report (Thursday) and FOMC minutes (Wednesday). The Fed's getting increasingly cautious - at least 5 officials are now questioning December rate cuts. Kashkari's quote says it all: "When it's foggy, let's just be a little careful and slow down." 🚨 Market Stress Signals - Corporate bankruptcies hit 15-YEAR HIGH (655 YTD vs 687 for all of 2024) - Unusual market action: Stocks AND bonds falling together - Credit spreads failed to confirm recent equity strength (early warning sign) - CTA/volatility control strategies likely net sellers here 💻 AI Trade Under Pressure The AI narrative is facing serious headwinds: - Open-source models (Kimi K2) performing at fraction of GPT costs - Capital becoming THE bottleneck (not just chips/power) - Oracle credit concerns widening - Market questioning massive capex ROI 🪙 Crypto & DeFi Update Price Action: - BTC: $98,329 (-2.61% WoW) - rejected at psychological $100k - ETH: $3,174 (-3.92% WoW) - $463M in liquidations when BTC pulled back from $100k The Bright Spots: 🌟 - USDC exploding: $73.7B circulation (+108% YoY) - Circle net income: $214M (+202% YoY) - Stablecoin rails strengthening everywhere - Major regulatory clarity coming (CFTC leveraged spot trading, UK stablecoin regs, IRS staking guidance) 🎯 Actionable Strategy for This Week Near-term positioning: 1. Stay cautious - Let de-risking run its course 2. Watch credit spreads - They're telling us something's off 3. DeFi focus: Lean into stablecoin infrastructure plays, onchain FX, tokenized funds 4. Key levels: BTC $100k psychological, monitor for stability What I'm watching: - Thursday's jobs report (GS expects +80k NFP) - NVDA earnings (Wed) - Critical for AI capex signals - Credit market deterioration (especially in Industrials/Consumer Discretionary) - Stablecoin adoption metrics

0 likes • 20d

@Juri Bastiaans that’s a good strategy but the DCA into an asset is not guaranteed. What if the price never reaches your downside range and instead moves back up out of range on the top side? For example, if you enter single-sided on Solana at 140 with a range of 125–138, and price never falls below 125 — then you don’t accumulate 100% SOL at all. In that case, what is the exit strategy? Exit the position at 130 for example? Thanks for your feedback

Bitcoin Weekly SMA200 Pattern – Potential Cycle Top Signal?

Hi all. I recently came across an article that discussed an interesting historical pattern on Bitcoin’s long-term chart. In every major cycle so far, the cycle top tended to occur once the 200week SMA reached the price level of the previous cycle’s all-time high. This dynamic appeared in the transitions from the 2013 cycle to 2017 and again from 2017 to 2021, where the cycle peak happened around the time the weekly SMA200 climbed up to the old ATH. Applying that same idea to the current cycle, the previous top sits around 66k, while the weekly SMA200 is currently near 55k and still trending upward. If the historical pattern were to repeat, the area around 66k could potentially act as the next cycle top once the SMA200 reaches it. Of course, there’s no guarantee this plays out the same way again, but it might be one more indicator worth keeping in mind when thinking about where this cycle could eventually peak.

LP vs spot

Hey everyone! I don’t know about you but thanks to things like gamma swap and all these different strategies I am finding it less attractive to hold spot. I’m at a point now where I feel like I’d rather just sell my spot bags and put 80-90% of it into farming as it’s just more consistent and honestly my profitable. Has anyone else felt this way? Even with this price action I’ve been doing extremely well thanks to hedging and I’d almost rather just DCA into bitcoin with fees or add to the size of my farms then borrow against my btc to farm

Understanding the Fed's Stealth Money Printer: What it Means For Bitcoin 🚀

Hey DeFi fam, let me break down an important macro thesis shared first by Arthur Hayes in his article entitled, "Hallelujah," about why Bitcoin and crypto could see massive upside once the Fed money printer gets turned back on. This involves some financial plumbing, but I'll make it as clear as possible because understanding this could be crucial for positioning. I also created a single page web app that helps explain these concepts using interactive visuals, take a look here: Fed Stealth QE Interactive Website Fed Stealth QE Interactive Site v2 The Core Thesis: Government Debt = Money Printing 🖨️ Here's the simple version: The US government needs to borrow ~$2 trillion per year to keep running. Someone has to buy all that debt. The way that debt gets purchased ultimately forces the Fed to print money, which is rocket fuel for Bitcoin. Let me walk you through the logic chain: The Setup: Who's Buying All This Government Debt? 🤔 The US Treasury issues about $2 trillion in new debt annually. But here's the problem - who has $2 trillion lying around to buy it? - Foreign central banks? ❌ Nope. After the US froze Russia's reserves in 2022, they're buying gold instead of Treasuries - US savers? ❌ The US savings rate is 4.6% of GDP, but the deficit is 6% of GDP. Math doesn't work - Big banks? ❌ They're buying some (~$300B) but nowhere near enough So who's the marginal buyer keeping this whole system running? Enter the Hedge Funds 🏦 Relative Value (RV) hedge funds based in the Cayman Islands 🏝️ are now the largest buyers of US Treasuries. They absorbed 37% of new Treasury issuance between 2022-2024, about $1.2 trillion worth. But here's the kicker - these funds don't use their own money. They run a leveraged trade: 1. Buy Treasury bonds 📄 2. Sell Treasury futures 📊 3. Pocket the tiny spread between them 💰

0 likes • 26d

@David Zimmerman Hey David, I was reading a local article that argued it’s actually the change in Fed policy (the transition from QT → QE or vice versa) that pushes BTC down in the short term, rather than the policy itself. They pointed out that we’ve seen both QE and QT bull markets before. What’s your take on that? Do you think it’s mainly the policy shift that drives short-term reactions, or the underlying liquidity dynamics like SRF and stealth QE? Thanks

1-8 of 8

Active 21h ago

Joined Oct 26, 2025

Powered by