Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

LetsGetFunded Starter (Free)

17.5k members • Free

Funding Freedom Challenge

969 members • Free

Fruitful Real Estate

2.9k members • Free

Funding Mafia Family (Free)

849 members • Free

Tradeline Secrets

1.6k members • Free

Free Vendlist Community

4.6k members • Free

Wealth University

2.7k members • Free

32 contributions to Tradeline Secrets

Business Credit Check In

I created this group to bring clarity to business credit. The only way this works is if you implement what you learn. How many of you have started to build business credit?

Poll

12 members have voted

Live starts at 8pm EST

Remember that the live is today at 8pm EST Make sure to like, comment, and share the post for chance to win a free funding call https://www.facebook.com/share/p/1Hq5y6LGMs/?mibextid=wwXIfr

Live Call and FAQ

Hey everyone, I know when most people go live. Or they do a webinar. Its really just disguised as a sales pitch. And there's nothing wrong with that. But my webinar will not be set up that way. Yes I will let you all know about my other paid services. But my main goal is to go over exactly what is need to qualify for business funding. One final update is that this Monday at 8pm EST. I will be doing a live call to answer questions. Will post more on that later. Thanks.

Webinar Recording

Incase you missed the Webinar....Here is the live recording. In this live session, I break down how business credit actually works and why most people get stuck chasing the wrong things. We cover: - What PAYDEX really is and why people obsess over it - The role personal credit still plays in business funding - Why net30s help, but rarely lead to real limits on their own - How banks actually look at business credit profiles - What separates small approvals from real business credit lines This isn’t theory or guru advice. It’s based on what actually gets approved. If you’re trying to build business credit or position yourself for real funding, this will save you time and mistakes. P.S. - this is my first time doing a webinar. Next time I plan to have slides but what are other ways I can improve? And what other topics should I go over? P.P.S. - I will also upload to my YouTube channel in case the video is deleted later.

Why I Refuse To Gatekeep Information

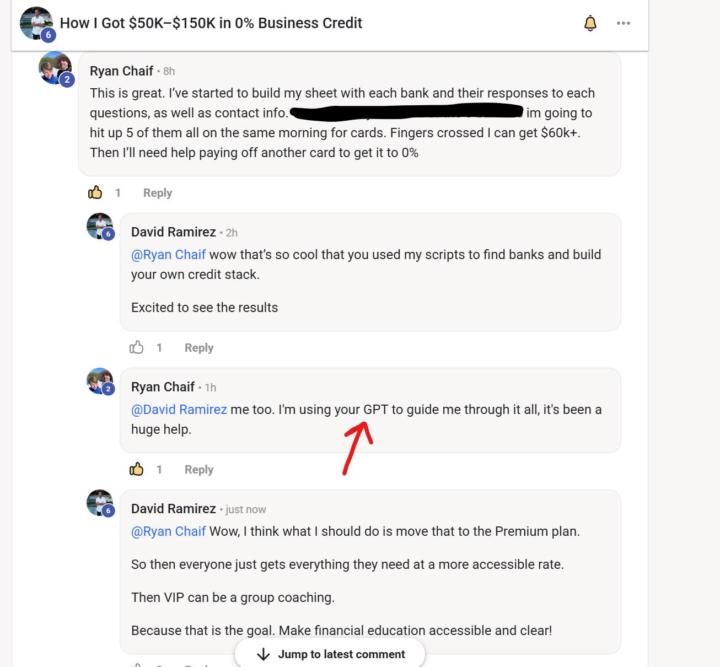

Someone just reached out. They're executing everything I taught them to get funded. That made my day. I've always believed that business funding information Shouldn't be locked behind expensive courses or consultations. The knowledge gap in this space is massive. And too many people are profiting off it. Keeping business owners and investors confused. I'd rather teach people the real playbook up front . Let them decide if they need help executing it. If your business model relies on gatekeeping basic information. So you can charge people to "decode" it later. You're doing it wrong. I'm not built like that. The goal isn't to keep people dependent. The goal is to give them the tools to move forward Whether that's with me or on their own. That's how you build something real.

1-10 of 32

@cynthia-haymon-1955

Hello, I have two E-commerce business, Hayskincare.com & Atlantabestbrewcoffee.com

Active 4d ago

Joined Nov 16, 2025

Decatur, Georgia

Powered by